Question: 1. Using the data in the following table, calculate the return for investing in Boeing stock (BA) from January 2, 2008, to January 2, 2009,

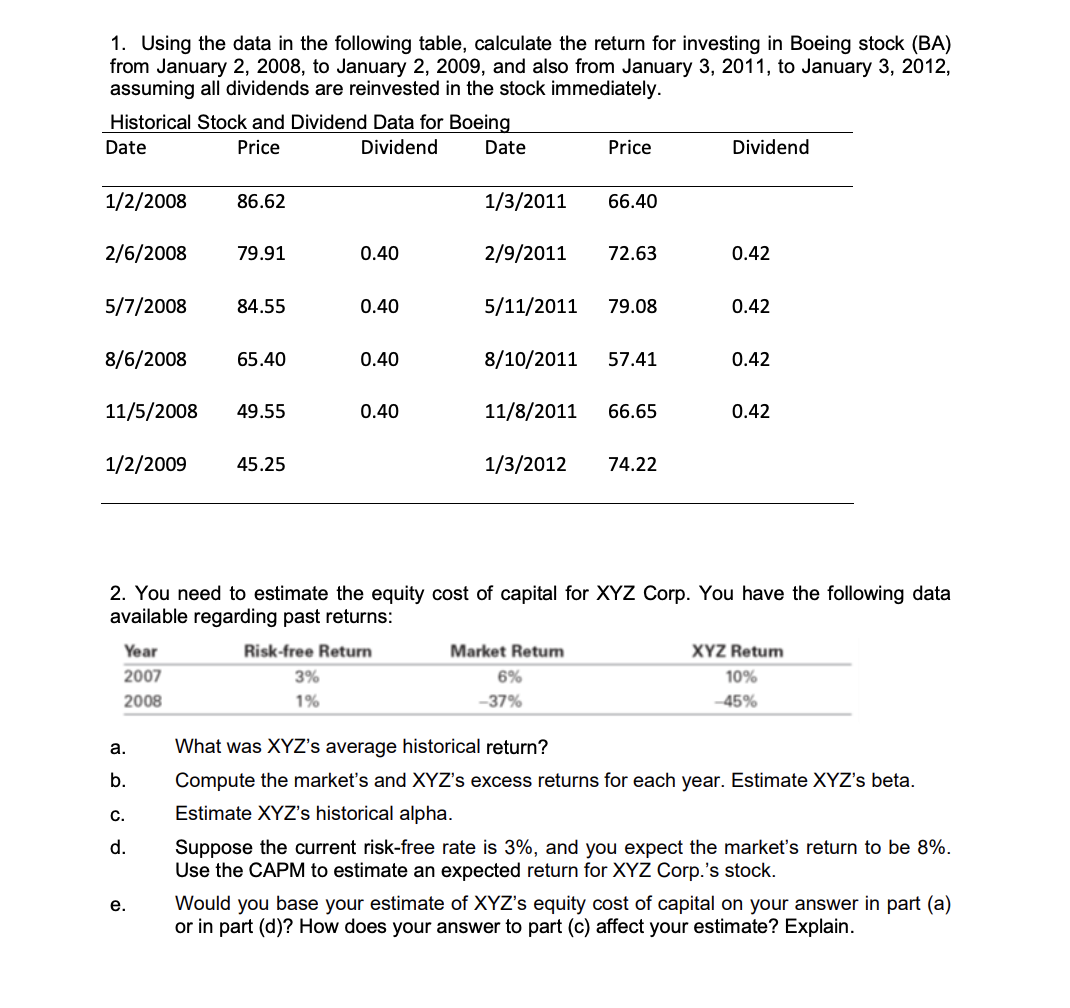

1. Using the data in the following table, calculate the return for investing in Boeing stock (BA) from January 2, 2008, to January 2, 2009, and also from January 3, 2011, to January 3, 2012, assuming all dividends are reinvested in the stock immediately. Historical Stock and Dividend Data for Boeing Date Price Dividend Date Price Dividend 1/2/2008 86.62 1/3/2011 66.40 2/6/2008 79.91 0.40 2/9/2011 72.63 0.42 5/7/2008 84.55 0.40 5/11/2011 79.08 0.42 8/6/2008 65.40 0.40 8/10/2011 57.41 0.42 11/5/2008 49.55 0.40 11/8/2011 66.65 0.42 1/2/2009 45.25 1/3/2012 74.22 2. You need to estimate the equity cost of capital for XYZ Corp. You have the following data available regarding past returns: Year 2007 2008 Risk-free Return 3% 1% Market Retum 6% -37% XYZ Retum 10% -45% a. b. C. What was XYZ's average historical return? Compute the market's and XYZ's excess returns for each year. Estimate XYZ's beta. Estimate XYZ's historical alpha. Suppose the current risk-free rate is 3%, and you expect the market's return to be 8%. Use the CAPM to estimate an expected return for XYZ Corp.'s stock. Would you base your estimate of XYZ's equity cost of capital on your answer in part (a) or in part (d)? How does your answer to part (c) affect your estimate? Explain. d. e. 1. Using the data in the following table, calculate the return for investing in Boeing stock (BA) from January 2, 2008, to January 2, 2009, and also from January 3, 2011, to January 3, 2012, assuming all dividends are reinvested in the stock immediately. Historical Stock and Dividend Data for Boeing Date Price Dividend Date Price Dividend 1/2/2008 86.62 1/3/2011 66.40 2/6/2008 79.91 0.40 2/9/2011 72.63 0.42 5/7/2008 84.55 0.40 5/11/2011 79.08 0.42 8/6/2008 65.40 0.40 8/10/2011 57.41 0.42 11/5/2008 49.55 0.40 11/8/2011 66.65 0.42 1/2/2009 45.25 1/3/2012 74.22 2. You need to estimate the equity cost of capital for XYZ Corp. You have the following data available regarding past returns: Year 2007 2008 Risk-free Return 3% 1% Market Retum 6% -37% XYZ Retum 10% -45% a. b. C. What was XYZ's average historical return? Compute the market's and XYZ's excess returns for each year. Estimate XYZ's beta. Estimate XYZ's historical alpha. Suppose the current risk-free rate is 3%, and you expect the market's return to be 8%. Use the CAPM to estimate an expected return for XYZ Corp.'s stock. Would you base your estimate of XYZ's equity cost of capital on your answer in part (a) or in part (d)? How does your answer to part (c) affect your estimate? Explain. d. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts