Question: 1. True or false questions (10 questions) Answer T for true or F for false. 2 marks for each correct answer. 1. If the net

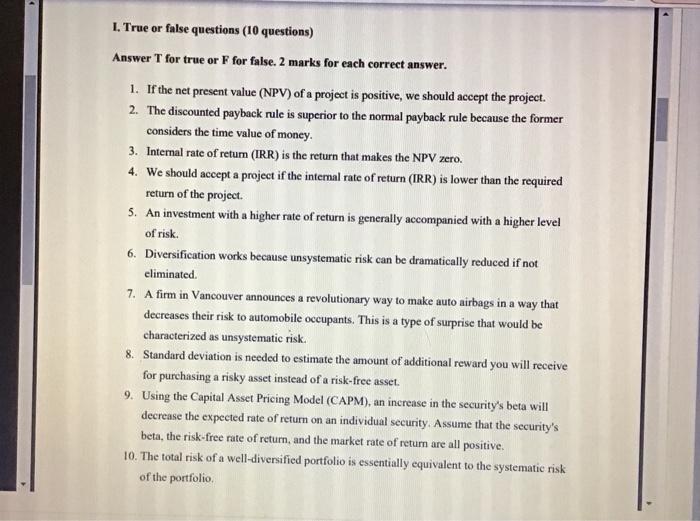

1. True or false questions (10 questions) Answer T for true or F for false. 2 marks for each correct answer. 1. If the net present value (NPV) of a project is positive, we should accept the project. 2. The discounted payback rule is superior to the normal payback rule because the former considers the time value of money. 3. Internal rate of retum (IRR) is the return that makes the NPV zero. 4. We should accept a project if the internal rate of return (IRR) is lower than the required return of the project 5. An investment with a higher rate of return is generally accompanied with a higher level of risk 6. Diversification works because unsystematic risk can be dramatically reduced if not eliminated 7. A firm in Vancouver announces a revolutionary way to make auto airbags in a way that decreases their risk to automobile occupants. This is a type of surprise that would be characterized as unsystematic risk. 8. Standard deviation is needed to estimate the amount of additional reward you will receive for purchasing a risky asset instead of a risk-free asset. 9. Using the Capital Asset Pricing Model (CAPM), an increase in the security's beta will decrease the expected rate of return on an individual security. Assume that the security's beta, the risk-free rate of return, and the market rate of retum are all positive. 10. The total risk of a well-diversified portfolio is essentially equivalent to the systematic risk of the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts