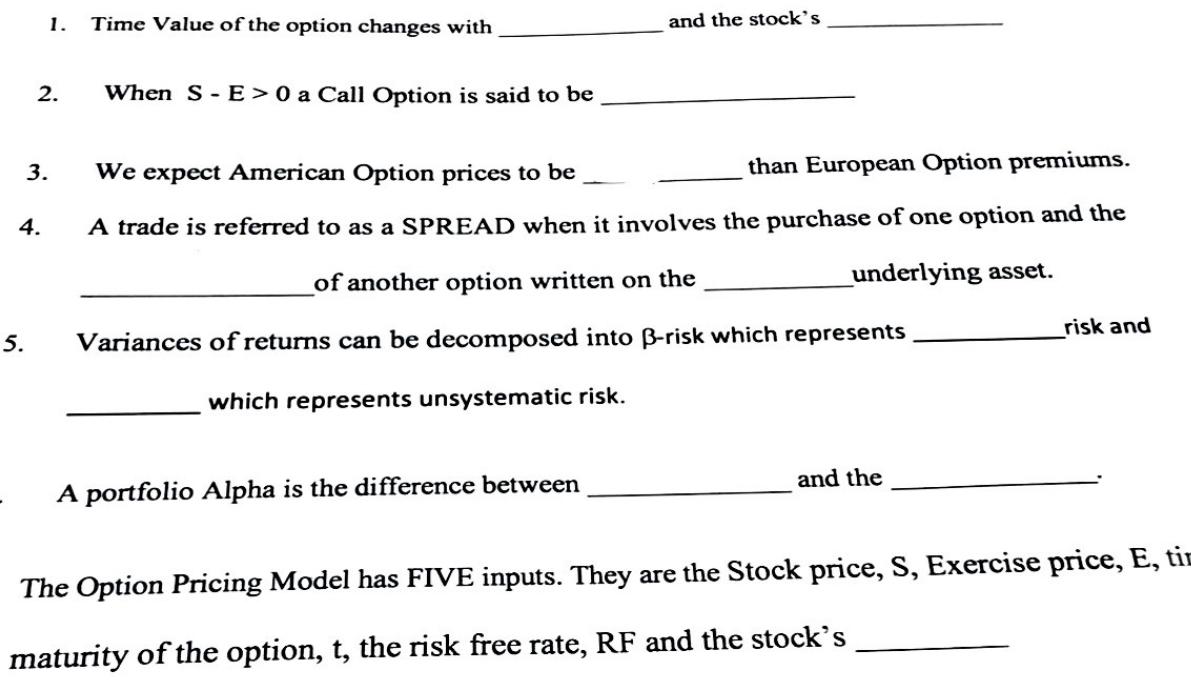

Question: 1. Time Value of the option changes with 2. and the stock's When S-E> 0 a Call Option is said to be 3. We expect

1. Time Value of the option changes with 2. and the stock's When S-E> 0 a Call Option is said to be 3. We expect American Option prices to be than European Option premiums. 4. A trade is referred to as a SPREAD when it involves the purchase of one option and the of another option written on the underlying asset. 5. risk and Variances of returns can be decomposed into B-risk which represents which represents unsystematic risk. and the A portfolio Alpha is the difference between The Option Pricing Model has FIVE inputs. They are the Stock price, S, Exercise price, E, tin maturity of the option, t, the risk free rate, RF and the stock's 1. Time Value of the option changes with 2. and the stock's When S-E> 0 a Call Option is said to be 3. We expect American Option prices to be than European Option premiums. 4. A trade is referred to as a SPREAD when it involves the purchase of one option and the of another option written on the underlying asset. 5. risk and Variances of returns can be decomposed into B-risk which represents which represents unsystematic risk. and the A portfolio Alpha is the difference between The Option Pricing Model has FIVE inputs. They are the Stock price, S, Exercise price, E, tin maturity of the option, t, the risk free rate, RF and the stock's

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts