Question: 1. True/False (2 pts) Note: You are not required to explain why it is true or not. Please clearly mark if it is true or

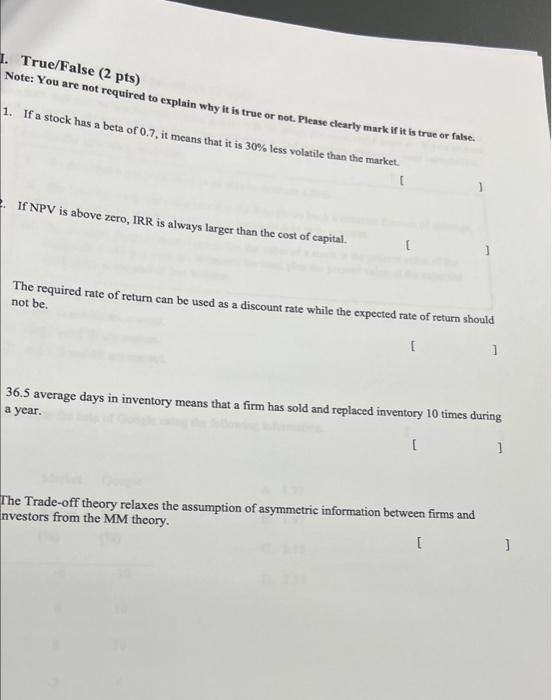

1. True/False (2 pts) Note: You are not required to explain why it is true or not. Please clearly mark if it is true or false. 1. If a stock has a beta of 0.7, it means that it is 30% less volatile than the market If NPV is above zero, IRR is always larger than the cost of capital. The required rate of return can be used as a discount rate while the expected rate of return should not be. 36.5 average days in inventory means that a firm has sold and replaced inventory 10 times during a year. [ ] The Trade-off theory relaxes the assumption of asymmetric information between firms and Investors from the MM theory. [ ]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts