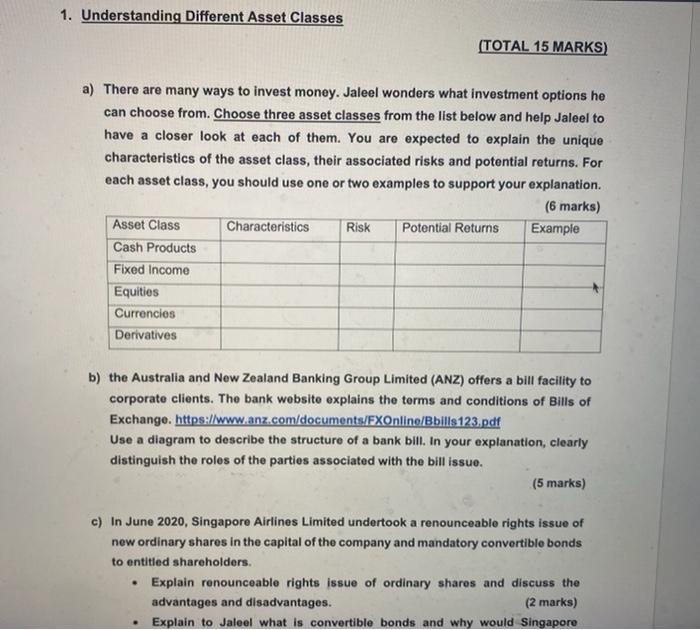

Question: 1. Understanding Different Asset Classes (TOTAL 15 MARKS) a) There are many ways to invest money. Jaleel wonders what investment options he can choose from.

1. Understanding Different Asset Classes (TOTAL 15 MARKS) a) There are many ways to invest money. Jaleel wonders what investment options he can choose from. Choose three asset classes from the list below and help Jaleel to have a closer look at each of them. You are expected to explain the unique characteristics of the asset class, their associated risks and potential returns. For each asset class, you should use one or two examples to support your explanation. (6 marks) Example Characteristics Risk Potential Returns Asset Class Cash Products Fixed Income Equities Currencies Derivatives b) the Australia and New Zealand Banking Group Limited (ANZ) offers a bill facility to corporate clients. The bank website explains the terms and conditions of Bills of Exchange. https://www.anz.com/documents/FXOnline/Bbills123.pdf Use a diagram to describe the structure of a bank bill. In your explanation, clearly distinguish the roles of the parties associated with the bill issue. (5 marks) c) In June 2020, Singapore Airlines Limited undertook a renounceable rights issue of new ordinary shares in the capital of the company and mandatory convertible bonds to entitled shareholders. Explain renounceable rights issue of ordinary shares and discuss the advantages and disadvantages. (2 marks) . Explain to Jaleel what is convertible bonds and why would Singapore c) In June 2020, Singapore Airlines Limited undertook a renounceable rights issue of new ordinary shares in the capital of the company and mandatory convertible bonds to entitled shareholders. Explain renounceable rights issue of ordinary shares and discuss the advantages and disadvantages. (2 marks) Explain to Jaleel what is convertible bonds and why would Singapore Airlines undertake mandatory convertible bonds to entitled shareholders? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts