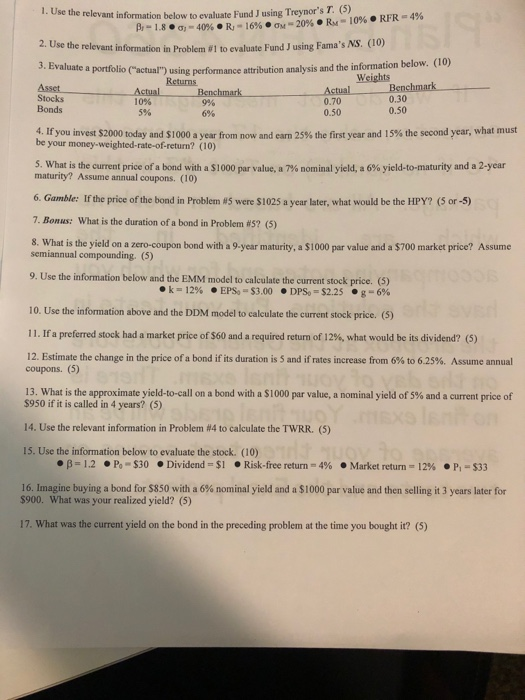

Question: 1. Use the relevant information below to evaluate Fund J using Treynor's T. ) 1.8. 40% OR-16% 20% OR-10% RFR - 4% 4. Use the

1. Use the relevant information below to evaluate Fund J using Treynor's T. ) 1.8. 40% OR-16% 20% OR-10% RFR - 4% 4. Use the relevant information in Problem to evaluate Fund J using Fama's S. (10) 3. Evaluate a portfolio ("actual") using perfor a portfolio (actual") using performance attribution analysis and the information below. (10) Returns Weights Asset Actual Benchmark Actual Stocks 9% 0.70 Bonds 5% 6% 0.50 0.50 Benchmark 0.30 10% 4. If you invest $2000 today and $1000 a year from now and earn 25% the first year and 15% the second year, warna be your money-weighted-rate-of-return? (10) 5. What is the current price of a bond with a $1000 par value. a 7% nominal vield. a 6% vield-to-maturity and a 2-year maturity? Assume annual coupons. (10) 6. Gamble: If the price of the bond in Problem #5 were $1025 a year later, what would be the HPY? (sor-5) 7. Bonus: What is the duration of a bond in Problem #5? (5) 8. What is the yield on a zero-coupon bond with a 9-year maturity. a $1000 par value and a $700 market price? Assume semiannual compounding. (5) 9. Use the information below and the EMM model to calculate the current stock price. (5) k=12% EPS-$3.00 DPS = $2.25 g -6% 10. Use the information above and the DDM model to calculate the current stock price. (5) 11. If a preferred stock had a market price of $60 and a required return of 12%, what would be its dividend? (5) 12. Estimate the change in the price of a bond if its duration is 5 and if rates increase from 6% to 6.25%. Assume annual coupons. (5) 13. What is the approximate yield-to-call on a bond with a S1000 par value, a nominal yield of 5% and a current price of $950 if it is called in 4 years? (5) 14. Use the relevant information in Problem #4 to calculate the TWRR (5) 15. Use the information below to evaluate the stock. (10) B-1.2 P - $30 Dividend - $1 Risk-free return 4% Market return -12% P - $33 16. Imagine buying a bond for $850 with a 6% nominal yield and a $1000 par value and then selling it 3 years later for $900. What was your realized yield? (5) 17. What was the current yield on the bond in the preceding problem at the time you bought it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts