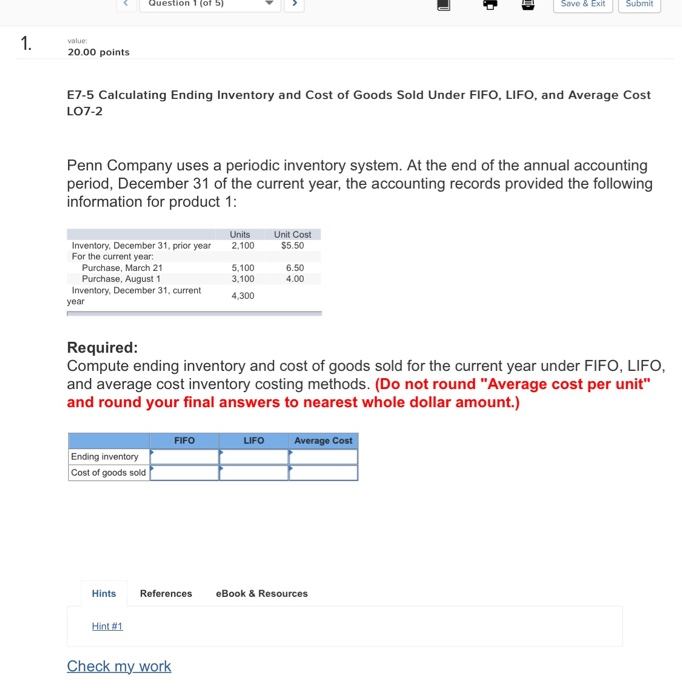

Question: 1. value: 20.00 points Question 1 (of 5) Save & Exit Submit E7-5 Calculating Ending Inventory and Cost of Goods Sold Under FIFO, LIFO,

1. value: 20.00 points Question 1 (of 5) Save & Exit Submit E7-5 Calculating Ending Inventory and Cost of Goods Sold Under FIFO, LIFO, and Average Cost L07-2 Penn Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 1: Units Unit Cost Inventory, December 31, prior year 2,100 $5.50 For the current year: Purchase, March 21 5,100 6.50 Purchase, August 1 3,100 4.00 Inventory, December 31, current 4,300 year Required: Compute ending inventory and cost of goods sold for the current year under FIFO, LIFO, and average cost inventory costing methods. (Do not round "Average cost per unit" and round your final answers to nearest whole dollar amount.) Ending inventory Cost of goods sold FIFO LIFO Average Cost Hints References eBook & Resources Hint #1 Check my work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts