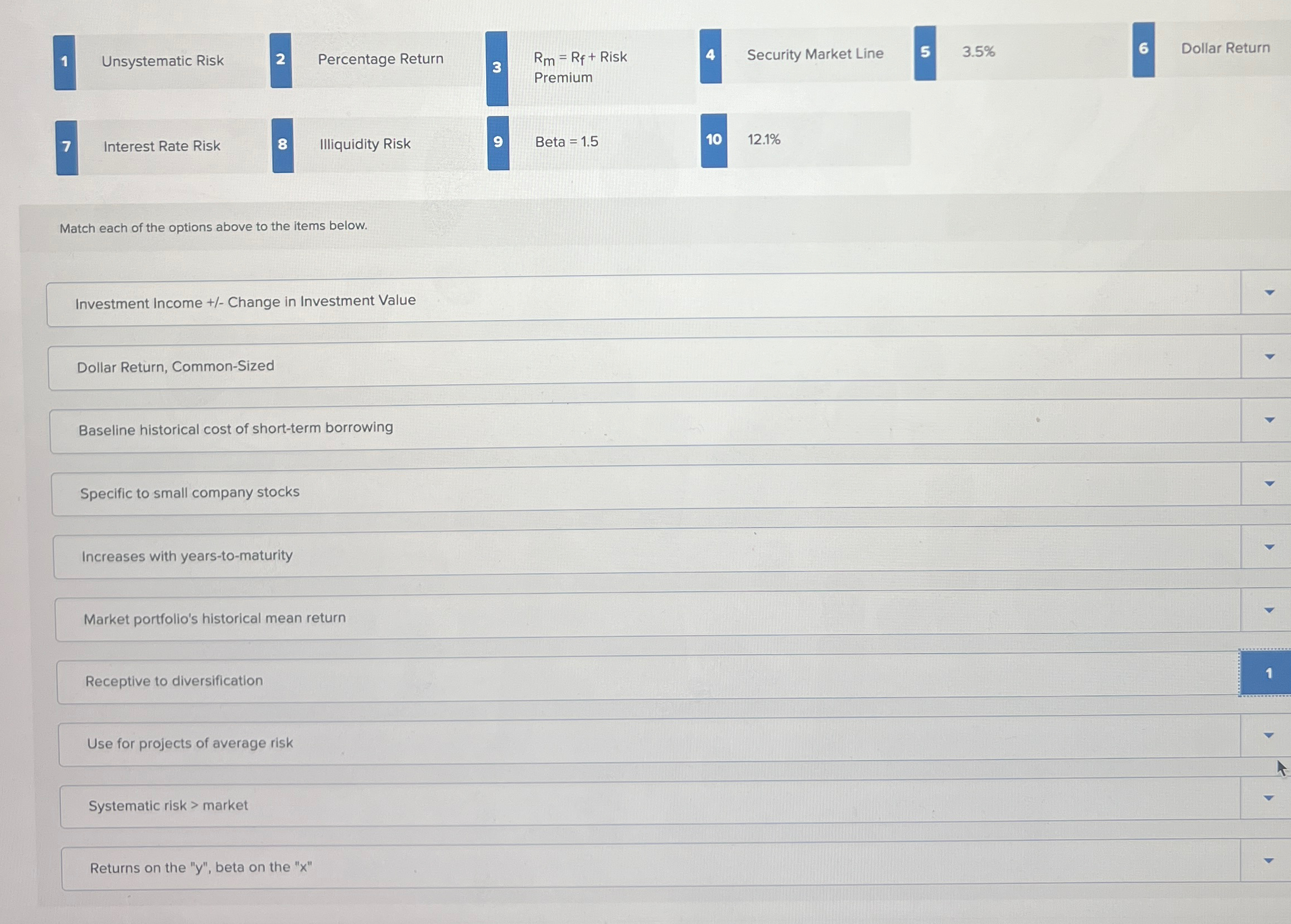

Question: 1 Unsystematic Risk 2 Percentage Return 3 Rm = Rf+ Risk 4 Security Market Line 5 3.5% 6 Dollar Return Premium 7 Interest Rate

1 Unsystematic Risk 2 Percentage Return 3 Rm = Rf+ Risk 4 Security Market Line 5 3.5% 6 Dollar Return Premium 7 Interest Rate Risk 8 Illiquidity Risk Match each of the options above to the items below. Investment Income +/- Change in Investment Value Dollar Return, Common-Sized Baseline historical cost of short-term borrowing Specific to small company stocks Increases with years-to-maturity Market portfolio's historical mean return Receptive to diversification Use for projects of average risk Systematic risk > market Returns on the "y", beta on the "x" 6 Beta = 1.5 10 10 12.1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts