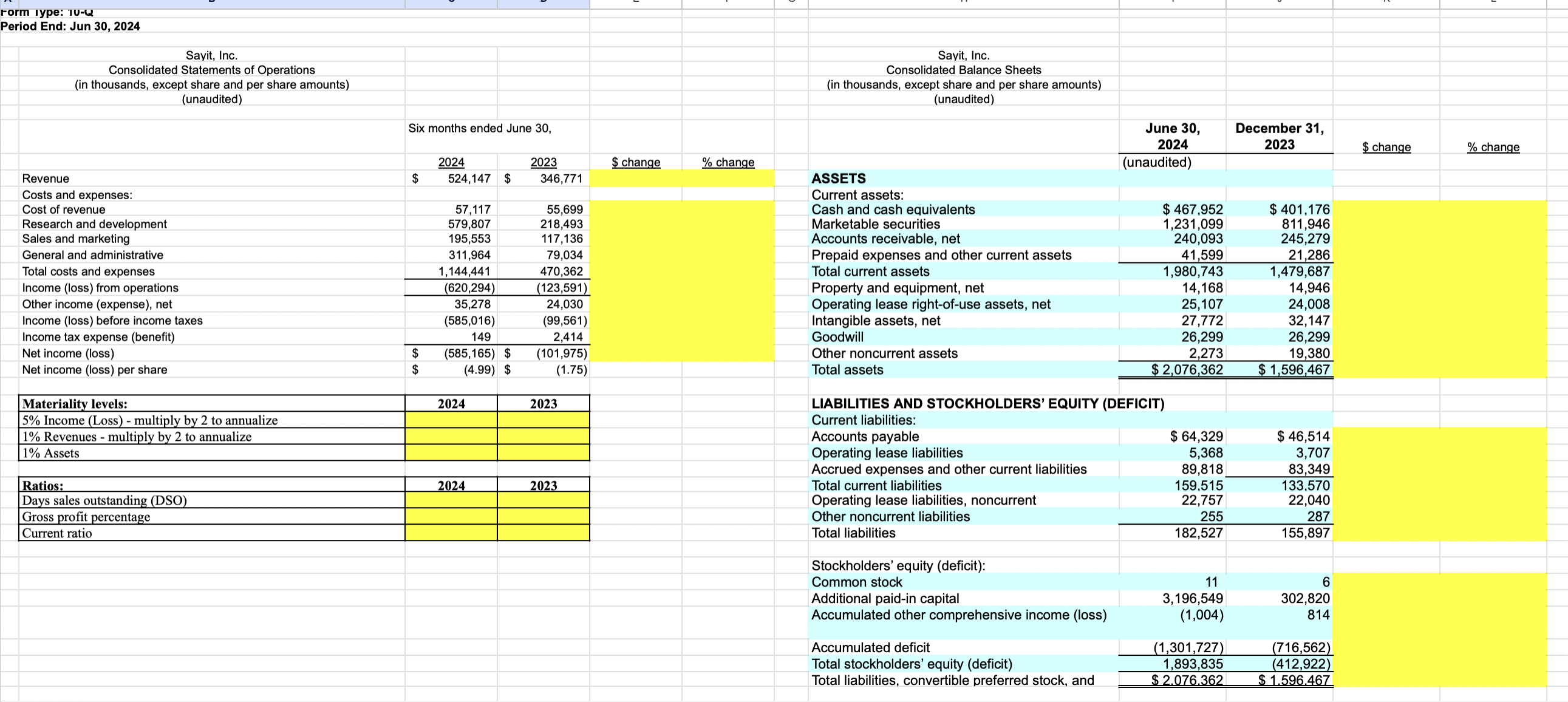

Question: 1 . Using the provided balance sheet and income statement, calculate the following ratios: 1 ) the gross profit margin percentage, 2 ) days sales

Using the provided balance sheet and income statement, calculate the following ratios: the gross profit margin percentage, days sales outstanding, and the current ratio. Also calculate the dollar and percent change for the income statement for the sixmonth period for each year and for the balance sheet for versus Populate the yellowhighlighted areas of the spreadsheet with your answers for these items and make sure to use Excel formulas for your calculations. points

Calculate the overall materiality level for Sayit in the yellowhighlighted area provided in the spreadsheet, based on the noted levels of incomeloss salesrevenues and total assets. In the space below, discuss which one of these three overall materiality levels you would recommend using for the Sayit audit and why. Make sure to annualize the materiality levels related to the income statement by multiplying the revenues and net incomeloss numbers by since the Form Q contains sixmonth figures. points

In the space below, address the following questions: What three balances other than cash or subtotalstotals have fluctuations that appear unusual and should receive special attention during the audit? Briefly explain the reasons you identified them as such. In other words, what are the potential accounting issues or operating changes that might have caused the unexpected balances or fluctuations? Make sure to select items that have material dollar and percent changes for these three items. points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock