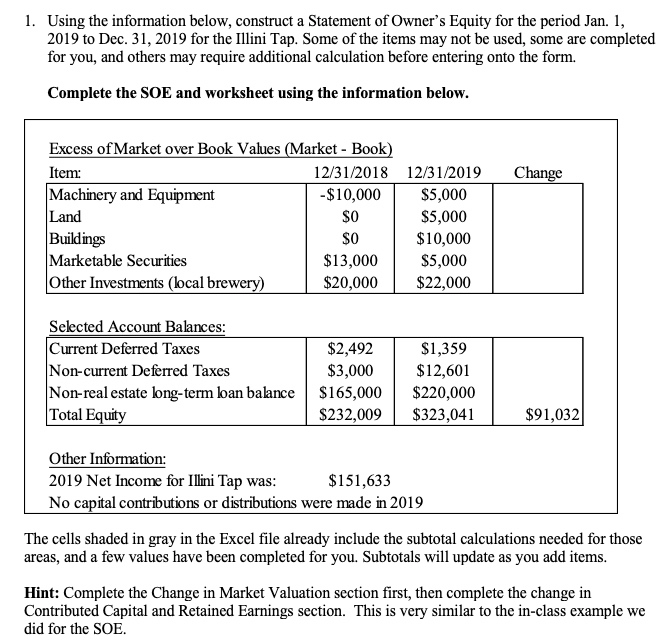

Question: 1. Using the information below, construct a Statement of Owner's Equity for the period Jan. 1, 2019 to Dec. 31, 2019 for the Illini Tap.

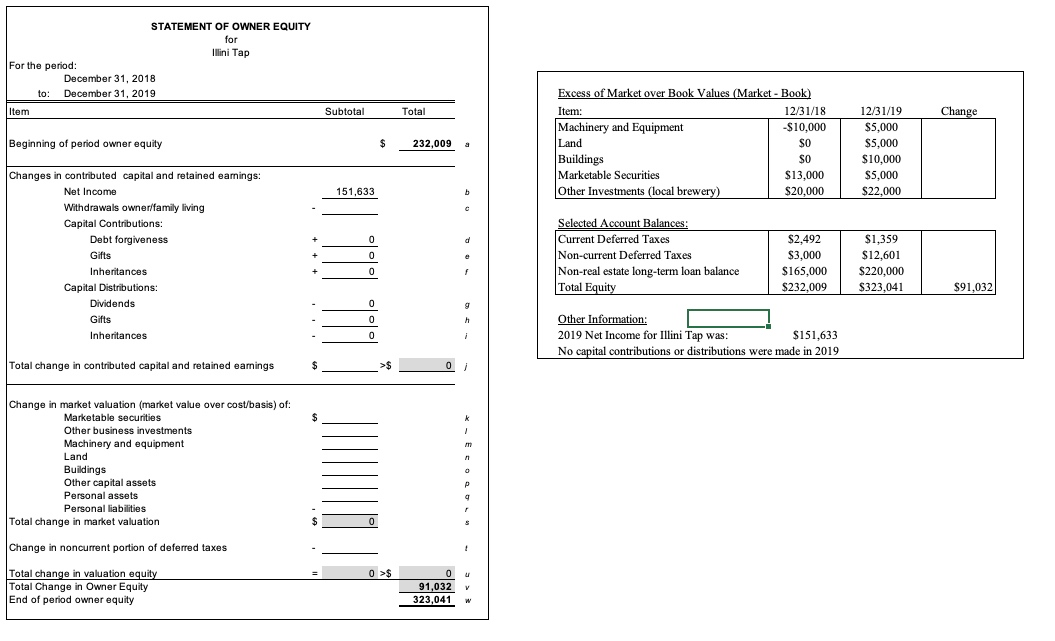

1. Using the information below, construct a Statement of Owner's Equity for the period Jan. 1, 2019 to Dec. 31, 2019 for the Illini Tap. Some of the items may not be used, some are completed for you, and others may require additional calculation before entering onto the form. Complete the SOE and worksheet using the information below. Change Excess of Market over Book Values (Market - Book) Item: 12/31/2018 12/31/2019 Machinery and Equipment -$10,000 $5,000 Land $0 $5,000 Buildings $0 $10,000 Marketable Securities $13,000 $5,000 Other Investments (local brewery) $20,000 $22,000 Selected Account Balances: Current Deferred Taxes Non-current Deferred Taxes Non-real estate long-term loan balance Total Equity $2,492 $3,000 $165,000 $232,009 $1,359 $12,601 $220,000 $323,041 $91,032 Other Information: 2019 Net Income for Illini Tap was: $151,633 No capital contributions or distributions were made in 2019 The cells shaded in gray in the Excel file already include the subtotal calculations needed for those areas, and a few values have been completed for you. Subtotals will update as you add items. Hint: Complete the Change in Market Valuation section first, then complete the change in Contributed Capital and Retained Earnings section. This is very similar to the in-class example we did for the SOE. STATEMENT OF OWNER EQUITY for Illini Tap For the period: December 31, 2018 to: December 31, 2019 Item Subtotal Total Change Beginning of period owner equity $ 232,009 a Excess of Market over Book Values (Market - Book) Item: 12/31/18 Machinery and Equipment -$10,000 Land SO Buildings SO Marketable Securities $13.000 Other Investments (local brewery) $20,000 12/31/19 S5,000 $5,000 $10,000 S5,000 $22.000 151,633 b d Changes in contributed capital and retained earnings: Net Income Withdrawals owner/family living Capital Contributions: Debt forgiveness Gifts Inheritances Capital Distributions: Dividends Gifts Inheritances 0 0 0 Selected Account Balances Current Deferred Taxes Non-current Deferred Taxes Non-real estate long-term loan balance Total Equity $2,492 $3,000 $165.000 $232,009 $1,359 $12,601 $220,000 f $323.041 $91,032 9 0 0 h 0 i Other Information: 2019 Net Income for Illini Tap was: $151,633 No capital contributions or distributions were made in 2019 Total change in contributed capital and retained earnings $ >$ 0 k 1 m n Change in market valuation (market value over cost/basis) of: Marketable securities Other business investments Machinery and equipment Land Buildings Other capital assets Personal assets Personal liabilities Total change in market valuation o P g 0 3 Change in noncurrent portion of deferred taxes 4 0 >$ u Total change in valuation equity Total Change in Owner Equity End of period owner equity V 91,032 323,041 W 1. Using the information below, construct a Statement of Owner's Equity for the period Jan. 1, 2019 to Dec. 31, 2019 for the Illini Tap. Some of the items may not be used, some are completed for you, and others may require additional calculation before entering onto the form. Complete the SOE and worksheet using the information below. Change Excess of Market over Book Values (Market - Book) Item: 12/31/2018 12/31/2019 Machinery and Equipment -$10,000 $5,000 Land $0 $5,000 Buildings $0 $10,000 Marketable Securities $13,000 $5,000 Other Investments (local brewery) $20,000 $22,000 Selected Account Balances: Current Deferred Taxes Non-current Deferred Taxes Non-real estate long-term loan balance Total Equity $2,492 $3,000 $165,000 $232,009 $1,359 $12,601 $220,000 $323,041 $91,032 Other Information: 2019 Net Income for Illini Tap was: $151,633 No capital contributions or distributions were made in 2019 The cells shaded in gray in the Excel file already include the subtotal calculations needed for those areas, and a few values have been completed for you. Subtotals will update as you add items. Hint: Complete the Change in Market Valuation section first, then complete the change in Contributed Capital and Retained Earnings section. This is very similar to the in-class example we did for the SOE. STATEMENT OF OWNER EQUITY for Illini Tap For the period: December 31, 2018 to: December 31, 2019 Item Subtotal Total Change Beginning of period owner equity $ 232,009 a Excess of Market over Book Values (Market - Book) Item: 12/31/18 Machinery and Equipment -$10,000 Land SO Buildings SO Marketable Securities $13.000 Other Investments (local brewery) $20,000 12/31/19 S5,000 $5,000 $10,000 S5,000 $22.000 151,633 b d Changes in contributed capital and retained earnings: Net Income Withdrawals owner/family living Capital Contributions: Debt forgiveness Gifts Inheritances Capital Distributions: Dividends Gifts Inheritances 0 0 0 Selected Account Balances Current Deferred Taxes Non-current Deferred Taxes Non-real estate long-term loan balance Total Equity $2,492 $3,000 $165.000 $232,009 $1,359 $12,601 $220,000 f $323.041 $91,032 9 0 0 h 0 i Other Information: 2019 Net Income for Illini Tap was: $151,633 No capital contributions or distributions were made in 2019 Total change in contributed capital and retained earnings $ >$ 0 k 1 m n Change in market valuation (market value over cost/basis) of: Marketable securities Other business investments Machinery and equipment Land Buildings Other capital assets Personal assets Personal liabilities Total change in market valuation o P g 0 3 Change in noncurrent portion of deferred taxes 4 0 >$ u Total change in valuation equity Total Change in Owner Equity End of period owner equity V 91,032 323,041 W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts