Question: 1. value: 10.00 points The next dividend payment by Halestorm, Inc., will be $1.52 per share. The dividends are anticipated to maintain a growth rate

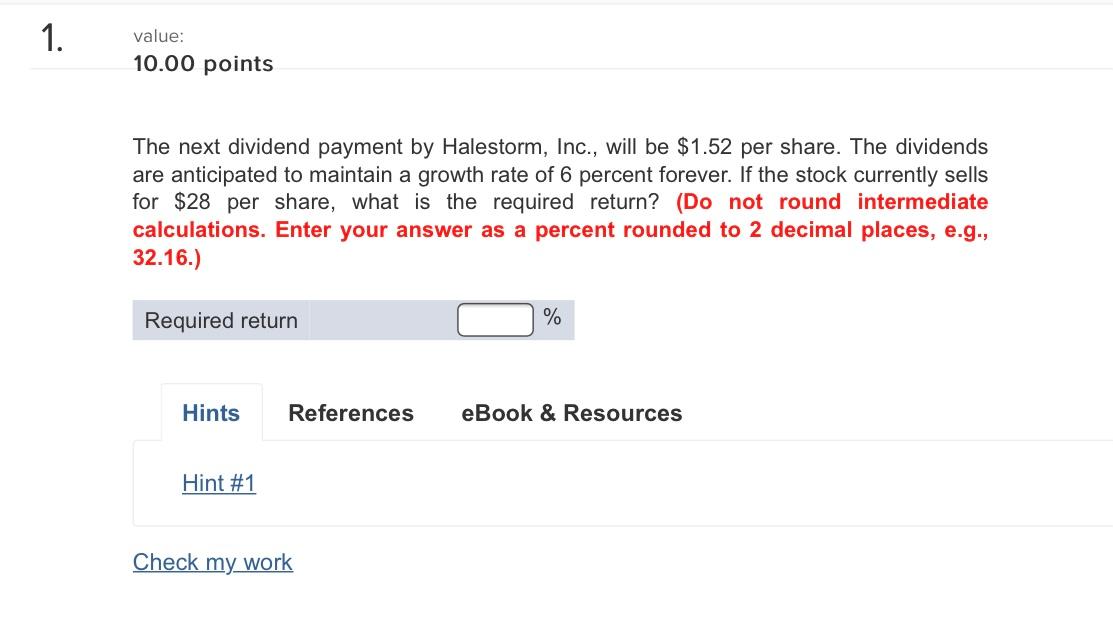

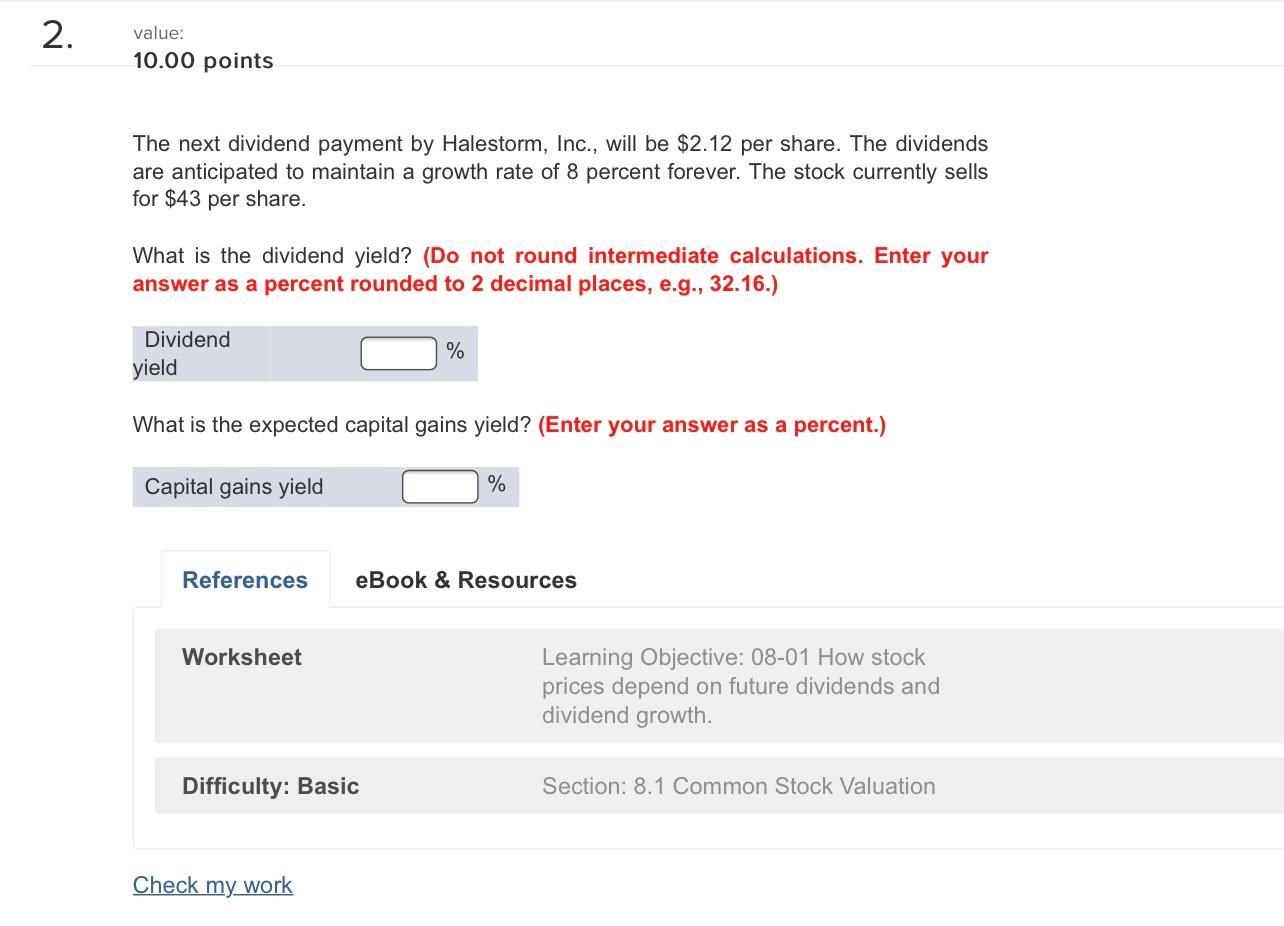

1. value: 10.00 points The next dividend payment by Halestorm, Inc., will be $1.52 per share. The dividends are anticipated to maintain a growth rate of 6 percent forever. If the stock currently sells for $28 per share, what is the required return? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Required return % Hints References eBook & Resources Hint #1 Check my work 2. value: 10.00 points The next dividend payment by Halestorm, Inc., will be $2.12 per share. The dividends are anticipated to maintain a growth rate of 8 percent forever. The stock currently sells for $43 per share. What is the dividend yield? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Dividend yield % What is the expected capital gains yield? (Enter your answer as a percent.) Capital gains yield % References eBook & Resources Worksheet Learning Objective: 08-01 How stock prices depend on future dividends and dividend growth. Difficulty: Basic Section: 8.1 Common Stock Valuation Check my work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts