Question: 1. Understand the similarities and differences between different types of bonds. 2. Discuss the differences between callable and puttable bond. Understand their advantages and disadvantages

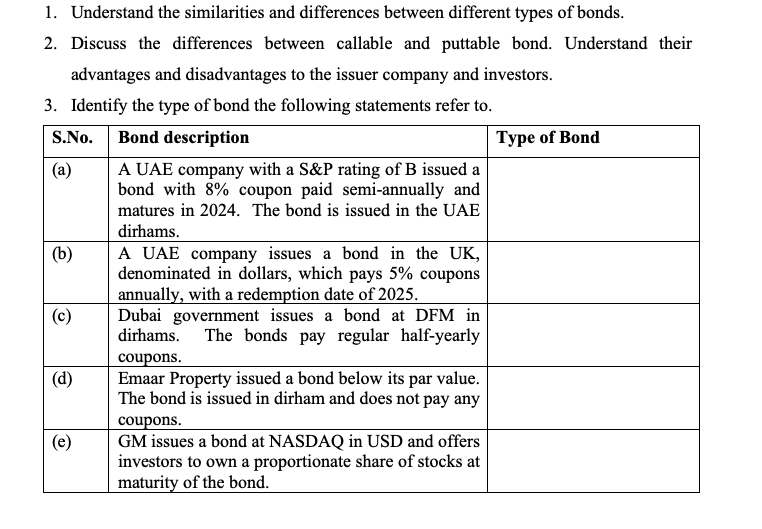

1. Understand the similarities and differences between different types of bonds. 2. Discuss the differences between callable and puttable bond. Understand their advantages and disadvantages to the issuer company and investors. 3. Identify the type of bond the following statements refer to. S.No. Bond description Type of Bond (a) A UAE company with a S&P rating of B issued a bond with 8% coupon paid semi-annually and matures in 2024. The bond is issued in the UAE dirhams. (b) A UAE company issues a bond in the UK, denominated in dollars, which pays 5% coupons annually, with a redemption date of 2025. (c) Dubai government issues a bond at DFM in dirhams. The bonds pay regular half-yearly coupons. (d) Emaar Property issued a bond below its par value. The bond is issued in dirham and does not pay any coupons. (e) GM issues a bond at NASDAQ in USD and offers investors to own a proportionate share of stocks at maturity of the bond. 1. Understand the similarities and differences between different types of bonds. 2. Discuss the differences between callable and puttable bond. Understand their advantages and disadvantages to the issuer company and investors. 3. Identify the type of bond the following statements refer to. S.No. Bond description Type of Bond (a) A UAE company with a S&P rating of B issued a bond with 8% coupon paid semi-annually and matures in 2024. The bond is issued in the UAE dirhams. (b) A UAE company issues a bond in the UK, denominated in dollars, which pays 5% coupons annually, with a redemption date of 2025. (c) Dubai government issues a bond at DFM in dirhams. The bonds pay regular half-yearly coupons. (d) Emaar Property issued a bond below its par value. The bond is issued in dirham and does not pay any coupons. (e) GM issues a bond at NASDAQ in USD and offers investors to own a proportionate share of stocks at maturity of the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts