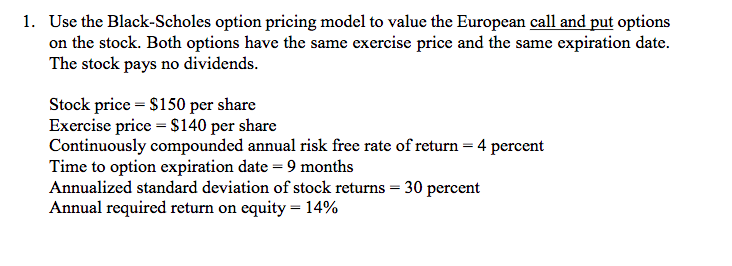

Question: 1. Use the Black-Scholes option pricing model to value the European call and put options on the stock. Both options have the same exercise price

1. Use the Black-Scholes option pricing model to value the European call and put options on the stock. Both options have the same exercise price and the same expiration date. The stock pays no dividends. Stock price = $150 per share Exercise price = $140 per share Continuously compounded annual risk free rate of return = 4 percent Time to option expiration date = 9 months Annualized standard deviation of stock returns = 30 percent Annual required return on equity = 14%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock