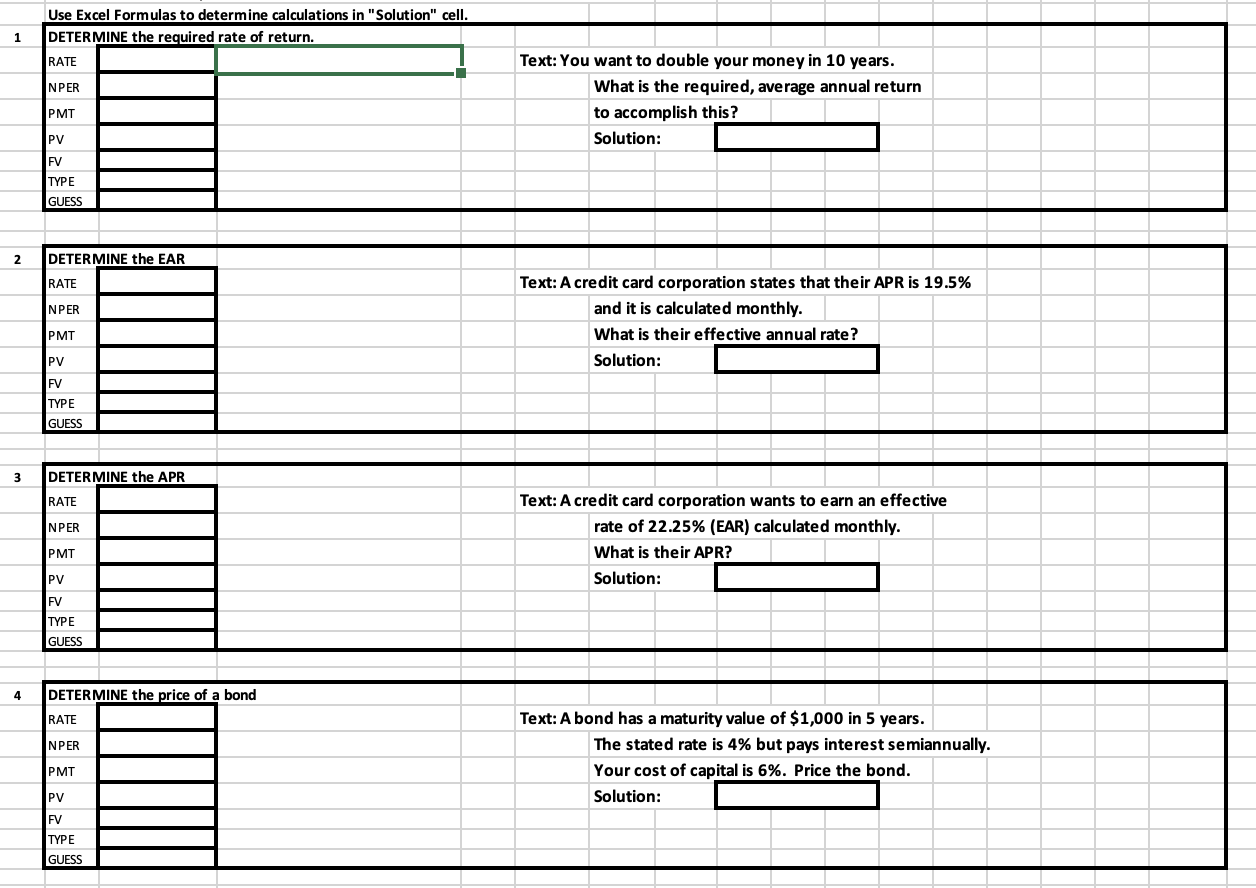

Question: 1 Use Excel Formulas to determine calculations in Solution cell. DETERMINE the required rate of return. RATE 1 NPER Text: You want to double your

1 Use Excel Formulas to determine calculations in "Solution" cell. DETERMINE the required rate of return. RATE 1 NPER Text: You want to double your money in 10 years. What is the required, average annual return to accomplish this? Solution: PMT PV FV TYPE GUESS 2 DETERMINE the EAR RATE NPER Text: A credit card corporation states that their APR is 19.5% and it is calculated monthly. What is their effective annual rate? Solution: PMT PV FV TYPE GUESS 3 DETERMINE the APR RATE NPER Text: A credit card corporation wants to earn an effective rate of 22.25% (EAR) calculated monthly. What is their APR? Solution: PMT PV FV TYPE GUESS 4 DETERMINE the price of a bond RATE NPER Text: A bond has a maturity value of $1,000 in 5 years. The stated rate is 4% but pays interest semiannually. Your cost of capital is 6%. Price the bond. Solution: PMT PV FV TYPE GUESS 1 Use Excel Formulas to determine calculations in "Solution" cell. DETERMINE the required rate of return. RATE 1 NPER Text: You want to double your money in 10 years. What is the required, average annual return to accomplish this? Solution: PMT PV FV TYPE GUESS 2 DETERMINE the EAR RATE NPER Text: A credit card corporation states that their APR is 19.5% and it is calculated monthly. What is their effective annual rate? Solution: PMT PV FV TYPE GUESS 3 DETERMINE the APR RATE NPER Text: A credit card corporation wants to earn an effective rate of 22.25% (EAR) calculated monthly. What is their APR? Solution: PMT PV FV TYPE GUESS 4 DETERMINE the price of a bond RATE NPER Text: A bond has a maturity value of $1,000 in 5 years. The stated rate is 4% but pays interest semiannually. Your cost of capital is 6%. Price the bond. Solution: PMT PV FV TYPE GUESS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts