Question: 1. Using the IRS Website - For every $100 the IRS collected, how much was spent on the IRS'S Collection efforts? What tax system criterion

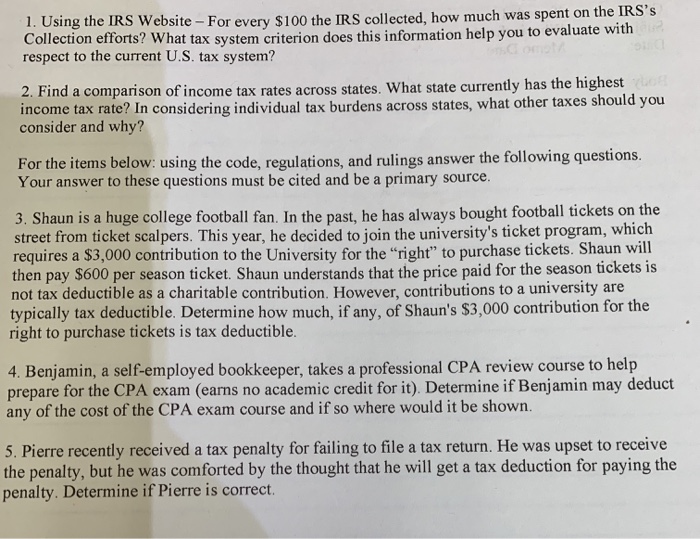

1. Using the IRS Website - For every $100 the IRS collected, how much was spent on the IRS'S Collection efforts? What tax system criterion does this information help you to evaluate with respect to the current U.S. tax system? 2. Find a comparison of income tax rates across states. What state currently has the highest income tax rate? In considering individual tax burdens across states, what other taxes should you consider and why? For the items below: using the code, regulations, and rulings answer the following questions, Your answer to these questions must be cited and be a primary source. 3. Shaun is a huge college football fan. In the past, he has always bought football tickets on the street from ticket scalpers. This year, he decided to join the university's ticket program, which requires a $3,000 contribution to the University for the "right" to purchase tickets. Shaun will then pay $600 per season ticket. Shaun understands that the price paid for the season tickets is not tax deductible as a charitable contribution. However, contributions to a university are typically tax deductible. Determine how much, if any, of Shaun's $3,000 contribution for the right to purchase tickets is tax deductible. 4. Benjamin, a self-employed bookkeeper, takes a professional CPA review course to help prepare for the CPA exam (earns no academic credit for it). Determine if Benjamin may deduct any of the cost of the CPA exam course and if so where would it be shown. 5. Pierre recently received a tax penalty for failing to file a tax return. He was upset to receive the penalty, but he was comforted by the thought that he will get a tax deduction for paying the penalty. Determine if Pierre is correct. 1. Using the IRS Website - For every $100 the IRS collected, how much was spent on the IRS'S Collection efforts? What tax system criterion does this information help you to evaluate with respect to the current U.S. tax system? 2. Find a comparison of income tax rates across states. What state currently has the highest income tax rate? In considering individual tax burdens across states, what other taxes should you consider and why? For the items below: using the code, regulations, and rulings answer the following questions, Your answer to these questions must be cited and be a primary source. 3. Shaun is a huge college football fan. In the past, he has always bought football tickets on the street from ticket scalpers. This year, he decided to join the university's ticket program, which requires a $3,000 contribution to the University for the "right" to purchase tickets. Shaun will then pay $600 per season ticket. Shaun understands that the price paid for the season tickets is not tax deductible as a charitable contribution. However, contributions to a university are typically tax deductible. Determine how much, if any, of Shaun's $3,000 contribution for the right to purchase tickets is tax deductible. 4. Benjamin, a self-employed bookkeeper, takes a professional CPA review course to help prepare for the CPA exam (earns no academic credit for it). Determine if Benjamin may deduct any of the cost of the CPA exam course and if so where would it be shown. 5. Pierre recently received a tax penalty for failing to file a tax return. He was upset to receive the penalty, but he was comforted by the thought that he will get a tax deduction for paying the penalty. Determine if Pierre is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts