Question: 1. True or false. Common size statements allow the comparison of two or more companies with different amounts of net sales and net assets. 2.

1. True or false. Common size statements allow the comparison of two or more companies with different amounts of net sales and net assets.

2. The formula to compute the rate of return on net sales is

| a. net income/average common stockholder's equity. |

| b. | net income + interest expense, then divide by average total assets. |

| c. | net income/interest expense. |

3. True or false. Horizontal analysis is the study of percentage changes in comparative financial statements.

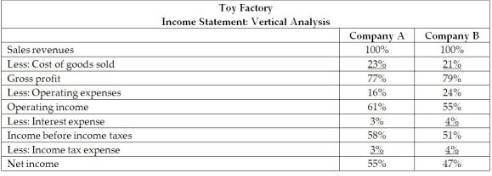

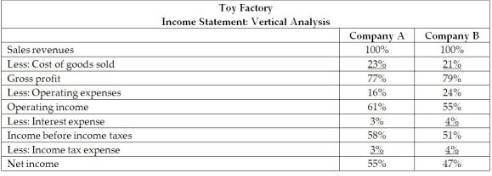

4. The managerial accountant at the Toy Factory presented the following information at a meeting:

What type of statement did the managerial accountant present at the meeting?

| d. | Statement of cash flows |

5. True or false. The formula used in vertical analysis of the income statement is: (each income statement line item/sales revenue) = vertical %.

6. True or false. A common size statement reports only dollar values.

7. True or false. The data provided by the horizontal or vertical analysis of the financial statements can be used in benchmarking.

8. The formula for computing the rate of return on common stockholders' equity is

| a. (net income - preferred dividends) / number of shares of outstanding common stock. |

| b. | net income / net sales. |

| c. | (net income + interest expense) / average total assets. |

| d. | (net income - preferred dividends) / average common stockholders' equity. |

9. Which of the following types of analysis include trend percentage analysis?

10. True or false. Days' sales in receivables is a measure of a company's ability to collect their accounts receivable.

Toy Factory Income Statement: Vertical Analysis Company ACompany B Sales revenues 100% 100% Less: Cost of goods sold Gross profit Less: Operating expenses Operating income Less: Interest expense Income before income taxes Less: Income tax expense3% Net income 77% 16% 61% 3% 58% 79% 24% 55% 51% 55% 47%