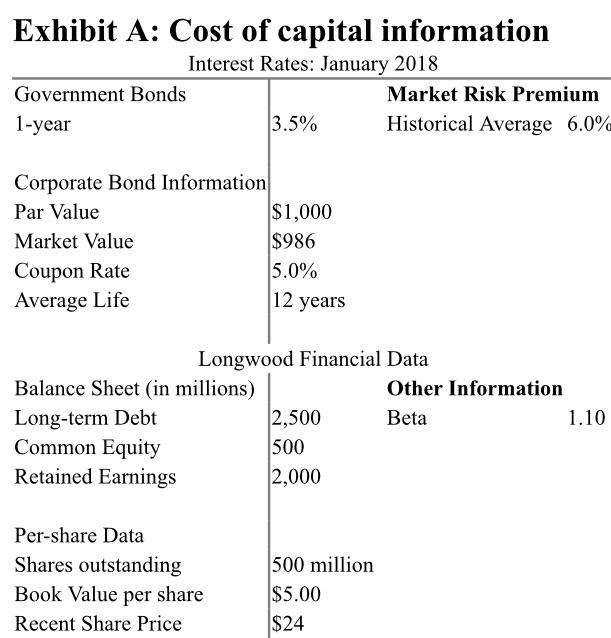

Question: 1. Using the information given in Exhibit A, compute Longwoods WACC. Assume Longwood has no preferred stock. Should the company continue to use its historic

Exhibit A: Cost of capital information Interest Rates: January 2018 Government Bonds Market Risk Premium 1-year 3.5% Historical Average 6.0% Corporate Bond Information Par Value $1,000 Market Value $986 Coupon Rate 5.0% Average Life 12 years Longwood Financial Data Balance Sheet (in millions) Other Information Long-term Debt 2,500 Beta Common Equity 500 Retained Earnings 2,000 1.10 Per-share Data Shares outstanding Book Value per share Recent Share Price 500 million $5.00 $24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts