Question: 1. value: 2.00 points E9-1 Calculating Unknown Values for Direct Materials, Direct Labor Variances [LO 9-3, 9-4] Ironwood Company manufactures cast-iron barbeque cookware. During a

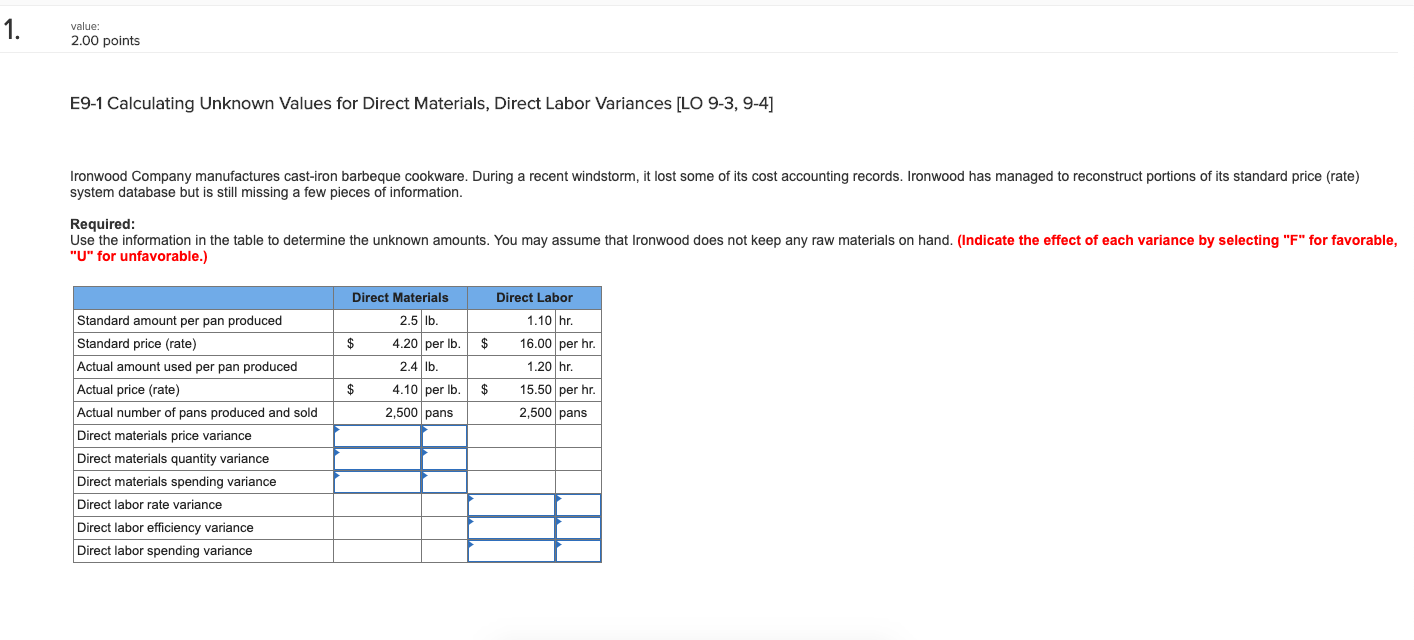

1. value: 2.00 points E9-1 Calculating Unknown Values for Direct Materials, Direct Labor Variances [LO 9-3, 9-4] Ironwood Company manufactures cast-iron barbeque cookware. During a recent windstorm, it lost some of its cost accounting records. Ironwood has managed to reconstruct portions of its standard price (rate) system database but is still missing a few pieces of information. Required: Use the information in the table to determine the unknown amounts. You may assume that Ironwood does not keep any raw materials on hand. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable.) Direct Materials 2.5 lb. $ 4.20 per lb. 2.4 lb. Direct Labor 1.10 hr. 16.00 per hr $ 1.20 hr. 15.50 per hr $ 4.10 per lb. $ 2,500 pans 2,500 pans Standard amount per pan produced Standard price (rate) Actual amount used per pan produced Actual price (rate) Actual number of pans produced and sold Direct materials price variance Direct materials quantity variance Direct materials spending variance Direct labor rate variance Direct labor efficiency variance Direct labor spending variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts