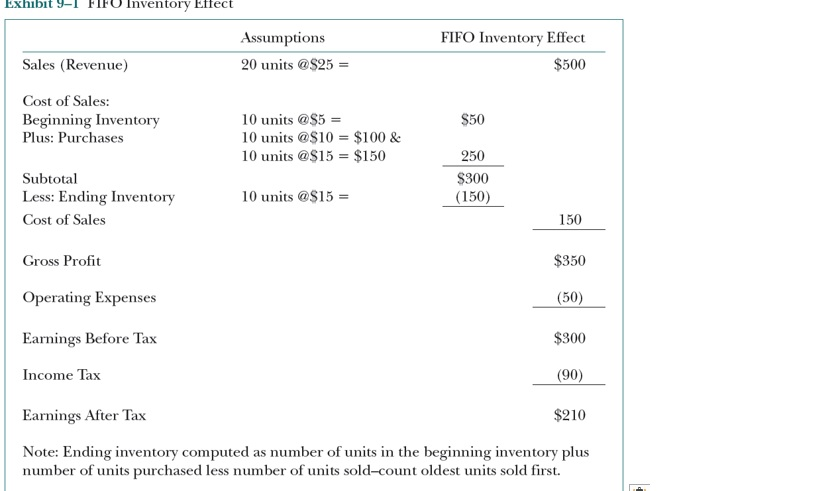

Question: 1. Use the format in Exhibit 9-1 ( bellow) to compute the ending FIFO inventory and cost of goods sold assuming: $550,000 in sales Beginning

1. Use the format in Exhibit 9-1 ( bellow) to compute the ending FIFO inventory and cost of goods sold assuming:

$550,000 in sales

Beginning inventory 1125 units @ $175

Purchases of 890 units @ $150

450 units @ $165

200 units @ $140

Ending inventory 892 units

Ending FIFO inventory value:

Cost of Goods Sold:

Cost of Goods Sold Percentage of Sales:

2. Use the format in Exhibit 9-2 to compute the same items using the same assumptions.

Ending LIFO inventory value:

Cost of Goods Sold

Cost of Goods Sold Percentage of Sales:

3. Comment on the difference in outcomes (multiple choice)

4. Assume that MHS purchased equipment for $1,400,000 cash on Oct. 1 (first day of its fiscal year). This equipment has an expected life of 11 years. The salvage value is 15% of cost. No equipment was traded in on this purchase.

Compute the straight-line depreciation for this purchase.

Compute the straight-line depreciation with no salvage value.

5. Set up a purchase scenario of your own and compute the straight-line depreciation with and without salvage value discuss in group.

Scenario With salvage value Without salvage value

Exhibit9 FIFO Inentory Effecit Assumptions 20 units @$25 FIFO Inventory Effect Sales (Revenue) Cost of Sales: Beginning Inventory $500 S50 10 units @s5- 10 units @s10 $100 & 10 units @S15- $150 Plus: Purchases Subtotal Less: Ending Inventory Cost of Sales 250 $300 (150) 10 units @S15 150 $350 (50) $300 (90) $210 Note: Ending inventory computed as number of units in the beginning inventory plus Gross Profit Operating Expenses Earnings Before Ta>x Income Tax Earnings After Tax number of units purchased less number of units sold-count oldest units sold first

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts