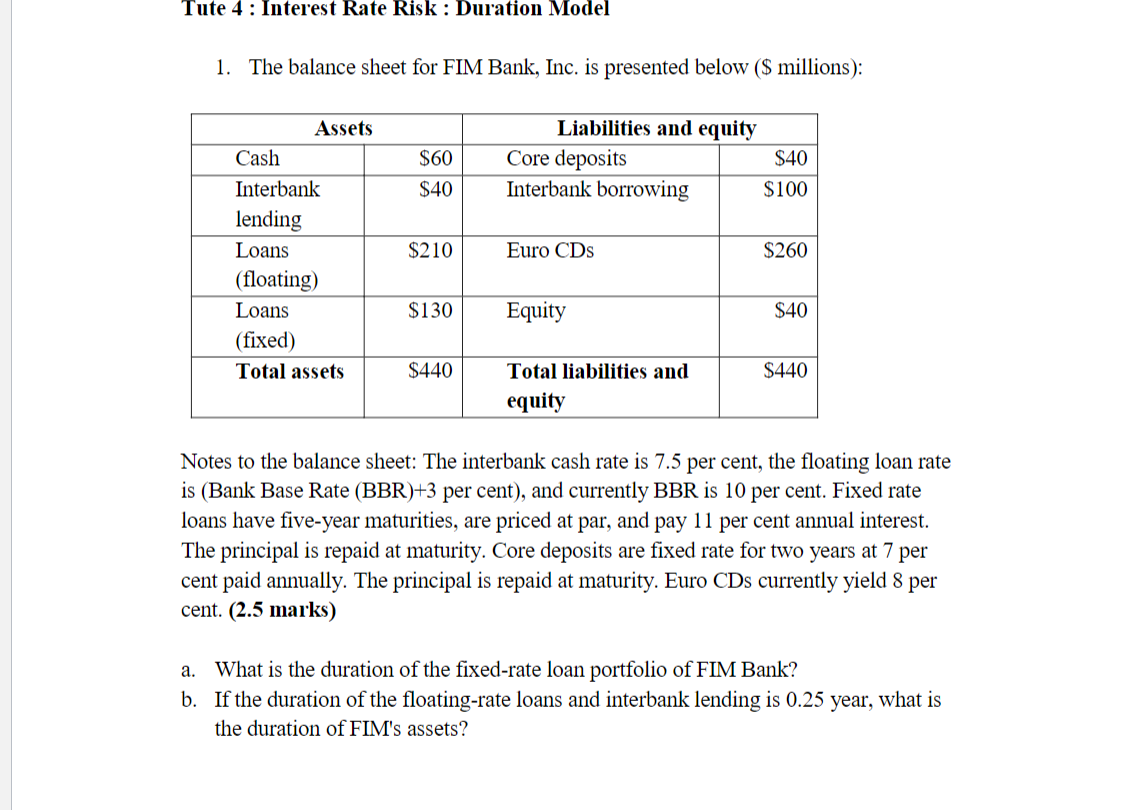

Question: 1. Tute 4: Interest Rate Risk : Duration Model 1. The balance sheet for FIM Bank, Inc. is presented below ($ millions): $60 $40 Liabilities

1.

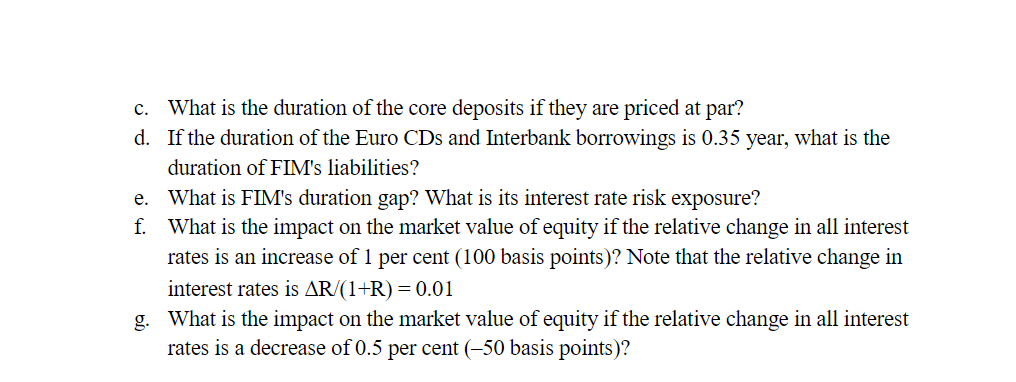

Tute 4: Interest Rate Risk : Duration Model 1. The balance sheet for FIM Bank, Inc. is presented below ($ millions): $60 $40 Liabilities and equity Core deposits $40 Interbank borrowing $100 Assets Cash Interbank lending Loans (floating) Loans (fixed) Total assets $210 Euro CDs $260 $130 Equity $40 $440 $440 Total liabilities and equity Notes to the balance sheet: The interbank cash rate is 7.5 per cent, the floating loan rate is (Bank Base Rate (BBR)+3 per cent), and currently BBR is 10 per cent. Fixed rate loans have five-year maturities, are priced at par, and pay 11 per cent annual interest. The principal is repaid at maturity. Core deposits are fixed rate for two years at 7 per cent paid annually. The principal is repaid at maturity. Euro CDs currently yield 8 per cent. (2.5 marks) a. What is the duration of the fixed-rate loan portfolio of FIM Bank? b. If the duration of the floating-rate loans and interbank lending is 0.25 year, what is the duration of FIM's assets? c. What is the duration of the core deposits if they are priced at par? d. If the duration of the Euro CDs and Interbank borrowings is 0.35 year, what is the duration of FIM's liabilities? e. What is FIM's duration gap? What is its interest rate risk exposure? f. What is the impact on the market value of equity if the relative change in all interest rates is an increase of 1 per cent (100 basis points)? Note that the relative change in interest rates is AR/(1+R) = 0.01 g. What is the impact on the market value of equity if the relative change in all interest rates is a decrease of 0.5 per cent (-50 basis points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts