Question: 1. Using information given in the case, allocate the company's shared costs to each service line four different ways: Based on FTEs, direct-labor costs, direct

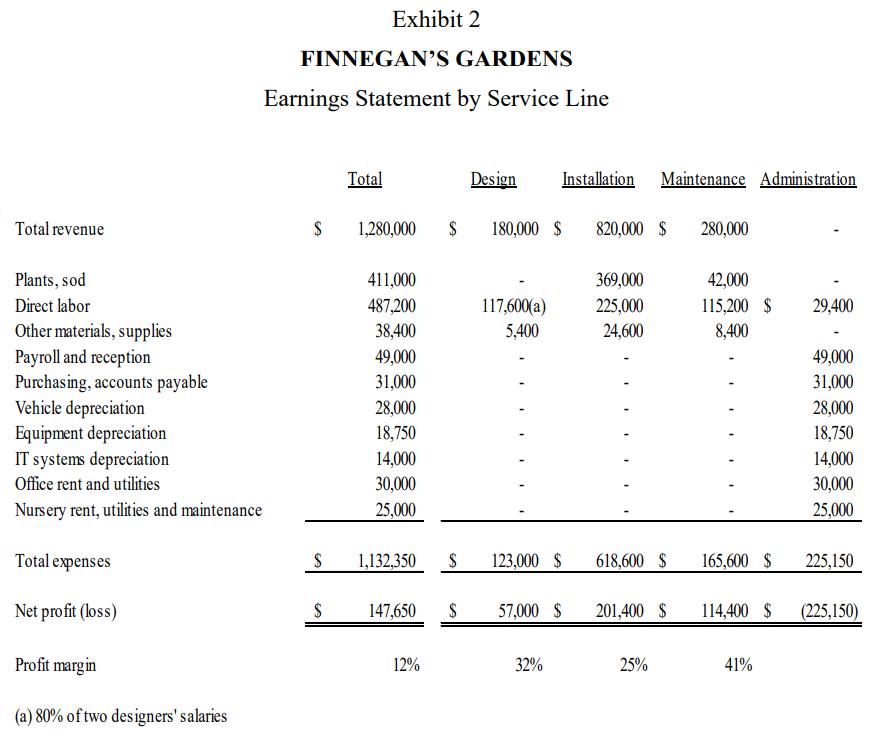

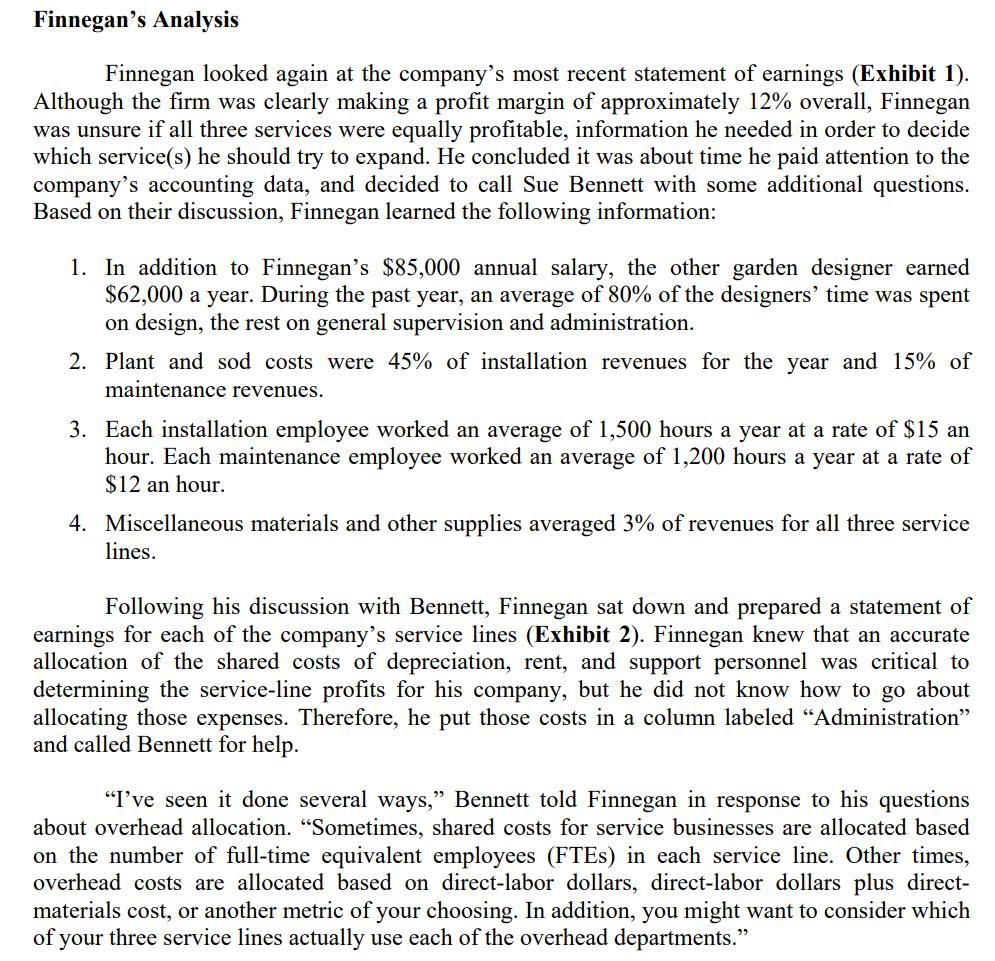

1. Using information given in the case, allocate the company's shared costs to each service line four different ways: Based on FTEs, direct-labor costs, direct labor plus direct materials, and the specific usage information given to Finnegan by Bennett (second image below)

2. Calculate the profit percentage for each service line under each overhead-allocation method

3. Which service line is the most financially attractive?

Exhibit 2 FINNEGAN'S GARDENS Earnings Statement by Service Line Total Design Installation Maintenance Administration Total revenue 1,280,000 180,000 $ 820,000 $ 280,000 Plants, sod 411,000 369,000 42,000 Direct labor 29,400 487,200 38,400 117,600(a) 225,000 115,200 $ Other materials, supplies Payroll and reception Purchasing, accounts payable Vehicle depreciation Equipment depreciation IT systems depreciation 5,400 24,600 8,400 49,000 49,000 31,000 31,000 28,000 28,000 18,750 18,750 14,000 30,000 25,000 14,000 30,000 Office rent and utilities Nursery rent, utilities and maintenance 25,000 Total expenses 1,132,350 123,000 $ 618,600 $ 165,600 $ 225,150 Net profit (loss) 147,650 57,000 $ 201,400 $ 114,400 $ (225,150) Profit margin 12% 32% 25% 41% (a) 80% of two designers' salaries

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Allocation of shared expenses amongst the 4 Service Lines Partiuclars Total Design Installation Maintenance Administration Expense Payroll and recepti... View full answer

Get step-by-step solutions from verified subject matter experts