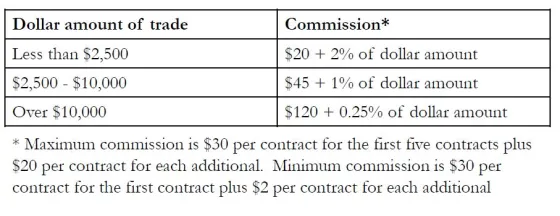

Question: 1) Using the table, what is the commission if an investor buys15 call option contracts with a strike price of $30, if the optionprice is

1) Using the table, what is the commission if an investor buys15 call option contracts with a strike price of $30, if the optionprice is $4.00?

2)Now let?s assume the day before the option expires, the stockis trading at $40 per share. If the investor sells the options for$10.05 (makes the offsetting trade), how much is the netprofit?

**I am Not understanding how I will use strike pricein part 1 and stock price in the part 2

contract size= 100

I know it is ambiguous, but that is how it was posted inlecture notes examples.

Another similar example done in class; forreference;

If you buy 100 call option contracts that cost $0.50 peroption, what is the commission? What if the option costs $5.00each?

Solution:

Option price = $0.50

Total dollar amount = ($0.50)*(100 contracts)*(100options/contract) = $5,000

Commission = $45+(1%)*($5,000) = $95

Compare this to the minimum and maximumcommission:

Minimum = $30*1 + $2*99 = $228

Maximum = $30*5+$20*95 = $2,050

Therefore the commission will be $228 (since $95 isbelow the minimum)

Option price = $5.00

Total dollar amount = ($5.00)*100*100 =$50,000

Commission = $120 + 0.25%*($50,000) = $245

Therefore the commission will be $245.

(Note: since this is still 100 contracts, the max and min are thesame as in the first part)

Dollar amount of trade Less than $2,500 $2,500 - $10,000 Over $10,000 Commission* $20 +2% of dollar amount $45+1% of dollar amount $120+ 0.25% of dollar amount Maximum commission is $30 per contract for the first five contracts plus $20 per contract for each additional. Minimum commission is $30 per contract for the first contract plus $2 per contract for each additional

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

The commission for buying 15 call option contracts with a strike price of 30 and an option price of ... View full answer

Get step-by-step solutions from verified subject matter experts