Question: 1. Using the Direct Method for allocating service costs, if the cost of the corporate Jet were to increase to $2,000,000 per year, what would

1. Using the Direct Method for allocating service costs, if the cost of the corporate Jet were to increase to $2,000,000 per year, what would happen to the amount of service costs allocated to Sales (relative to $1,000,000 per year cost for the Jet)?

A. Allocated overhead would increase

B. Allocated overhead would decrease

C. Allocated overhead would remain the same

2. Using the Step Down method to Accounting first for allocating service costs, if the cost of the corporate Jet were to increase to $2,000,000 per year, what would happen to the amount of service costs allocated to Sales (relative to $1,000,000 per year cost for the Jet)?

A. Allocated overhead would increase

B. Allocated overhead would decrease

C. Allocated overhead would remain the same

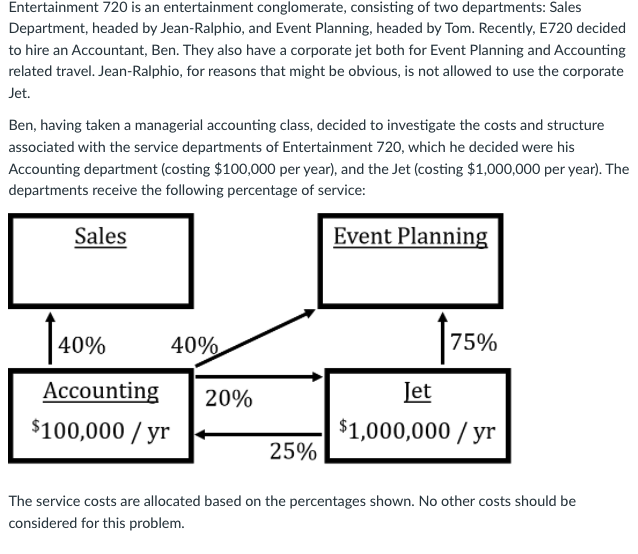

Entertainment 720 is an entertainment conglomerate, consisting of two departments: Sales Department, headed by Jean-Ralphio, and Event Planning, headed by Tom. Recently, E720 decided to hire an Accountant, Ben. They also have a corporate jet both for Event Planning and Accounting related travel. Jean-Ralphio, for reasons that might be obvious, is not allowed to use the corporate Jet. Ben, having taken a managerial accounting class, decided to investigate the costs and structure associated with the service departments of Entertainment 720, which he decided were his Accounting department (costing $100,000 per year), and the Jet (costing $1,000,000 per year). The departments receive the following percentage of service: Sales Event Planning 140 40% 40% 75% 20% Accounting $100,000 / yr Jet $1,000,000 / yr 25% The service costs are allocated based on the percentages shown. No other costs should be considered for this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts