Question: 1) Using the excel file: A) Perform Multiples Valuations to find Hope's equity price per share. At a minimum find the industry competitors' EV/EBITA and

1) Using the excel file:

A) Perform Multiples Valuations to find Hope's equity price per share. At a minimum find the industry competitors' EV/EBITA and EV/EBIT multiples. Also, find the EV/Sales multiples. Then, apply the multiple to Hope's EBITA or EBIT, respectively, to calculate an enterprise value for Hope. Next take Hope's enterprise value and subtract Hope's debt to equal Hope's equity value. Finally, divide the equity value by the number of shares outstanding to equal the intrinsic market price per share.

B) Perform a Discounted Cash Flow Valuation to find Hope's equity price per share. First compute WACC for all competitors, the gaming and hotel industries and for Hope itself. Next, use the asset turnover ratios to find Hope's forecasted Annual FCF's and the Terminal FCF for 2022. Sum up to get a Total Annual FCF. Use the NPV function with various WACC's and the associated Total Annual FCF's to find Hope's enterprise value and then subtract out the debt to equal equity value and divide by shares outstanding to find the intrinsic equity market price per share.

C) Also compute the Annual Discounted FCFs. Include the time zero investment of buying all outstanding stock at current market price. Then calculate the Discounted payback time period. Remember, the lower or the quicker the payback, the better the project performs on this measurement.

D) Compute the IRR for the Total Annual FCFs. Remember if greater than the WACC then the project earns more than the discount rate.

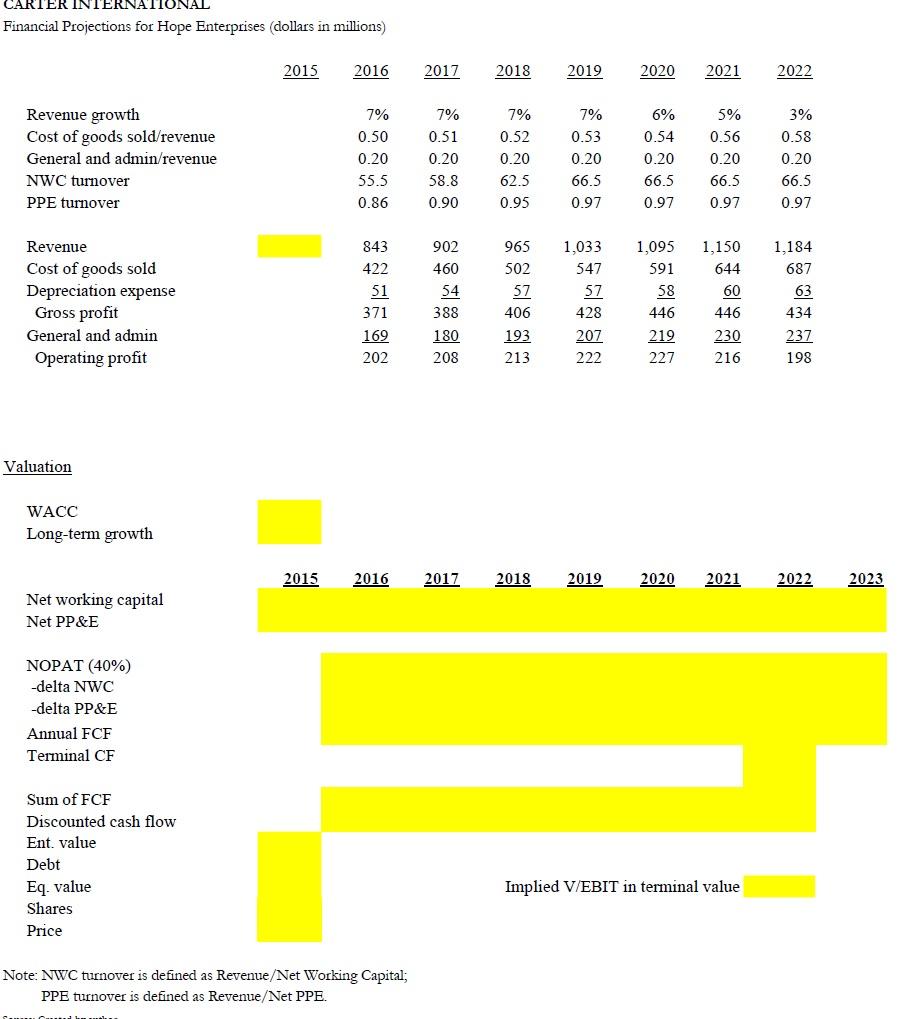

CARTER INTERNATIONAL Financial Projections for Hope Enterprises (dollars in millions) 2015 2016 2017 2018 2019 2020 2021 2022 Revenue growth Cost of goods sold/revenue General and admin/revenue NWC turnover PPE turnover 7% 0.50 0.20 55.5 0.86 7% 0.51 0.20 58.8 0.90 7% 0.52 0.20 62.5 0.95 7% 0.53 0.20 66.5 0.97 6% 0.54 0.20 66.5 0.97 5% 0.56 0.20 66.5 0.97 3% 0.58 0.20 66.5 0.97 965 502 1.184 687 Revenue Cost of goods sold Depreciation expense Gross profit General and admin Operating profit 843 422 51 371 169 202 902 460 54 388 180 208 57 406 193 213 1.033 547 57 428 207 222 1,095 591 58 446 219 227 1,150 644 60 446 230 216 63 434 237 198 Valuation WACC Long-term growth 2015 2016 2017 2018 2019 2020 2021 2022 2023 Net working capital Net PP&E NOPAT (40%) -delta NWC -delta PP&E Annual FCF Terminal CF Sum of FCF Discounted cash flow Ent value Debt Eq. value Shares Price Implied V/EBIT in terminal value Note: NWC turnover is defined as Revenue/Net Working Capital; PPE turnover is defined as Revenue/Net PPE. Cumi CARTER INTERNATIONAL Financial Projections for Hope Enterprises (dollars in millions) 2015 2016 2017 2018 2019 2020 2021 2022 Revenue growth Cost of goods sold/revenue General and admin/revenue NWC turnover PPE turnover 7% 0.50 0.20 55.5 0.86 7% 0.51 0.20 58.8 0.90 7% 0.52 0.20 62.5 0.95 7% 0.53 0.20 66.5 0.97 6% 0.54 0.20 66.5 0.97 5% 0.56 0.20 66.5 0.97 3% 0.58 0.20 66.5 0.97 965 502 1.184 687 Revenue Cost of goods sold Depreciation expense Gross profit General and admin Operating profit 843 422 51 371 169 202 902 460 54 388 180 208 57 406 193 213 1.033 547 57 428 207 222 1,095 591 58 446 219 227 1,150 644 60 446 230 216 63 434 237 198 Valuation WACC Long-term growth 2015 2016 2017 2018 2019 2020 2021 2022 2023 Net working capital Net PP&E NOPAT (40%) -delta NWC -delta PP&E Annual FCF Terminal CF Sum of FCF Discounted cash flow Ent value Debt Eq. value Shares Price Implied V/EBIT in terminal value Note: NWC turnover is defined as Revenue/Net Working Capital; PPE turnover is defined as Revenue/Net PPE. Cumi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts