Question: 1. Using the financial statements and additional information provided in the case, prepare the 2006 statement of cash flows (SCF) for North Mountain Nursery, Inc

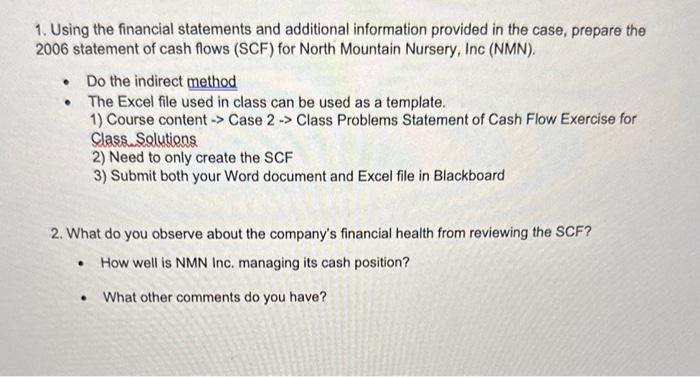

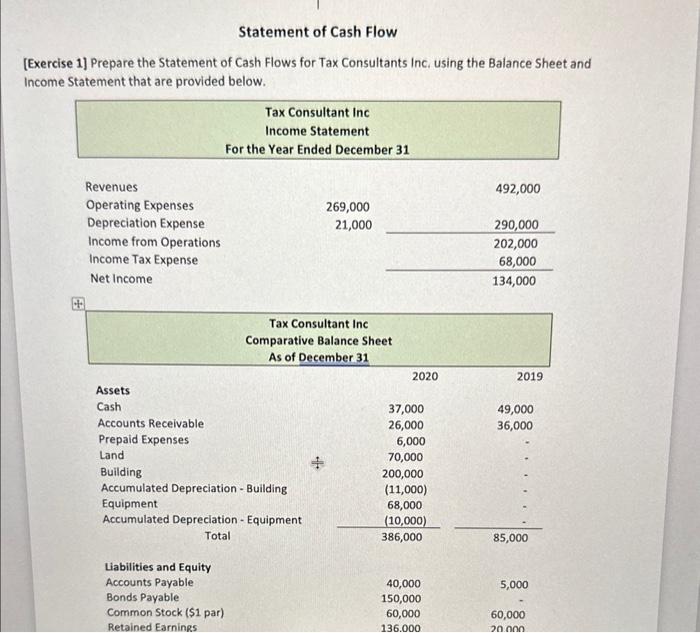

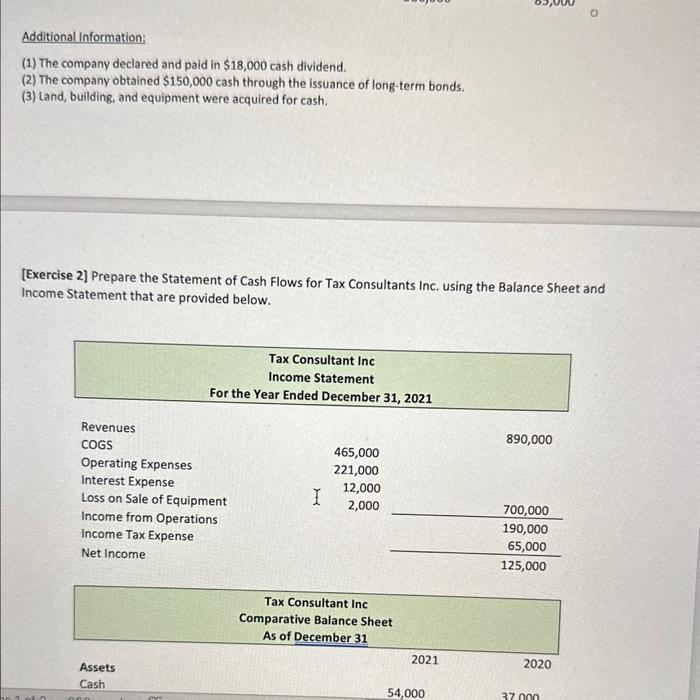

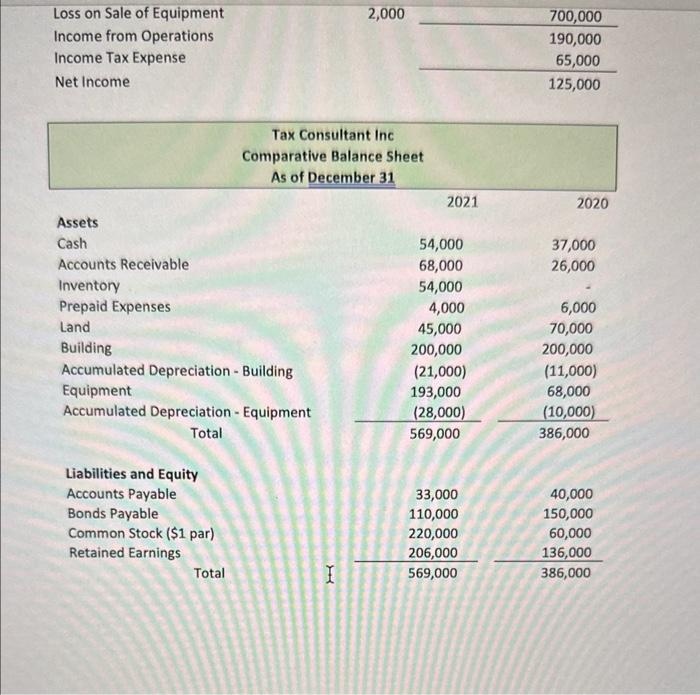

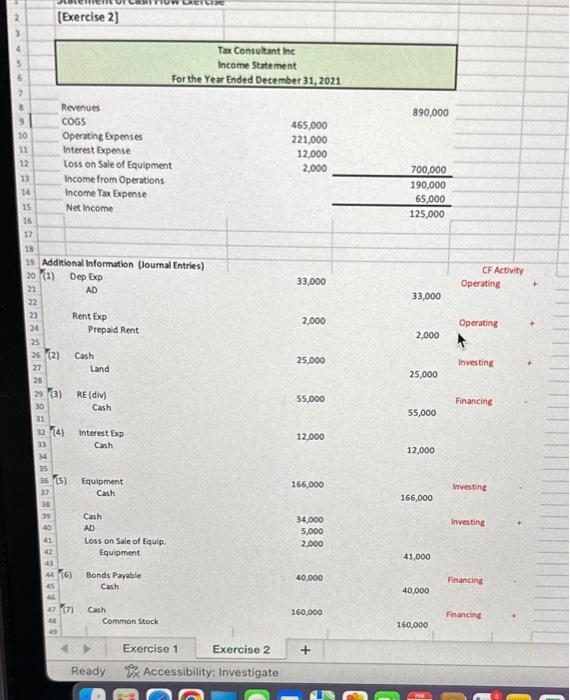

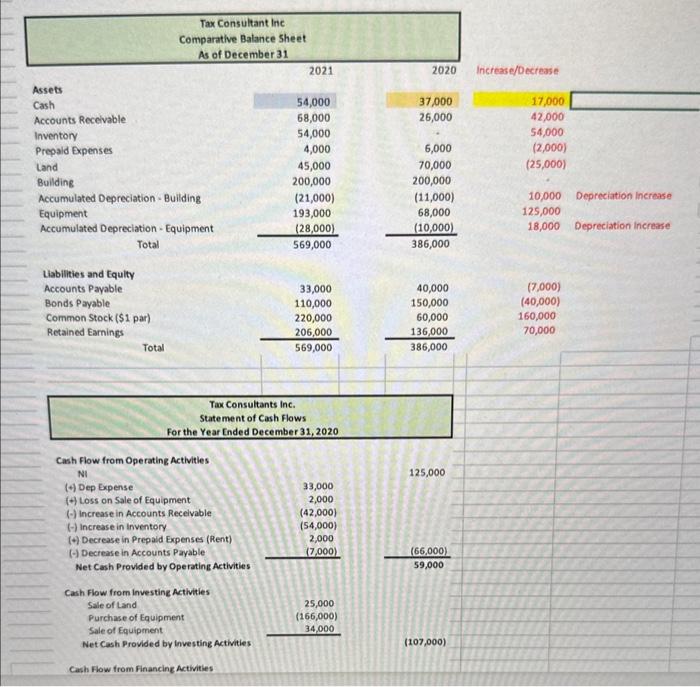

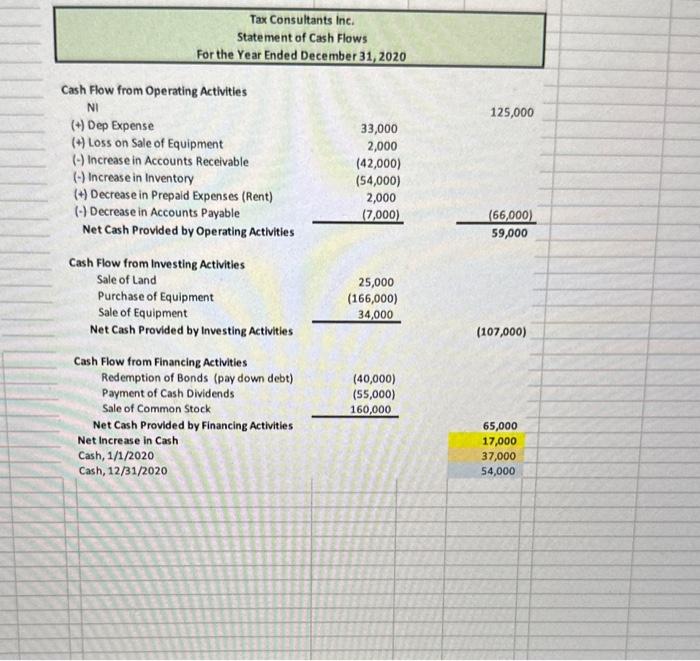

1. Using the financial statements and additional information provided in the case, prepare the 2006 statement of cash flows (SCF) for North Mountain Nursery, Inc (NMN). - Do the indirect method - The Excel file used in class can be used as a template. 1) Course content Case 2 Class Problems Statement of Cash Flow Exercise for Class. Solutions 2) Need to only create the SCF 3) Submit both your Word document and Excel file in Blackboard 2. What do you observe about the company's financial health from reviewing the SCF? - How well is NMN Inc. managing its cash position? - What other comments do you have? [Exercise 1] Prepare the Statement of Cash Flows for Tax Consultants Inc. using the Balance Sheet and Income Statement that are provided below. Additional information: (1) The company declared and paid in $18,000 cash dividend. (2) The company obtained $150,000 cash through the issuance of long-term bonds. (3) Land, building, and equipment were acquired for cash. [Exercise 2] Prepare the Statement of Cash Flows for Tax Consultants Inc. using the Balance Sheet and Income Statement that are provided below. [Exercise 2] Tax Consultant inc Income Statement For the Year Ended December 31, 2021 20 (1) Dep Exp 33,000 CFActivity \begin{tabular}{|c|c|} \hline 22 & \\ 23 & Rent Exp \\ 24 & Prepaid Rient: \\ 25 & \end{tabular} 33,000 Operating 26 (2) Cash Land 25,000 Investing: Cash 12,000 12,000 (6) Bonds Parable Cash 40,000 55,000 Financing Tax Consultant Inc Comparative Balance sheet As of December 31 Assets Cash Accounts Recelvable Inventory Prepaid Expenses Land Bullding 2021 2020 Increase/Decrease Accumulated Depreciation - Building Equipment Accumulated Depreciation - Equipment Total 54,00068,00054,0004,00045,000200,000(21,000)193,000(28,000)569,000 Liabilities and tquity Accounts Payable Bonds Payable Common Stock (\$1 par) Retained Earnings Total \begin{tabular}{rrr} 33,000 & 40,000 & (7,000) \\ 110,000 & 150,000 & (40,000) \\ 220,000 & 60,000 & 160,000 \\ 206,000 & 136,000 & 70,000 \\ \hline 569,000 & 386,000 & \\ \hline \end{tabular} Tax Consultants inc. Statement of Cash Flows For the Year Ended December 31, 2020 Cash flow from Operating Activities NI (-) Dep Expense (-) Loss on Sale of Equipment (-) increase in Accounts Recelvable (-) increase in inventory (f) Decrease in Prepaid Expenses (Rent) (-) Decrease in Accounts Payable Net Cash Provided by Operating Activities \begin{tabular}{cc} 33,000 & 125,000 \\ 2,000 & \\ (42,000) \\ (54,000) \\ 2,000 & \\ (7,000) \\ & \\ & \\ \hline \end{tabular} Cash Flow from investine Acthvies Sale of Land Purchase of Equipment Sale of Equipment Net Cash Provided by investing Activities (107,000) Cash Flow from financing Activities Tax Consultants Inc. Statement of Cash Flows For the Year Ended December 31,2020 Cash Flow from Operating Activities NI (t) Dep Expense (t) Loss on Sale of Equipment (-) Increase in Accounts Receivable (-) Increase in Inventory (t) Decrease in Prepaid Expenses (Rent) (-) Decrease in Accounts Payable Net Cash Provided by Operating Activities 59,000(66,000) Cash Flow from Investing Activities Sale of Land Purchase of Equipment Sale of Equipment Net Cash Provided by Investing Activities (107,000) Cash Flow from Financing Activities Redemption of Bonds (pay down debt) Payment of Cash Dividends Sale of Common Stock \begin{tabular}{c} (40,000) \\ (55,000) \\ 160,000 \\ \hline \end{tabular} Net Cash Provided by Financing Activities Net increase in Cash Cash, 1/1/2020 Cash, 12/31/2020 65,000 17,000 37,000 54,000 1. Using the financial statements and additional information provided in the case, prepare the 2006 statement of cash flows (SCF) for North Mountain Nursery, Inc (NMN). - Do the indirect method - The Excel file used in class can be used as a template. 1) Course content Case 2 Class Problems Statement of Cash Flow Exercise for Class. Solutions 2) Need to only create the SCF 3) Submit both your Word document and Excel file in Blackboard 2. What do you observe about the company's financial health from reviewing the SCF? - How well is NMN Inc. managing its cash position? - What other comments do you have? [Exercise 1] Prepare the Statement of Cash Flows for Tax Consultants Inc. using the Balance Sheet and Income Statement that are provided below. Additional information: (1) The company declared and paid in $18,000 cash dividend. (2) The company obtained $150,000 cash through the issuance of long-term bonds. (3) Land, building, and equipment were acquired for cash. [Exercise 2] Prepare the Statement of Cash Flows for Tax Consultants Inc. using the Balance Sheet and Income Statement that are provided below. [Exercise 2] Tax Consultant inc Income Statement For the Year Ended December 31, 2021 20 (1) Dep Exp 33,000 CFActivity \begin{tabular}{|c|c|} \hline 22 & \\ 23 & Rent Exp \\ 24 & Prepaid Rient: \\ 25 & \end{tabular} 33,000 Operating 26 (2) Cash Land 25,000 Investing: Cash 12,000 12,000 (6) Bonds Parable Cash 40,000 55,000 Financing Tax Consultant Inc Comparative Balance sheet As of December 31 Assets Cash Accounts Recelvable Inventory Prepaid Expenses Land Bullding 2021 2020 Increase/Decrease Accumulated Depreciation - Building Equipment Accumulated Depreciation - Equipment Total 54,00068,00054,0004,00045,000200,000(21,000)193,000(28,000)569,000 Liabilities and tquity Accounts Payable Bonds Payable Common Stock (\$1 par) Retained Earnings Total \begin{tabular}{rrr} 33,000 & 40,000 & (7,000) \\ 110,000 & 150,000 & (40,000) \\ 220,000 & 60,000 & 160,000 \\ 206,000 & 136,000 & 70,000 \\ \hline 569,000 & 386,000 & \\ \hline \end{tabular} Tax Consultants inc. Statement of Cash Flows For the Year Ended December 31, 2020 Cash flow from Operating Activities NI (-) Dep Expense (-) Loss on Sale of Equipment (-) increase in Accounts Recelvable (-) increase in inventory (f) Decrease in Prepaid Expenses (Rent) (-) Decrease in Accounts Payable Net Cash Provided by Operating Activities \begin{tabular}{cc} 33,000 & 125,000 \\ 2,000 & \\ (42,000) \\ (54,000) \\ 2,000 & \\ (7,000) \\ & \\ & \\ \hline \end{tabular} Cash Flow from investine Acthvies Sale of Land Purchase of Equipment Sale of Equipment Net Cash Provided by investing Activities (107,000) Cash Flow from financing Activities Tax Consultants Inc. Statement of Cash Flows For the Year Ended December 31,2020 Cash Flow from Operating Activities NI (t) Dep Expense (t) Loss on Sale of Equipment (-) Increase in Accounts Receivable (-) Increase in Inventory (t) Decrease in Prepaid Expenses (Rent) (-) Decrease in Accounts Payable Net Cash Provided by Operating Activities 59,000(66,000) Cash Flow from Investing Activities Sale of Land Purchase of Equipment Sale of Equipment Net Cash Provided by Investing Activities (107,000) Cash Flow from Financing Activities Redemption of Bonds (pay down debt) Payment of Cash Dividends Sale of Common Stock \begin{tabular}{c} (40,000) \\ (55,000) \\ 160,000 \\ \hline \end{tabular} Net Cash Provided by Financing Activities Net increase in Cash Cash, 1/1/2020 Cash, 12/31/2020 65,000 17,000 37,000 54,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts