Question: 1. Using the Excel PV function, determine the proceeds of the bond issuance assuming a 6 percent effective (market) annual interest rate. Use two present

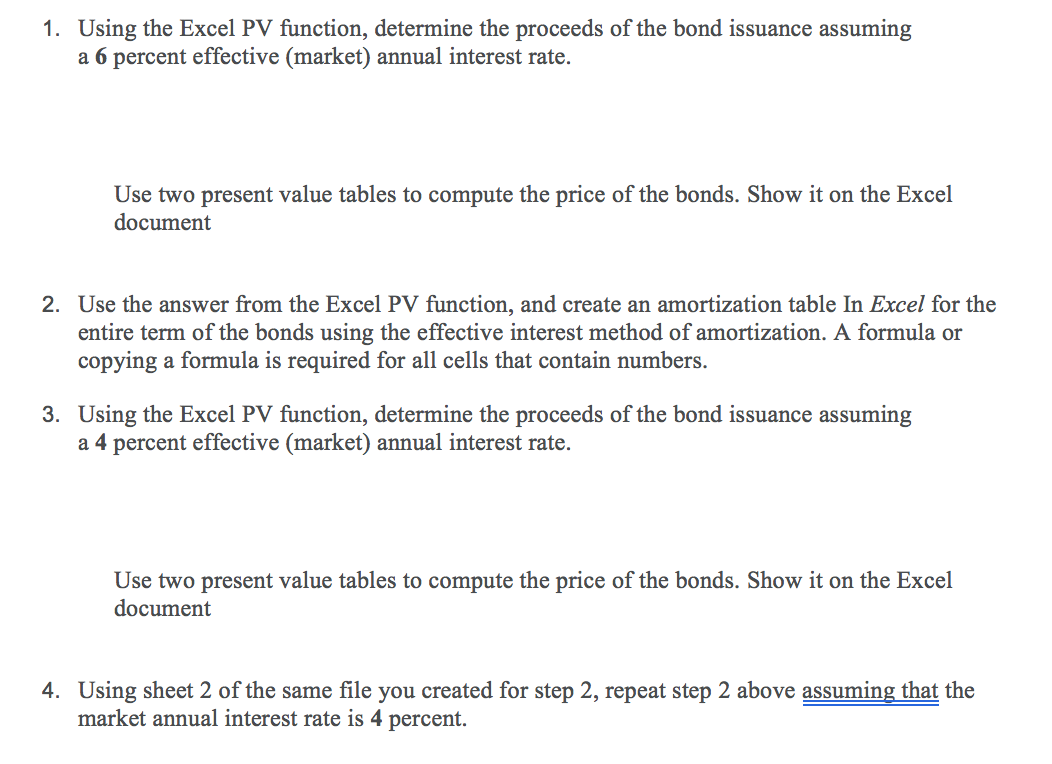

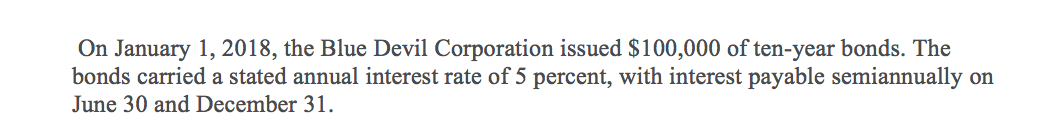

1. Using the Excel PV function, determine the proceeds of the bond issuance assuming a 6 percent effective (market) annual interest rate. Use two present value tables to compute the price of the bonds. Show it on the Excel document 2. Use the answer from the Excel PV function, and create an amortization table In Excel for the entire term of the bonds using the effective interest method of amortization. A formula or copying a formula is required for all cells that contain numbers. 3. Using the Excel PV function, determine the proceeds of the bond issuance assuming a 4 percent effective (market) annual interest rate. Use two present value tables to compute the price of the bonds. Show it on the Excel document 4. Using sheet 2 of the same file you created for step 2, repeat step 2 above assuming that the market annual interest rate is 4 percent. On January 1, 2018, the Blue Devil Corporation issued $100,000 of ten-year bonds. The bonds carried a stated annual interest rate of 5 percent, with interest payable semiannually on June 30 and December 31. 1. Using the Excel PV function, determine the proceeds of the bond issuance assuming a 6 percent effective (market) annual interest rate. Use two present value tables to compute the price of the bonds. Show it on the Excel document 2. Use the answer from the Excel PV function, and create an amortization table In Excel for the entire term of the bonds using the effective interest method of amortization. A formula or copying a formula is required for all cells that contain numbers. 3. Using the Excel PV function, determine the proceeds of the bond issuance assuming a 4 percent effective (market) annual interest rate. Use two present value tables to compute the price of the bonds. Show it on the Excel document 4. Using sheet 2 of the same file you created for step 2, repeat step 2 above assuming that the market annual interest rate is 4 percent. On January 1, 2018, the Blue Devil Corporation issued $100,000 of ten-year bonds. The bonds carried a stated annual interest rate of 5 percent, with interest payable semiannually on June 30 and December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts