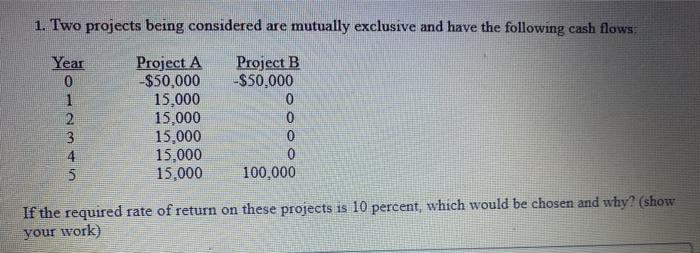

Question: 1. Two projects being considered are mutually exclusive and have the following cash flows: Year 0 Project A -$50,000 15.000 15,000 15,000 15,000 15,000 Project

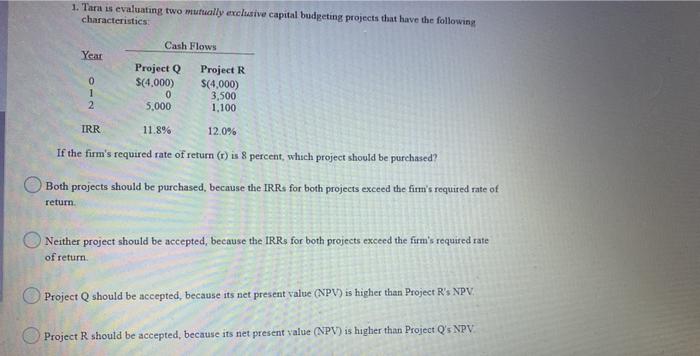

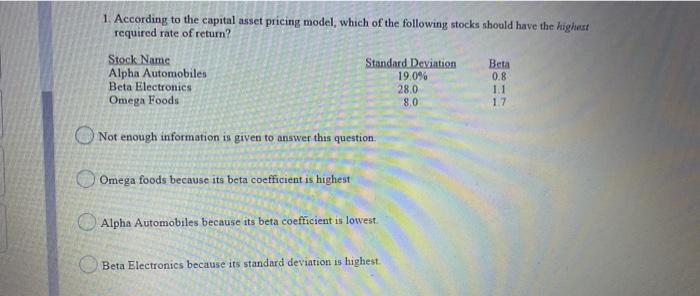

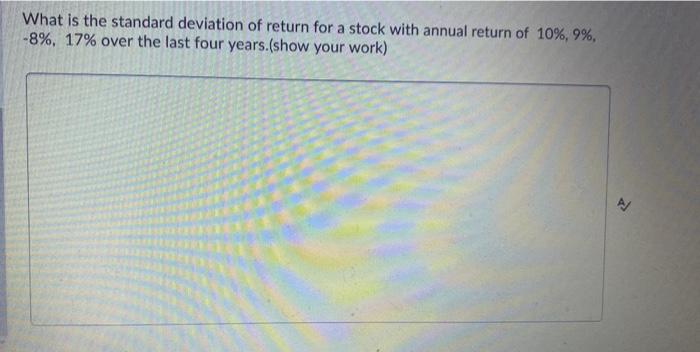

1. Two projects being considered are mutually exclusive and have the following cash flows: Year 0 Project A -$50,000 15.000 15,000 15,000 15,000 15,000 Project B -$50.000 0 0 0 0 100,000 If the required rate of return on these projects is 10 percent, which would be chosen and why? (show your work) 1. Tara is evaluating two mutually exclusive capital budgeting projects that have the following characteristics Cash Flows Year 0 1 2 Project $(4.000) 0 5,000 Project R $(4,000) 3,500 1.100 IRR 11.8% 12.0% If the firm's required rate of return (1) is 8 percent, which project should be purchased? Both projects should be purchased, because the IRRs for both projects exceed the firm's required rate of return Neither project should be accepted, because the IRRs for both projects exceed the firm's required rate of return Project Q should be accepted, because its net present value (NPV) is higher than Project R's NPV Project R should be accepted, because its net present value (NPV) is higher than Project Q's NPV 1. According to the capital asset pricing model, which of the following stocks should have the highest required rate of return? Stock Name Standard Deviation Beta Alpha Automobiles 19.0% Beta Electronics 28.0 1.1 Omega Foods 80 1.7 0.8 Not enough information is given to answer this question Omega foods because its beta coefficient is highest Alpha Automobiles because its beta coefficient is lowest Beta Electronics because its standard deviation is highest What is the standard deviation of return for a stock with annual return of 10%, 9%, -8%, 17% over the last four years.(show your work) N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts