Question: 1. Use the information below to construct a 2014 income statement and balance sheets for both years. The average tax rate is 34% and

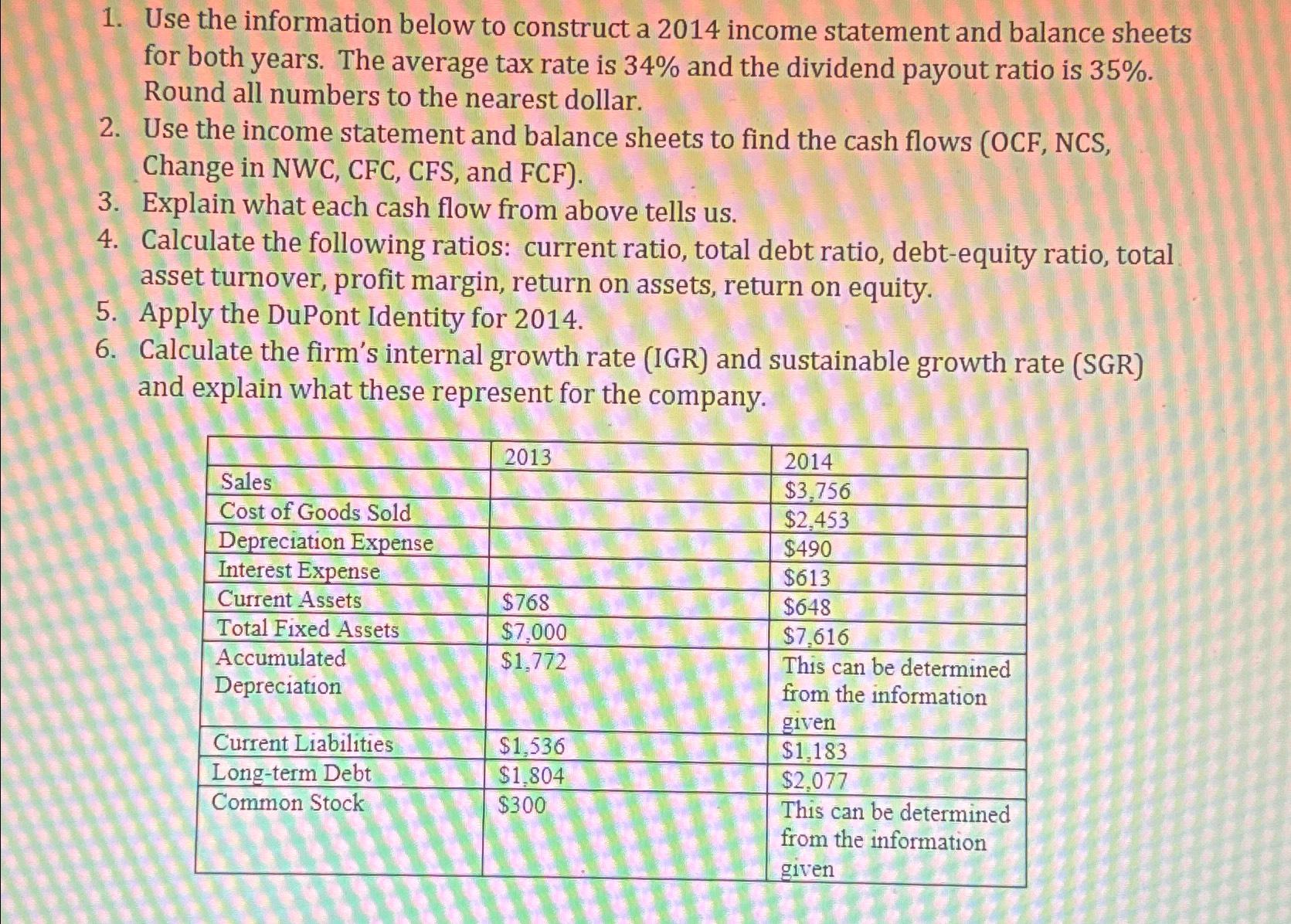

1. Use the information below to construct a 2014 income statement and balance sheets for both years. The average tax rate is 34% and the dividend payout ratio is 35%. Round all numbers to the nearest dollar. 2. Use the income statement and balance sheets to find the cash flows (OCF, NCS, Change in NWC, CFC, CFS, and FCF). 3. Explain what each cash flow from above tells us. 4. Calculate the following ratios: current ratio, total debt ratio, debt-equity ratio, total asset turnover, profit margin, return on assets, return on equity. 5. Apply the DuPont Identity for 2014. 6. Calculate the firm's internal growth rate (IGR) and sustainable growth rate (SGR) and explain what these represent for the company. Sales Cost of Goods Sold Depreciation Expense Interest Expense Current Assets Total Fixed Assets 2013 $768 $7,000 2014 $3,756 $2,453 $490 $613 $648 $7,616 59 Accumulated Depreciation $1,772 Current Liabilities Long-term Debt $1,536 $1,804 $300 Common Stock This can be determined from the information given $1,183 $2,077 This can be determined from the information given

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts