Question: 1. Today is May 15, 2000, and the current, semi-annually compounded yield curve is in the table below Compute the Macaulay and modified duration for

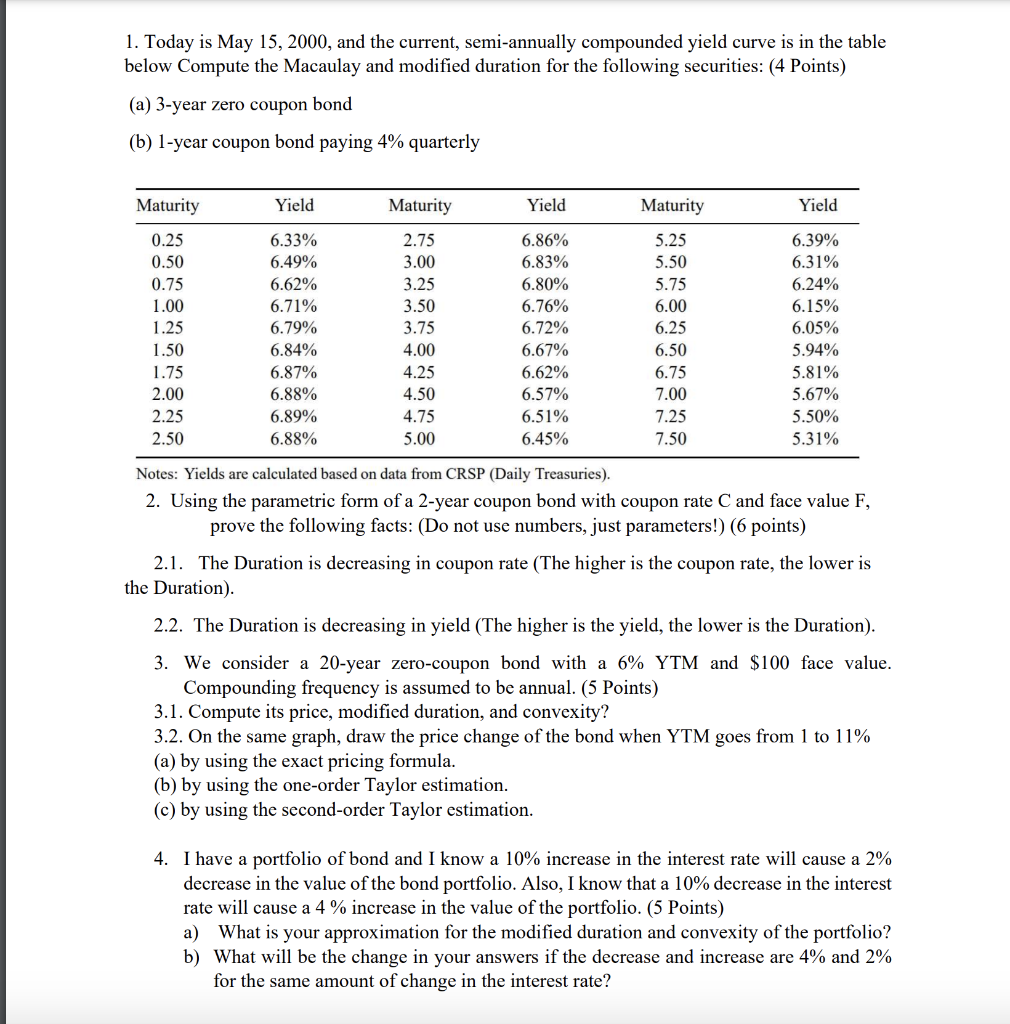

1. Today is May 15, 2000, and the current, semi-annually compounded yield curve is in the table below Compute the Macaulay and modified duration for the following securities: (4 Points) (a) 3-year zero coupon bond (b) 1-year coupon bond paying 4% quarterly Maturity Yield Maturity Yield Maturity Yield 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 6.33% 6.49% 6.62% 6.71% 6.79% 6.84% 6.87% 6.88% 6.89% 6.88% 2.75 3.00 3.25 3.50 3.75 4.00 4.25 4.50 4.75 5.00 6.86% 6.83% 6.80% 6.76% 6.72% 6.67% 6.62% 6.57% 6.51% 6.45% 5.25 5.50 5.75 6.00 6.25 6.50 6.75 7.00 7.25 7.50 6.39% 6.31% 6.24% 6.15% 6.05% 5.94% 5.81% 5.67% 5.50% 5.31% 2.25 2.50 Notes: Yields are calculated based on data from CRSP (Daily Treasuries). 2. Using the parametric form of a 2-year coupon bond with coupon rate C and face value F, prove the following facts: (Do not use numbers, just parameters!) (6 points) 2.1. The Duration is decreasing in coupon rate (The higher is the coupon rate, the lower is the Duration) 2.2. The Duration is decreasing in yield (The higher is the yield, the lower is the Duration). 3. We consider a 20-year zero-coupon bond with a 6% YTM and $100 face value. Compounding frequency is assumed to be annual. (5 Points) 3.1. Compute its price, modified duration, and convexity? 3.2. On the same graph, draw the price change of the bond when YTM goes from 1 to 11% (a) by using the exact pricing formula. (b) by using the one-order Taylor estimation. (c) by using the second-order Taylor estimation. 4. I have a portfolio of bond and I know a 10% increase in the interest rate will cause a 2% decrease in the value of the bond portfolio. Also, I know that a 10% decrease in the interest rate will cause a 4 % increase in the value of the portfolio. (5 Points) a) What is your approximation for the modified duration and convexity of the portfolio? b) What will be the change in your answers if the decrease and increase are 4% and 2% for the same amount of change in the interest rate? 1. Today is May 15, 2000, and the current, semi-annually compounded yield curve is in the table below Compute the Macaulay and modified duration for the following securities: (4 Points) (a) 3-year zero coupon bond (b) 1-year coupon bond paying 4% quarterly Maturity Yield Maturity Yield Maturity Yield 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 6.33% 6.49% 6.62% 6.71% 6.79% 6.84% 6.87% 6.88% 6.89% 6.88% 2.75 3.00 3.25 3.50 3.75 4.00 4.25 4.50 4.75 5.00 6.86% 6.83% 6.80% 6.76% 6.72% 6.67% 6.62% 6.57% 6.51% 6.45% 5.25 5.50 5.75 6.00 6.25 6.50 6.75 7.00 7.25 7.50 6.39% 6.31% 6.24% 6.15% 6.05% 5.94% 5.81% 5.67% 5.50% 5.31% 2.25 2.50 Notes: Yields are calculated based on data from CRSP (Daily Treasuries). 2. Using the parametric form of a 2-year coupon bond with coupon rate C and face value F, prove the following facts: (Do not use numbers, just parameters!) (6 points) 2.1. The Duration is decreasing in coupon rate (The higher is the coupon rate, the lower is the Duration) 2.2. The Duration is decreasing in yield (The higher is the yield, the lower is the Duration). 3. We consider a 20-year zero-coupon bond with a 6% YTM and $100 face value. Compounding frequency is assumed to be annual. (5 Points) 3.1. Compute its price, modified duration, and convexity? 3.2. On the same graph, draw the price change of the bond when YTM goes from 1 to 11% (a) by using the exact pricing formula. (b) by using the one-order Taylor estimation. (c) by using the second-order Taylor estimation. 4. I have a portfolio of bond and I know a 10% increase in the interest rate will cause a 2% decrease in the value of the bond portfolio. Also, I know that a 10% decrease in the interest rate will cause a 4 % increase in the value of the portfolio. (5 Points) a) What is your approximation for the modified duration and convexity of the portfolio? b) What will be the change in your answers if the decrease and increase are 4% and 2% for the same amount of change in the interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts