Question: 1) Today's LIBOR term structure is 30 days 2% 60 days 2.2% 90 days 2.5% 120 days 3% Our firm is interested in locking in

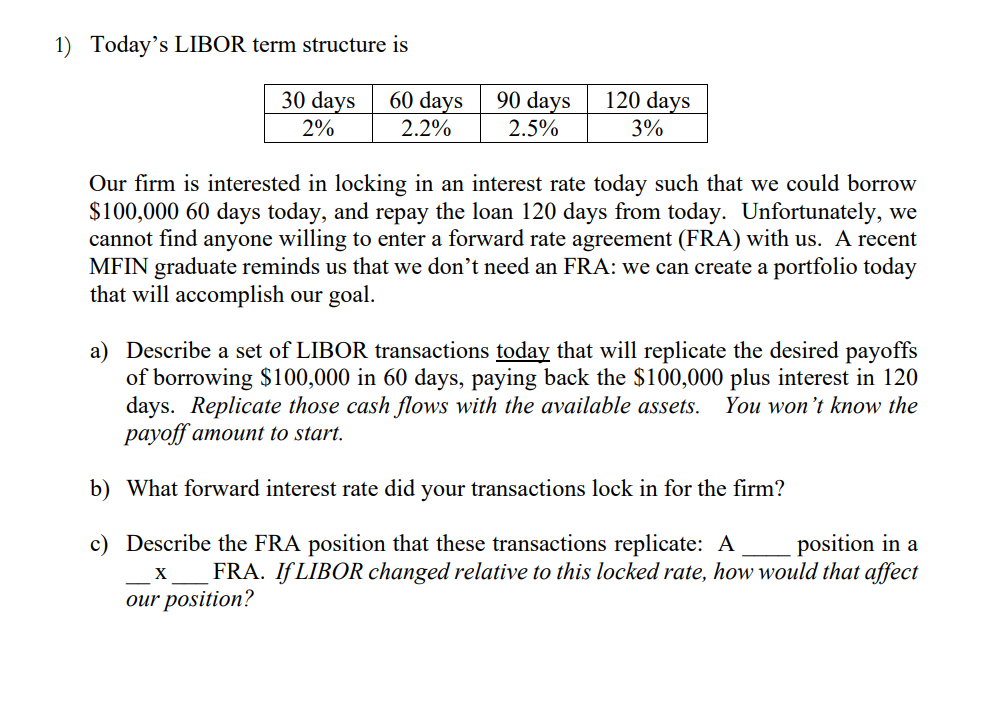

1) Today's LIBOR term structure is 30 days 2% 60 days 2.2% 90 days 2.5% 120 days 3% Our firm is interested in locking in an interest rate today such that we could borrow $100,000 60 days today, and repay the loan 120 days from today. Unfortunately, we cannot find anyone willing to enter a forward rate agreement (FRA) with us. A recent MFIN graduate reminds us that we don't need an FRA: we can create a portfolio today that will accomplish our goal. a) Describe a set of LIBOR transactions today that will replicate the desired payoffs of borrowing $100,000 in 60 days, paying back the $100,000 plus interest in 120 days. Replicate those cash flows with the available assets. You won't know the payoff amount to start. b) What forward interest rate did your transactions lock in for the firm? c) Describe the FRA position that these transactions replicate: A position in a FRA. If LIBOR changed relative to this locked rate, how would that affect our position? 1) Today's LIBOR term structure is 30 days 2% 60 days 2.2% 90 days 2.5% 120 days 3% Our firm is interested in locking in an interest rate today such that we could borrow $100,000 60 days today, and repay the loan 120 days from today. Unfortunately, we cannot find anyone willing to enter a forward rate agreement (FRA) with us. A recent MFIN graduate reminds us that we don't need an FRA: we can create a portfolio today that will accomplish our goal. a) Describe a set of LIBOR transactions today that will replicate the desired payoffs of borrowing $100,000 in 60 days, paying back the $100,000 plus interest in 120 days. Replicate those cash flows with the available assets. You won't know the payoff amount to start. b) What forward interest rate did your transactions lock in for the firm? c) Describe the FRA position that these transactions replicate: A position in a FRA. If LIBOR changed relative to this locked rate, how would that affect our position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts