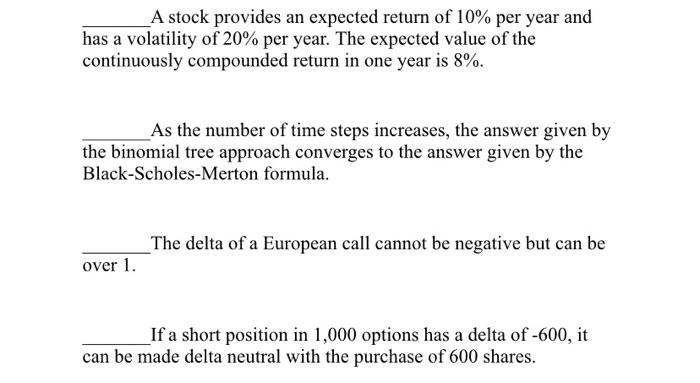

Question: 1. TRUE or FALSE (if false, please indicate why the statement is false in the space below the statement. A stock provides an expected return

1. TRUE or FALSE (if false, please indicate why the statement is false in the space below the statement. A stock provides an expected return of 10% per year and has a volatility of 20% per year. The expected value of the continuously compounded return in one year is 8%. As the number of time steps increases, the answer given by the binomial tree approach converges to the answer given by the Black-Scholes-Merton formula. _The delta of a European call cannot be negative but can be over 1. If a short position in 1,000 options has a delta of -600, it can be made delta neutral with the purchase of 600 shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts