Question: 1 . Using the template provided in this Homework module of D 2 L , complete the financial statements in the three worksheets included in

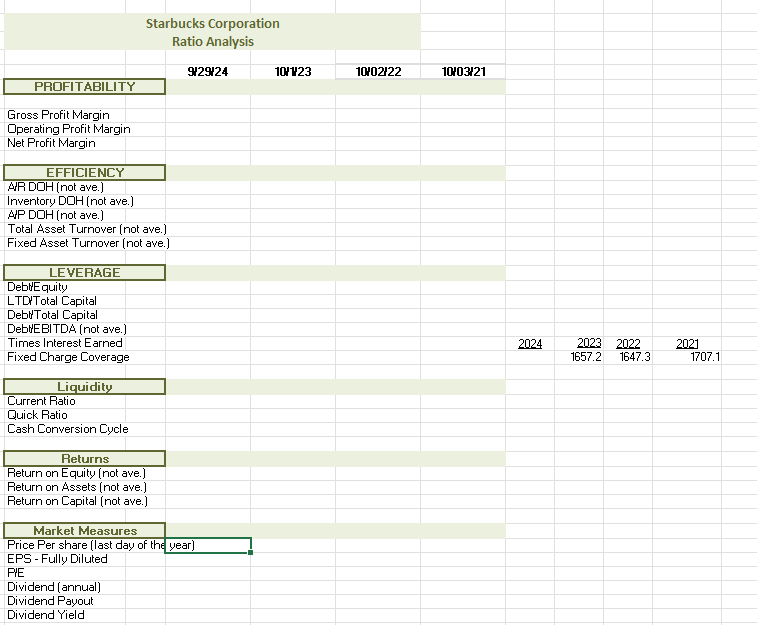

Using the template provided in this "Homework" module of DL complete the financial statements in the three worksheets included in the template. The three worksheets are: The Company's Balance Sheet for the last three years The company's Income Statement for the last three years The company's Statement of Cash Flows for the last three years. After you have added the financial information to your Excel file, calculate the financial ratios included in the RATIOS worksheet. Your completed ratio worksheet will use formulas for each ratio you are not allowed to calculate the ratio separately and then add the quotient manually. You must use Excel formulas to calculate the ratios. The ratios on the template include ratios from each of the six key focus areas: Liquidity Leverage Profitability Efficiency Returns Market Measures If there are any adjustments that you would like to make to your calculations eg EBITDA alternatives please don't hesitate to do so If there are any ratios you would like to add to your spreadsheet, please do that as well. Keeping in mind the Starbucks "story" ie Starbucks has an ongoing operating strategy including a pandemic strategy provide thoughts around each of the key focus areas. Specifically, think about the company's "story" as well as their performance over the year historical period and write a section a few paragraphs? about each focus area. After completing # above, consolidateprioritize your thoughts as follows: Which focus area in # above do you consider to be SBUX's greatest strength? Explain your thoughts. Which focus area in # above do you consider to be SBUX's greatest weakness? Explain your thoughts. Given these strengths and weaknesses, are you bullish or bearish on the company? Would you buy their stock? Starbucks Corporation Ratio AnalysisPrice Per share last day of the year EPS Fully Diluted

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock