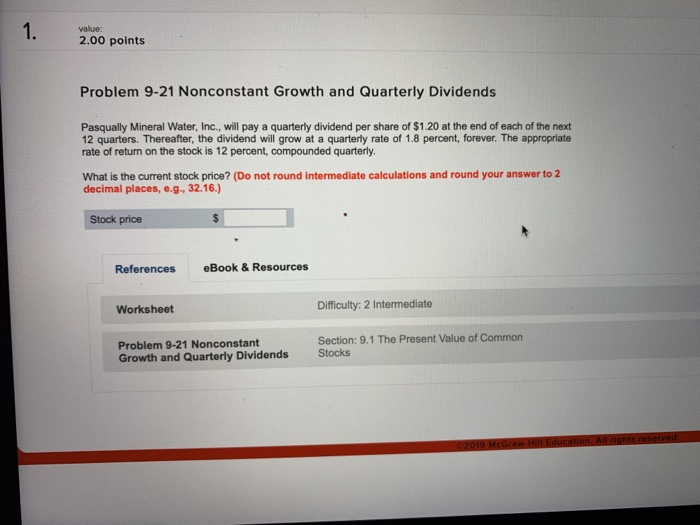

Question: 1 value: 2.00 points Problem 9-21 Nonconstant Growth and Quarterly Dividends Pasqually Mineral Water, Inc., will pay a quarterly dividend per share of $1.20 at

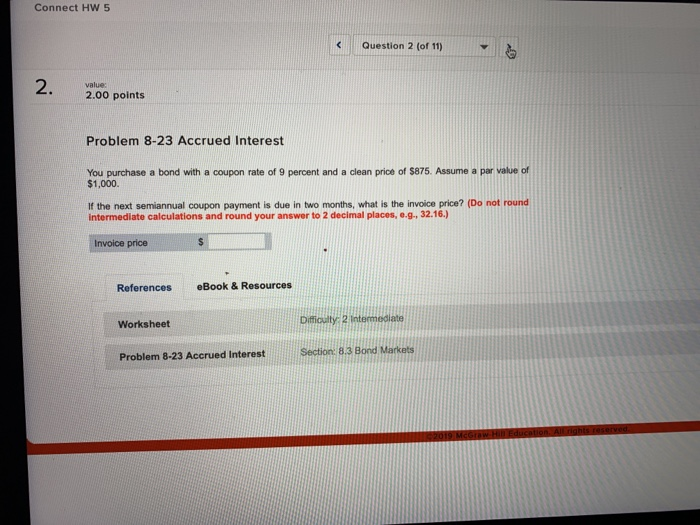

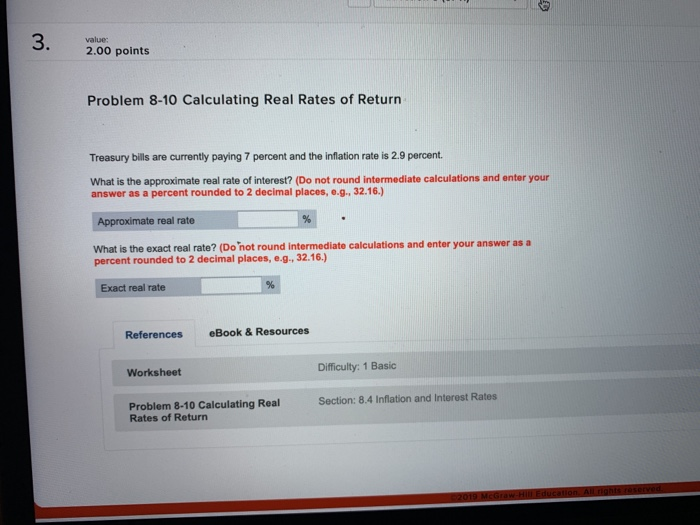

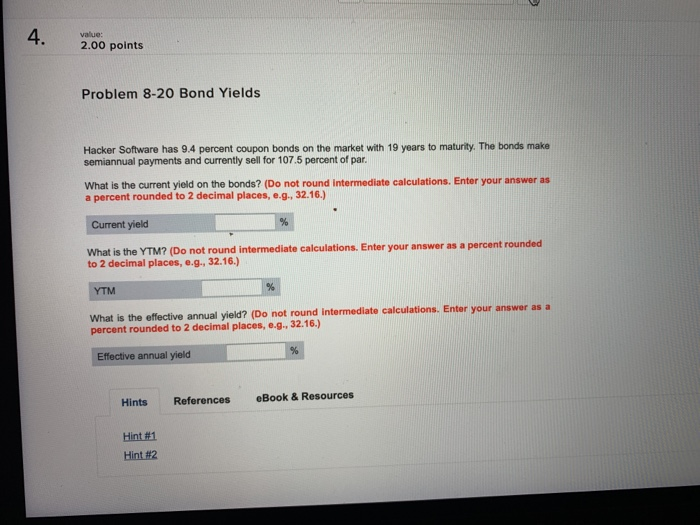

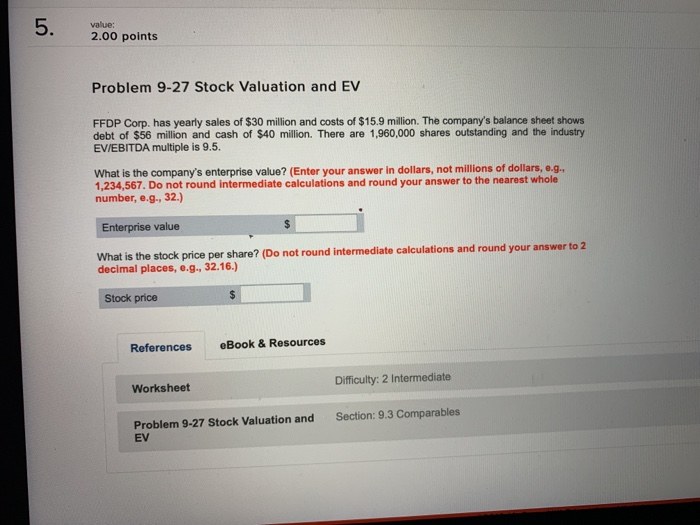

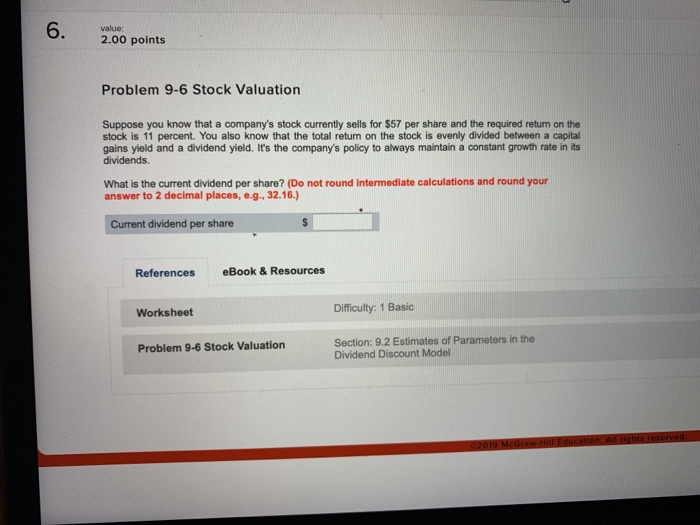

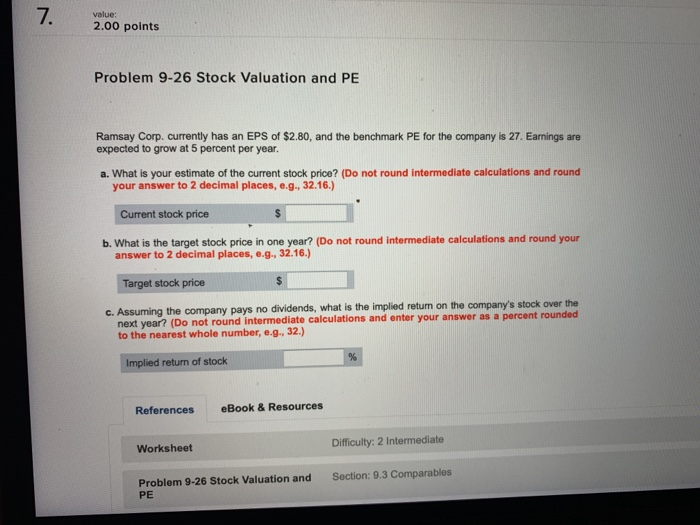

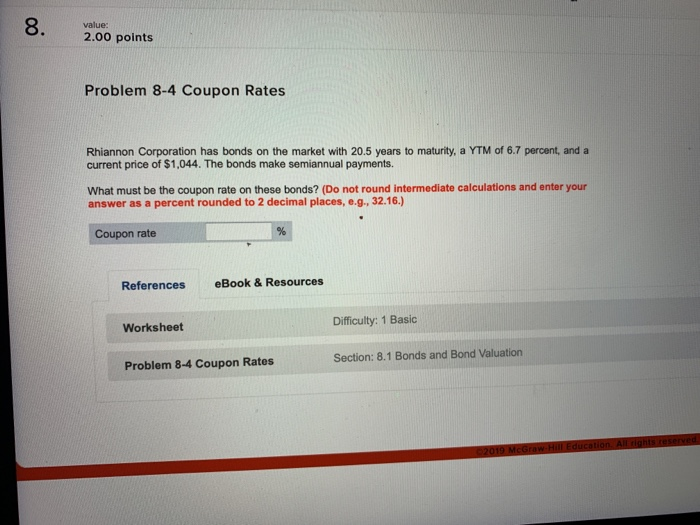

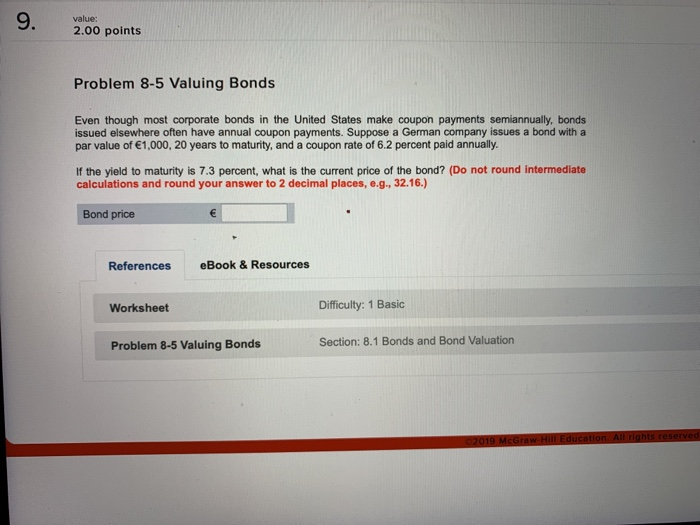

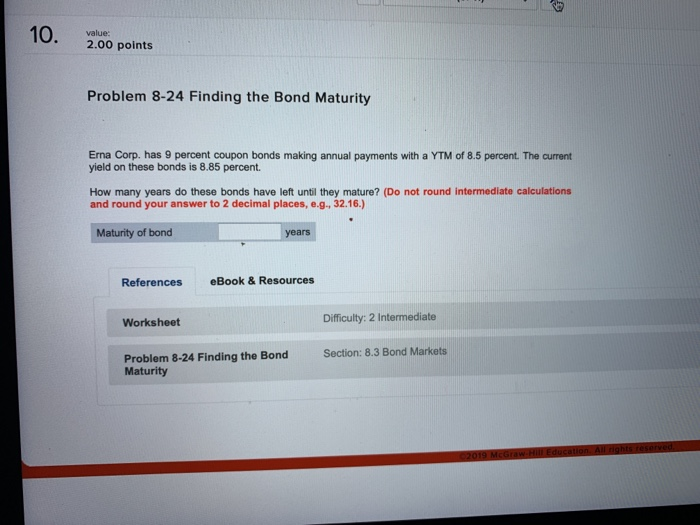

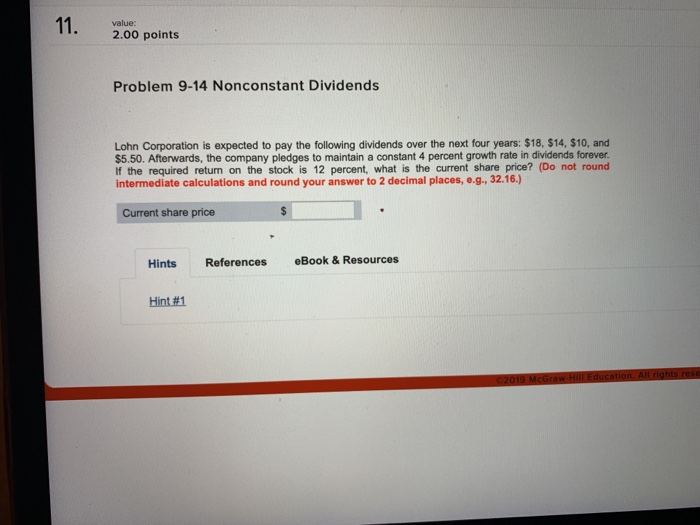

1 value: 2.00 points Problem 9-21 Nonconstant Growth and Quarterly Dividends Pasqually Mineral Water, Inc., will pay a quarterly dividend per share of $1.20 at the end of each of the next 12 quarters. Thereafter, the dividend will grow at a quarterly rate of 1.8 percent, forever. The appropriate rate of return on the stock is 12 percent, compounded quarterly. What is the current stock price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Stock price References eBook& Resources Worksheet Difficulty: 2 Intermediate Section: 9.1 The Present Value of Common Problem 9-21 Nonconstant Growth and Quarterly Dividends Stocks value: 2.00 points Problem 9-27 Stock Valuation and EV FFDP Corp. has yearly sales of $30 million and costs of $15.9 million. The company's balance sheet shows debt of $56 million and cash of $40 million. There are 1,960,000 shares outstanding and the industry EVIEBITDA multiple is 9.5. What is the company's enterprise value? (Enter your answer in dollars, not millions of dollars, e.g.. 1,234,567. Do not round intermediate calculations and round your answer to the nearest whole number, e.g, 32.) Enterprise value What is the stock price per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Stock price References eBook&Resources Difficulty: 2 Intermediate Worksheet Section: 9.3 Comparables Problem 9-27 Stock Valuation and EV 2.00 points Problem 9-6 Stock Valuation Suppose you know that a company's stock currently sells for $57 per share and the required return on the stock is 11 percent. You also know that the total retum on the stock is evenly divided between a capital gains yield and a dividend yield. I's the company's polioy to always maintain a constant growth rate in its dividends. What is the current dividend per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16) Current dividend per share References eBook & Resources Difficulty: 1 Basic Worksheet Section: 9.2 Estimates of Parameters in the Dividend Discount Model Problem 9-6 Stock Valuation value: 2.00 points Problem 9-26 Stock Valuation and PE Ramsay Corp. currently has an EPS of $2.80, and the benchmark PE for the company is 27. Earnings are expected to grow at 5 percent per year. a. What is your estimate of the current stock price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g,32.16.) Current stock price b. What is the target stock price in one year? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Target stock price c. Assuming the company pays no dividends, what is the implied retun on the company's stock over the next year? (Do not round intermediate calculations and enter your answer as a percent rounded to the nearest whole number, e.g 32.) Implied return of stock References eBook&Resources Worksheet Difficulty: 2 Intermediate Problem 9-26 Stock Valuation and PE Section: 9.3 Comparables 8. 2.00 points value: Problem 8-4 Coupon Rates Rhiannon Corporation has bonds on the market with 20.5 years to maturity, a YTM of 6.7 percent, and a current price of $1,044. The bonds make semiannual payments. What must be the coupon rate on these bonds? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Coupon rate References eBook & Resources Difficulty: 1 Basic Worksheet Section: 8.1 Bonds and Bond Valuation Problem 8-4 Coupon Rates 9. value: 2.00 points Problem 8-5 Valuing Bonds Even though most corporate bonds in the United States make coupon payments semiannually, bonds issued elsewhere often have annual coupon payments. Suppose a German company issues a bond with a par value of 1,000, 20 years to maturity, and a coupon rate of 6.2 percent paid annually If the yield to maturity is 7.3 percent, what is the current price of the bond? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Bond price References eBook &Resources Worksheet Difficulty: 1 Basic Problem 8-5 Valuing Bonds Section: 8.1 Bonds and Bond Valuation 1 20 value: 2.00 points Problem 9-14 Nonconstant Dividends Lohn Corporation is expected to pay the following dividends over the next four years: $18, $14, $10, and $5.50. Afterwards, the company pledges to maintain a constant 4 percent growth rate in dividends forever If the required return on the stock is 12 percent, what is the current share price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Current share price Hints References eBook&Resources Hint#1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts