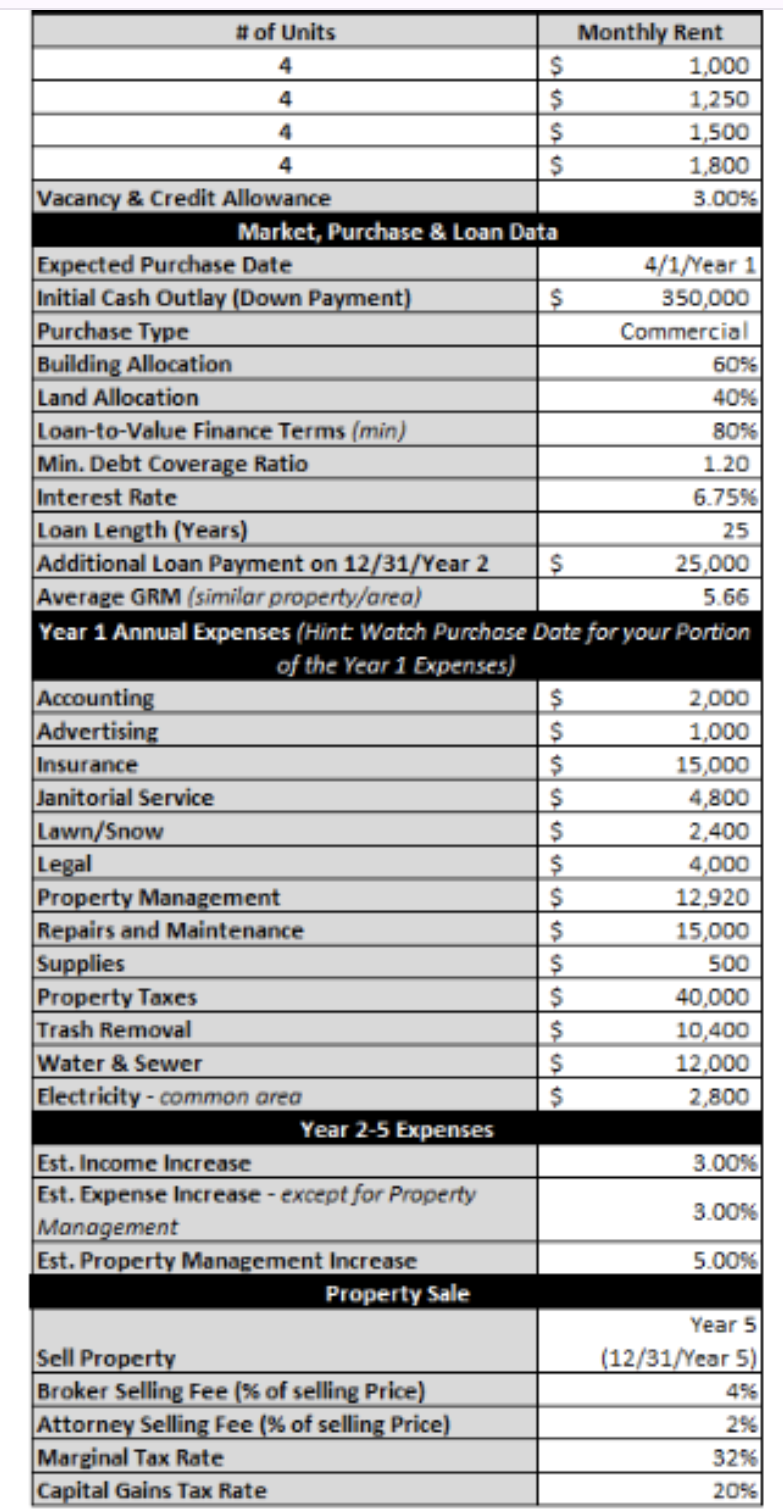

Question: 1 . Using the average market GRM , what is the estimated market selling price in Year 1 for the purchase? ( Hint: you will

Using the average market GRM what is the estimated market selling price in Year for the purchase? Hint: you will need to annualize the estimated market selling price

Using the estimated market selling price in Year from above, what is the loan or mortgage value for this purchase?

Using the loan or mortgage value from above, what is the LoantoValue Ratio at the time of purchase?

The calculated LoantoValue Ratio for Year meets the minimum loan term requirements. True or False?

Using the estimated market selling price in Year for the purchase and your calculated NOI in Year what is the market capitalization rate? Hint: you will need to annualize these amounts

Calculate the CashonCash Return for each year through

Calculate the Derived Capitalization Rate at the time of purchase Hint: use the CashonCash Return calculated above for Year

Calculate the Debt Coverage Ratio for each year through Hint: annual debt service payments are based on your annual minimum payment

Each year's Debt Coverage Ratio does not exceed the minimum Debt Coverage Ratio required by the loan. True or False?

Calculate the BreakEven Ratio for each year through

Calculate the LoantoValue Ratio for each year through Hint: you have to annualize Year

Calculate the Return on Equity for each year through

Calculate the NPV of this real estate investment.

Calculate the IRR of this real estate investment.

Calculate the MIRR of this real estate investment.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock