Question: 1) Using activity-based costing method, what is the total cost for High F? 2) Using activity-based costing method, what is the total cost for Great

1) Using activity-based costing method, what is the total cost for High F?

2) Using activity-based costing method, what is the total cost for Great P?

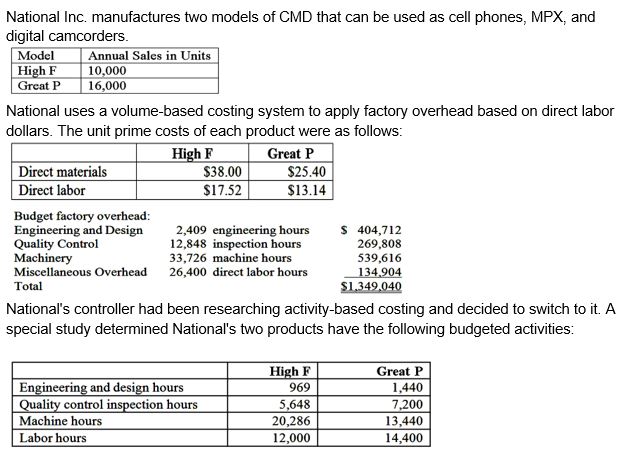

National Inc. manufactures two models of CMD that can be used as cell phones, MPX, and digital camcorders. Model High F Great P Annual Sales in Units 10,000 16,000 National uses a volume-based costing system to apply factory overhead based on direct labor dollars. The unit prime costs of each product were as follows: Direct materials Direct labor Budget factory overhead: Engineering and Design Quality Control Machinery Miscellaneous Overhead Total High F Great P $38.00 $17.52 $25.40 $13.14 $ 404,712 269,808 539,616 2,409 engineering hours 12,848 inspection hours 33,726 machine hours 26,400 direct labor hours 134,904 $1,349,040 National's controller had been researching activity-based costing and decided to switch to it. A special study determined National's two products have the following budgeted activities: High F Great P Engineering and design hours 969 1,440 Quality control inspection hours 5,648 7,200 Machine hours 20,286 13,440 Labor hours 12,000 14,400

Step by Step Solution

There are 3 Steps involved in it

Based on the information provided in the imagewe can calculate the total cost for High F and Great P ... View full answer

Get step-by-step solutions from verified subject matter experts