Question: 1) Using the following information a) Do the journal entries for 1994 and 1995 assuming: i. tax rates will remain at 35% ii. income for

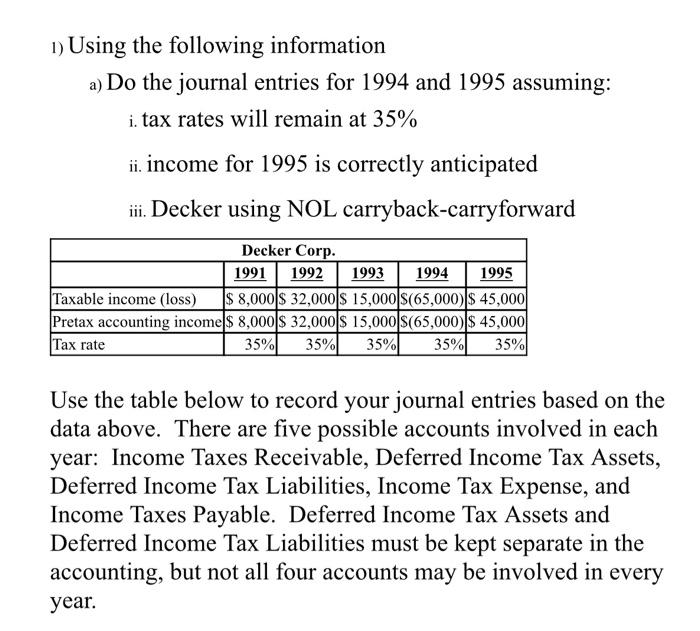

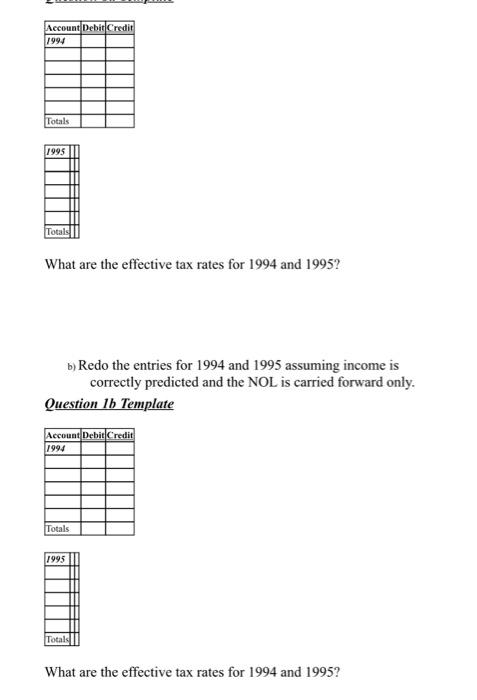

1) Using the following information a) Do the journal entries for 1994 and 1995 assuming: i. tax rates will remain at 35% ii. income for 1995 is correctly anticipated iii. Decker using NOL carryback-carryforward Decker Corp. 1991 1992 1993 1994 1995 Taxable income (loss) $ 8,000 $ 32,000 15,000 $(65,000) $ 45,000 Pretax accounting income $ 8,000$ 32,000 $ 15,000 S(65,000) $ 45,000 Tax rate 35% 35% 35% 35% 35% Use the table below to record your journal entries based on the data above. There are five possible accounts involved in each year: Income Taxes Receivable, Deferred Income Tax Assets, Deferred Income Tax Liabilities, Income Tax Expense, and Income Taxes Payable. Deferred Income Tax Assets and Deferred Income Tax Liabilities must be kept separate in the accounting, but not all four accounts may be involved in every year. Account Debit Credit 1994 Totals 1995 Total What are the effective tax rates for 1994 and 1995? b) Redo the entries for 1994 and 1995 assuming income is correctly predicted and the NOL is carried forward only. Question 1b Template Account Debit Credit 1994 Totals 1995 1 Total What are the effective tax rates for 1994 and 1995

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts