Question: 1. Use the present value tables (example excel attached) to calculate the issue price and make the journal entry of a $100,000 bond issue in

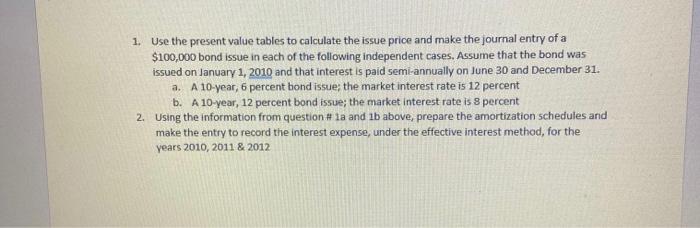

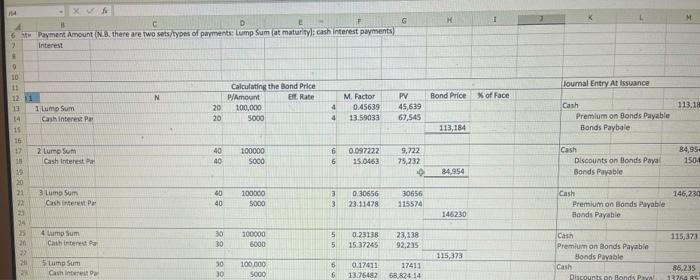

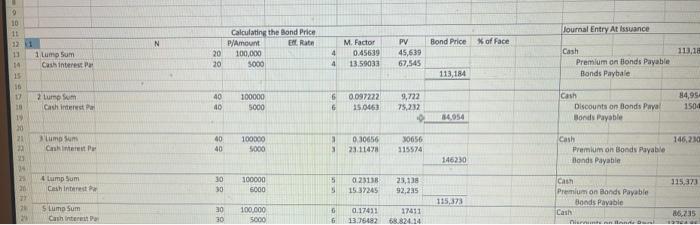

1. Use the present value tables to calculate the issue price and make the journal entry of a $100,000 bond issue in each of the following independent cases. Assume that the bond was issued on January 1,2010 and that interest is paid semi-annually on June 30 and December 31. a. A 10-year, 6 percent bond issue; the market interest rate is 12 percent b. A 10 -year, 12 percent bond issue; the market interest rate is 8 percent 2. Using the information from question # 1a and 1b above, prepare the amortization schedules and make the entry to record the interest expense, under the effective interest method, for the years 2010,2011&2012 interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts