Question: 1. Using the P/E and EV/EBITDA multiple, estimate a fundamental value of Walmart. (ONLY COMPUTE VALUES IN YELLOW ) 2. Based on the values, provide

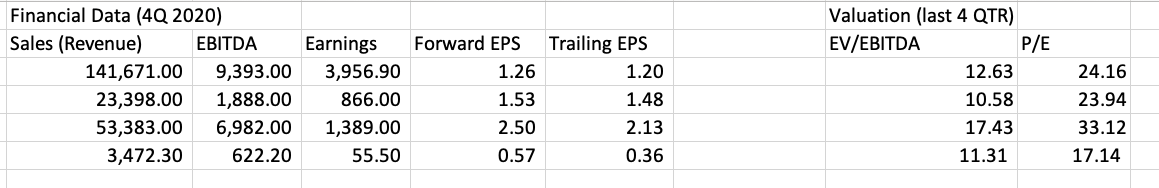

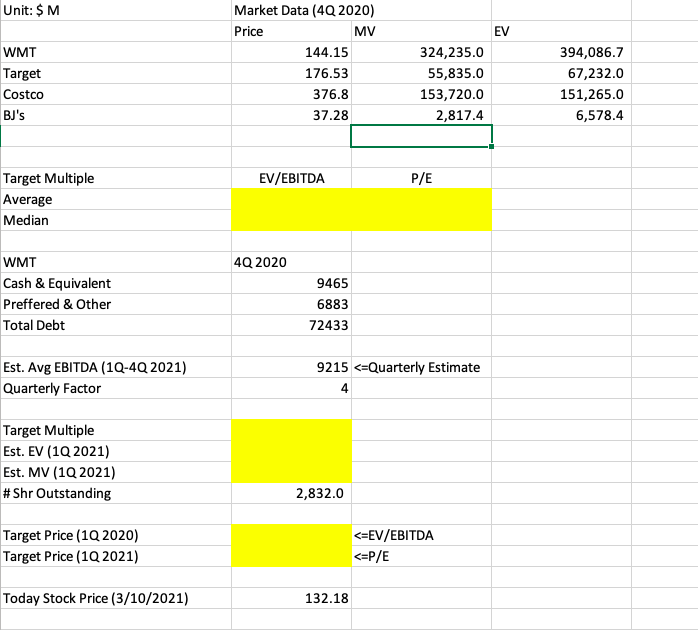

1. Using the P/E and EV/EBITDA multiple, estimate a fundamental value of Walmart. (ONLY COMPUTE VALUES IN YELLOW )

2. Based on the values, provide an investment recommendation and explain why.

3. Consider a 15% margin safety rule and give an investment recommendation.

*Below are screenshots of an excel sheet- PLEASE ANSWER ASAP, trying to check answers*

Trailing EPS 1.20 Financial Data (4Q 2020) Sales (Revenue) EBITDA 141,671.00 9,393.00 23,398.00 1,888.00 53,383.00 6,982.00 3,472.30 622.20 Earnings 3,956.90 866.00 1,389.00 55.50 Forward EPS 1.26 1.53 2.50 0.57 Valuation (last 4 QTR) EV/EBITDA P/E 12.63 10.58 17.43 11.31 1.48 2.13 0.36 24.16 23.94 33.12 17.14 Unit: $M EV WMT Target Costco BJ's Market Data (4Q 2020) Price MV 144.15 176.53 376.8 37.28 324,235.0 55,835.0 153,720.0 2,817.4 394,086.7 67,232.0 151,265.0 6,578.4 EV/EBITDA P/E Target Multiple Average Median 4Q 2020 WMT Cash & Equivalent Preffered & Other Total Debt 9465 6883 72433 9215

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts