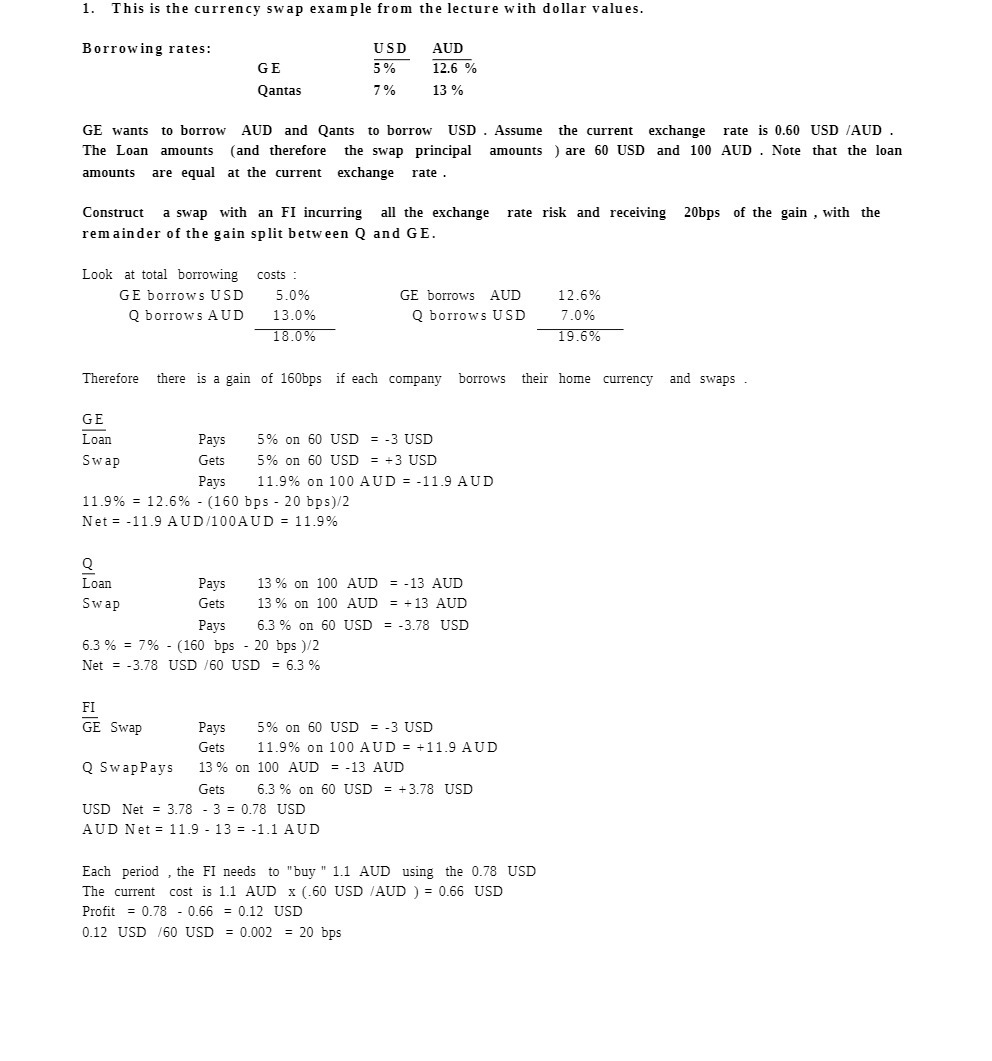

Question: 1. This is the currency swap example from the lecture with dollar values. Borrowing rates: USD AUD GE 5% 12.6 % Qantas 7% 13 %

1. This is the currency swap example from the lecture with dollar values. Borrowing rates: USD AUD GE 5% 12.6 % Qantas 7% 13 % GE wants to borrow AUD and Qants to borrow USD . Assume the current exchange rate is 0.60 USD /AUD The Loan amounts (and therefore the swap principal amounts ) are 60 USD and 100 AUD . Note that the loan amounts are equal at the current exchange rate Construct a swap with an FI incurring all the exchange rate risk and receiving 20bps of the gain , with the remainder of the gain split between Q and GE. Look at total borrowing costs : GE borrows USD 5.0% GE borrows AUD 12.6% Q borrows AUD 13.0% Q borrows USD 7.0% 18.0% 19.6% Therefore there is a gain of 160bps if each company borrows their home currency and swaps GE Loan Pays 5% on 60 USD = -3 USD Swap Gets 5% on 60 USD = +3 USD Pays 11.9% on 100 AUD = -11.9 AUD 11.9% = 12.6% - (160 bps - 20 bps)/2 Net = -11.9 AUD/100AUD = 11.9% Loan Pays 13 % on 100 AUD = -13 AUD Swap Gets 13 % on 100 AUD = + 13 AUD Pays 6.3 % on 60 USD = -3.78 USD 6.3 % = 7% - (160 bps - 20 bps )/2 Net = -3.78 USD /60 USD = 6.3% FI GE Swap Pays 5% on 60 USD = -3 USD Gets 11.9% on 100 AUD = +11.9 AUD Q SwapPays 13 % on 100 AUD = -13 AUD Gets 6.3 % on 60 USD = +3.78 USD USD Net = 3.78 - 3 = 0.78 USD AUD Net = 11.9 - 13 = -1.1 AUD Each period , the FI needs to "buy " 1.1 AUD using the 0.78 USD The current cost is 1.1 AUD x (.60 USD /AUD ) = 0.66 USD Profit = 0.78 - 0.66 = 0.12 USD 0.12 USD /60 USD = 0.002 = 20 bps

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts