Question: 1. Using a spreadsheet, make a form that computes the withholding tax and the deductions ot each employee. Using a spreadsheet, create a file that

1. Using a spreadsheet, make a form that computes the withholding tax and the deductions ot each employee. Using a spreadsheet, create a file that provides every ermployee a summary ot all his net earnings in every month. Make a graph of his net income, total earnings, and also the tota deductions. 3. Use spreadsheet to compute the half-net pay given the computed monthly net of an employee. 4.Compute for the total deduction provided that the employee is a minimum wage earner. Include Pag-lbig Contribution, SSS Contribution, and Philhealth. 5. Suppose there is a spreadsheet for the company A for salary computations. In the deduction section of every employee payslip, there is an item called retirement fund. This fund is only given by the formula 200x + 50, where x is the number of years. Implement the said condition in the spreadsheet. 6. Suppose SSS premiums are computed based on the following: a. if the total earning of the employee is at most 20,000, then SSS Premium is 500. b. for every 100 in excess of P20,000, there is an additional 23% of it in the SSS premium deduction. 7. In a company where commissions is part of the payslip, specifically in the earnings section, utilize the formulas in the spreadsheet to implement the following conditions: a. In a separate spreadsheet, the total sales of each employee is located. Look for the value in that particular cell and use the formula: y-0.1x-100,000). b. In the withholding tax cell, assume that all employees are taxed with at least P5,000. Make a formula in the cell for withholding tax computation, where 20% of the commission is added to it. 8. Reverse a cell for "loanable amount" in a spreadsheet. This loanable amount is the amount that cn be granted to any employee just in case they wish to cash advance from the company. The conditions for this, "loanable amount" are specified below The employee can only avail this loan if he serves the company for at least two years. a. b. Fifty percent of the monthly net earnings times 5, less 10% tax of the gross loanable amount that should appear in the cell, that is we can view as the net. Make sure that loanable amount shall not exceed P150,000. Hint Find the maximum net earnings possible to avail the loanable amount.

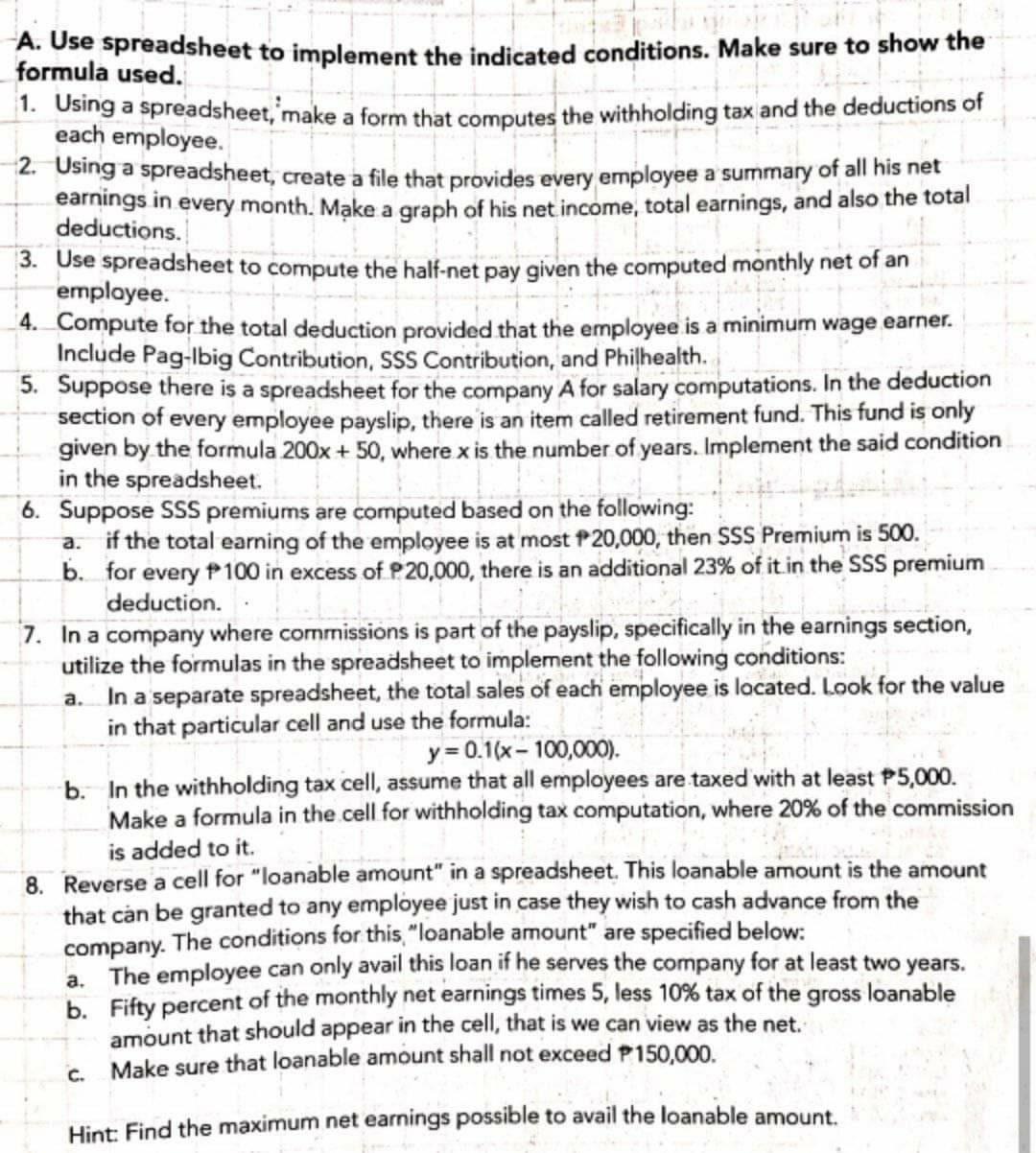

A. Use spreadsheet to implement the indicated conditions. Make sure to show the formula used. 1. Using a spreadsheet, make a form that computes the withholding tax and the deductions of each employee. 2. Using a spreadsheet, create a file that provides every employee a summary of all his net earnings in every month. Make a graph of his net income, total earnings, and also the total deductions. 3. Use spreadsheet to compute the half-net pay given the computed monthly net of an employee. 4. Compute for the total deduction provided that the employee is a minimum wage earner. Include Pag-Ibig Contribution, SSS Contribution, and Philhealth. 5. Suppose there is a spreadsheet for the company A for salary computations. In the deduction section of every employee payslip, there is an item called retirement fund. This fund is only given by the formula 200x + 50, where x is the number of years. Implement the said condition in the spreadsheet. 6. Suppose SSS premiums are computed based on the following: a. if the total earning of the employee is at most 20,000, then SSS Premium is 500. b. for every + 100 in excess of P20,000, there is an additional 23% of it in the SSS premium deduction. 7. In a company where commissions is part of the payslip, specifically in the earnings section, utilize the formulas in the spreadsheet to implement the following conditions: In a separate spreadsheet, the total sales of each employee is located. Look for the value in that particular cell and use the formula: y=0.1(x - 100,000). b. In the withholding tax cell, assume that all employees are taxed with at least P5,000. Make a formula in the cell for withholding tax computation, where 20% of the commission is added to it. 8. Reverse a cell for "loanable amount" in a spreadsheet . This loanable amount is the amount that can be granted to any employee just in case they wish to cash advance from the company. The conditions for this "loanable amount" are specified below: a. The employee can only avail this loan if he serves the company for at least two years. b. Fifty percent of the monthly net earnings times 5, less 10% tax of the gross loanable amount that should appear in the cell , that is we can view as the net. Make sure that loanable amount shall not exceed P150,000. a. C. Hint: Find the maximum net earnings possible to avail the loanable amount. A. Use spreadsheet to implement the indicated conditions. Make sure to show the formula used. 1. Using a spreadsheet, make a form that computes the withholding tax and the deductions of each employee. 2. Using a spreadsheet, create a file that provides every employee a summary of all his net earnings in every month. Make a graph of his net income, total earnings, and also the total deductions. 3. Use spreadsheet to compute the half-net pay given the computed monthly net of an employee. 4. Compute for the total deduction provided that the employee is a minimum wage earner. Include Pag-Ibig Contribution, SSS Contribution, and Philhealth. 5. Suppose there is a spreadsheet for the company A for salary computations. In the deduction section of every employee payslip, there is an item called retirement fund. This fund is only given by the formula 200x + 50, where x is the number of years. Implement the said condition in the spreadsheet. 6. Suppose SSS premiums are computed based on the following: a. if the total earning of the employee is at most 20,000, then SSS Premium is 500. b. for every + 100 in excess of P20,000, there is an additional 23% of it in the SSS premium deduction. 7. In a company where commissions is part of the payslip, specifically in the earnings section, utilize the formulas in the spreadsheet to implement the following conditions: In a separate spreadsheet, the total sales of each employee is located. Look for the value in that particular cell and use the formula: y=0.1(x - 100,000). b. In the withholding tax cell, assume that all employees are taxed with at least P5,000. Make a formula in the cell for withholding tax computation, where 20% of the commission is added to it. 8. Reverse a cell for "loanable amount" in a spreadsheet . This loanable amount is the amount that can be granted to any employee just in case they wish to cash advance from the company. The conditions for this "loanable amount" are specified below: a. The employee can only avail this loan if he serves the company for at least two years. b. Fifty percent of the monthly net earnings times 5, less 10% tax of the gross loanable amount that should appear in the cell , that is we can view as the net. Make sure that loanable amount shall not exceed P150,000. a. C. Hint: Find the maximum net earnings possible to avail the loanable amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts