Question: 1. Use e (continuously compounded) to answer. 2. Typed answer would be better Thank you! 10. A while ago you have entered into a currency

1. Use "e" (continuously compounded) to answer.

2. Typed answer would be better

Thank you!

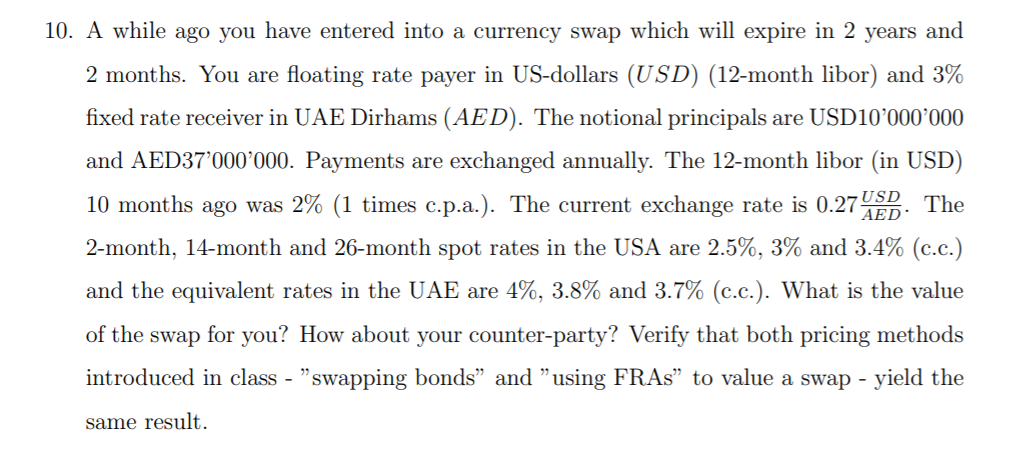

10. A while ago you have entered into a currency swap which will expire in 2 years and 2 months. You are floating rate payer in US-dollars (USD) (12-month libor) and 3% fixed rate receiver in UAE Dirhams (AED). The notional principals are USD10'000'000 and AED37'000'000. Payments are exchanged annually. The 12-month libor (in USD) 10 months ago was 2% (1 times c.p.a.). The current exchange rate is 0.27 LED. The 2-month, 14-month and 26-month spot rates in the USA are 2.5%, 3% and 3.4% (c.c.) and the equivalent rates in the UAE are 4%, 3.8% and 3.7% (c.c.). What is the value of the swap for you? How about your counter-party? Verify that both pricing methods introduced in class - "swapping bonds and using FRAs to value a swap - yield the same result. 10. A while ago you have entered into a currency swap which will expire in 2 years and 2 months. You are floating rate payer in US-dollars (USD) (12-month libor) and 3% fixed rate receiver in UAE Dirhams (AED). The notional principals are USD10'000'000 and AED37'000'000. Payments are exchanged annually. The 12-month libor (in USD) 10 months ago was 2% (1 times c.p.a.). The current exchange rate is 0.27 LED. The 2-month, 14-month and 26-month spot rates in the USA are 2.5%, 3% and 3.4% (c.c.) and the equivalent rates in the UAE are 4%, 3.8% and 3.7% (c.c.). What is the value of the swap for you? How about your counter-party? Verify that both pricing methods introduced in class - "swapping bonds and using FRAs to value a swap - yield the same result

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts