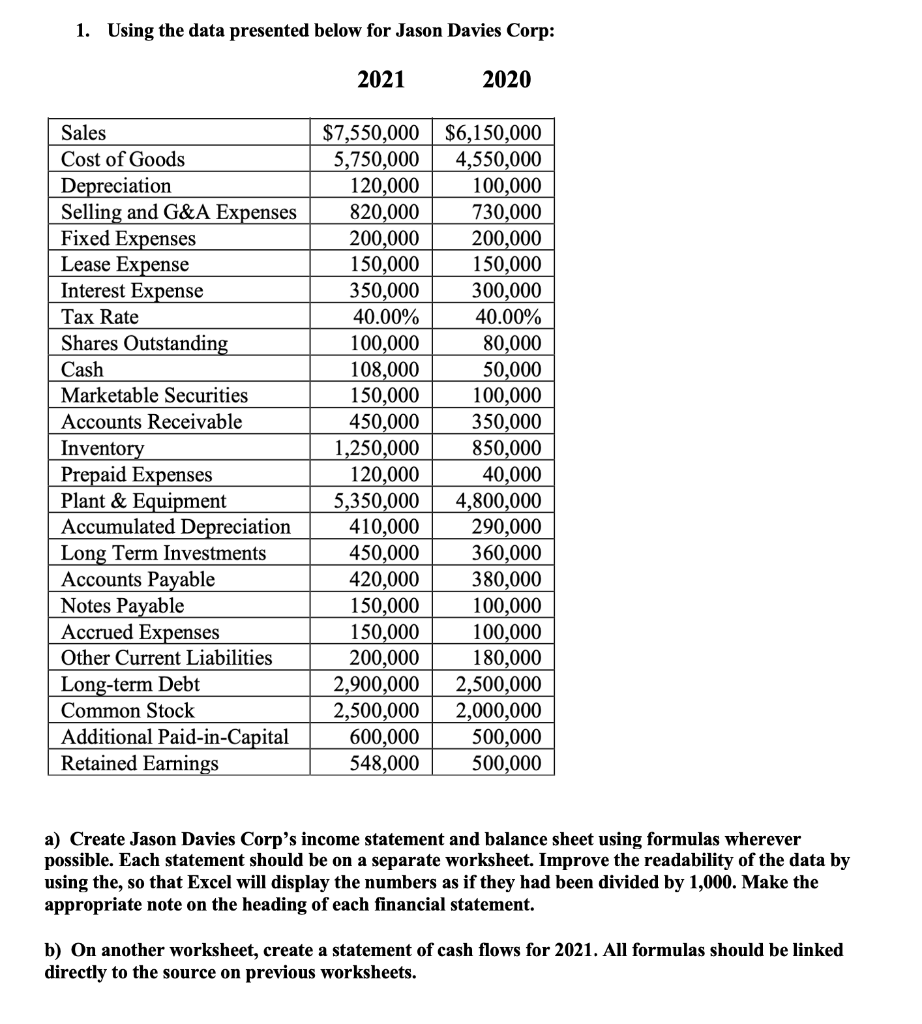

Question: 1. Using the data presented below for Jason Davies Corp: 2021 2020 Sales Cost of Goods Depreciation Selling and G&A Expenses Fixed Expenses Lease Expense

1. Using the data presented below for Jason Davies Corp: 2021 2020 Sales Cost of Goods Depreciation Selling and G&A Expenses Fixed Expenses Lease Expense Interest Expense Tax Rate Shares Outstanding Cash Marketable Securities Accounts Receivable Inventory Prepaid Expenses Plant & Equipment Accumulated Depreciation Long Term Investments Accounts Payable Notes Payable Accrued Expenses Other Current Liabilities Long-term Debt Common Stock Additional Paid-in-Capital Retained Earnings $7,550,000 $6,150,000 5,750,000 4,550,000 120,000 100,000 820,000 730,000 200,000 200,000 150,000 150,000 350,000 300,000 40.00% 40.00% 100,000 80,000 108,000 50,000 150,000 100,000 450,000 350,000 1,250,000 850,000 120,000 40,000 5,350,000 4,800,000 410,000 290,000 450,000 360,000 420,000 380,000 150,000 100,000 150,000 100,000 200,000 180,000 2,900,000 2,500,000 2,500,000 2,000,000 600,000 500,000 548,000 500,000 a) Create Jason Davies Corp's income statement and balance sheet using formulas wherever possible. Each statement should be on a separate worksheet. Improve the readability of the data by using the, so that Excel will display the numbers as if they had been divided by 1,000. Make the appropriate note on the heading of each financial statement. b) On another worksheet, create a statement of cash flows for 2021. All formulas should be linked directly to the source on previous worksheets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts