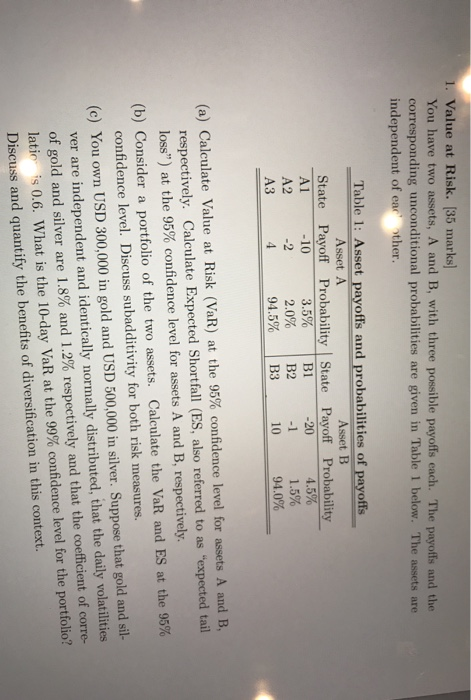

Question: 1. Value at Risk. (35 marks) You have two assets, A and B, with three possible payoffs each. The payoffs and the corresponding unconditional probabilities

1. Value at Risk. (35 marks) You have two assets, A and B, with three possible payoffs each. The payoffs and the corresponding unconditional probabilities are given in Table 1 below. The assets are independent of earl other. Table 1: Asset payoffs and probabilities of payoffs Asset A Asset B State Payoff Probability State Payoff Probability -10 AL 3.5% B1 -20 4.5% A2 2.0% 1.5% -2 B2 94.5% A3 4 10 B3 94.0% (a) Calculate Value at Risk (VaR) at the 95% confidence level for assets A and B, respectively. Calculate Expected Shortfall (ES, also referred to as "expected tail loss") at the 95% confidence level for assets A and B, respectively. (b) Consider a portfolio of the two assets. Calculate the VaR and ES at the 95%! confidence level. Discuss subadditivity for both risk measures. (c) You own USD 300,000 in gold and USD 500,000 in silver. Suppose that gold and sil- ver are independent and identically normally distributed, that the daily volatilities of gold and silver are 1.8% and 1.2% respectively and that the coefficient of corte latie is 0.6. What is the 10-day VaR at the 99% confidence level for the portfolio?! Discuss and quantify the benefits of diversification in this context. 1. Value at Risk. (35 marks) You have two assets, A and B, with three possible payoffs each. The payoffs and the corresponding unconditional probabilities are given in Table 1 below. The assets are independent of earl other. Table 1: Asset payoffs and probabilities of payoffs Asset A Asset B State Payoff Probability State Payoff Probability -10 AL 3.5% B1 -20 4.5% A2 2.0% 1.5% -2 B2 94.5% A3 4 10 B3 94.0% (a) Calculate Value at Risk (VaR) at the 95% confidence level for assets A and B, respectively. Calculate Expected Shortfall (ES, also referred to as "expected tail loss") at the 95% confidence level for assets A and B, respectively. (b) Consider a portfolio of the two assets. Calculate the VaR and ES at the 95%! confidence level. Discuss subadditivity for both risk measures. (c) You own USD 300,000 in gold and USD 500,000 in silver. Suppose that gold and sil- ver are independent and identically normally distributed, that the daily volatilities of gold and silver are 1.8% and 1.2% respectively and that the coefficient of corte latie is 0.6. What is the 10-day VaR at the 99% confidence level for the portfolio?! Discuss and quantify the benefits of diversification in this context

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts