Question: 1. This problem is a continuation of the PQ problem in class. We are now selling all 100P's (all demand satisfied) and only 34 Q's

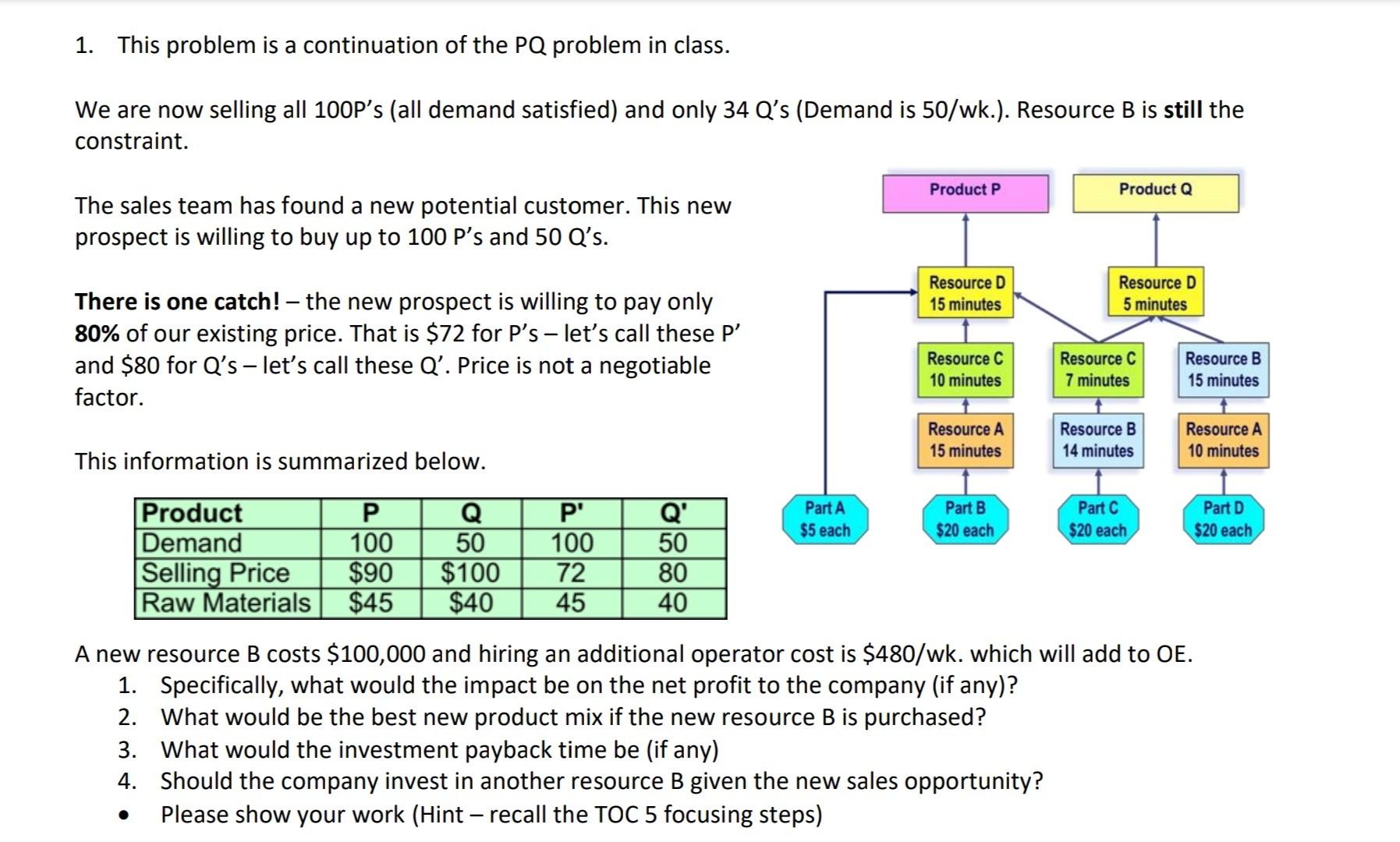

1. This problem is a continuation of the PQ problem in class. We are now selling all 100P's (all demand satisfied) and only 34 Q's (Demand is 50/wk.). Resource B is still the constraint. The sales team has found a new potential customer. This new prospect is willing to buy up to 100P s and 50Q 's. There is one catch! - the new prospect is willing to pay only 80% of our existing price. That is $72 for Ps - let's call these P and $80 for Qs - let's call these Q. Price is not a negotiable factor. This information is summarized below. A new resource B costs $100,000 and hiring an additional operator cost is $480/ wk. which will add to OE. 1. Specifically, what would the impact be on the net profit to the company (if any)? 2. What would be the best new product mix if the new resource B is purchased? 3. What would the investment payback time be (if any) 4. Should the company invest in another resource B given the new sales opportunity? - Please show your work (Hint - recall the TOC 5 focusing steps)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts