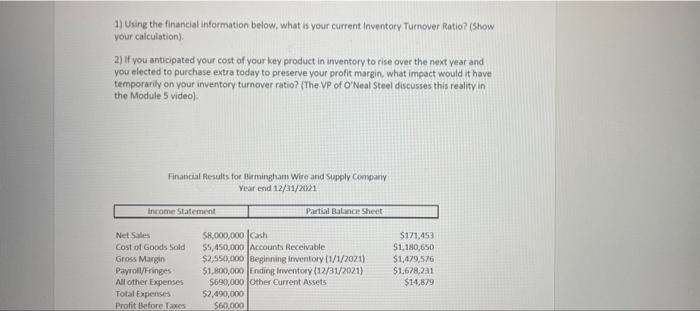

Question: 1) Using the financial information below, what is your current Inventory Turnover Ratio (Show your calculation) 2) If you anticipated your cost of your key

1) Using the financial information below, what is your current Inventory Turnover Ratio (Show your calculation) 2) If you anticipated your cost of your key product in inventory to rise over the next year and you elected to purchase extra today to preserve your profit margin, what impact would it have temporarily on your inventory turnover ratio (The VP of O'Neal Steel discusses this reality in the Module 5 video) Financial Results for Irmingham Wire and Supply Company Year end 12/21/2021 Income Statement Partial Balance Sheet Net Sales Cost of Goods Sold Gross Margin Payroll/Fringes All other Expenses Total Expenses Profit Before Taxes $8,000,000 cash $5,450,000 Accounts Receivable $2,950,000 Beginning inventory (1/1/2021) $1,800,000 Ending Inventory (12/31/2021) $690,000 Jother Current Assets 52,490,000 560.000 $171,453 $1,180,650 $1,479,576 $1,678,231 $14,879

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts