Question: 1. True (T) or False (F) (10 points) (1) Long-term debt is defined as a residual claim on a firm's assets. ( ) (2) Net

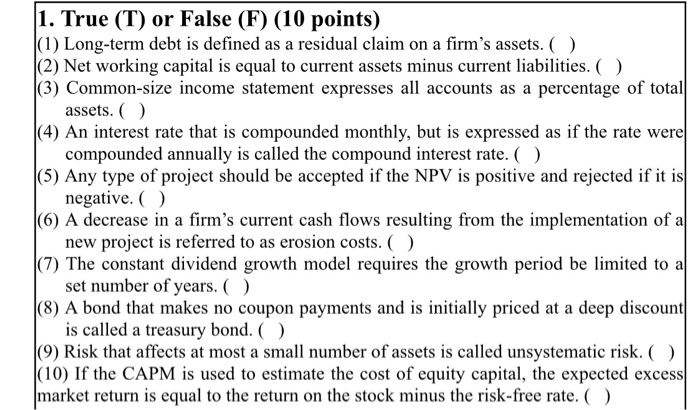

1. True (T) or False (F) (10 points) (1) Long-term debt is defined as a residual claim on a firm's assets. ( ) (2) Net working capital is equal to current assets minus current liabilities. ( ) (3) Common-size income statement expresses all accounts as a percentage of total assets. ( ) (4) An interest rate that is compounded monthly, but is expressed as if the rate were compounded annually is called the compound interest rate. ( ) (5) Any type of project should be accepted if the NPV is positive and rejected if it is negative. (6) A decrease in a firm's current cash flows resulting from the implementation of a new project is referred to as erosion costs. ( ). (7) The constant dividend growth model requires the growth period be limited to a set number of years. ( ) (8) A bond that makes no coupon payments and is initially priced at a deep discount is called a treasury bond. ( ) (9) Risk that affects at most a small number of assets is called unsystematic risk. ( ) (10) If the CAPM is used to estimate the cost of equity capital, the expected excess market return is equal to the return on the stock minus the risk-free rate. ( )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts