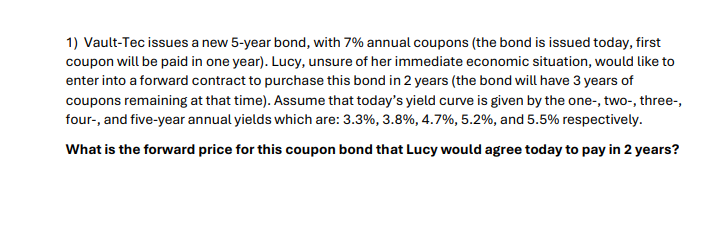

Question: 1 ) Vault - Tec issues a new 5 - year bond, with ( 7 % ) annual coupons ( the bond

VaultTec issues a new year bond, with annual coupons the bond is issued today, first coupon will be paid in one year Lucy, unsure of her immediate economic situation, would like to enter into a forward contract to purchase this bond in years the bond will have years of coupons remaining at that time Assume that today's yield curve is given by the one two three four and fiveyear annual yields which are: and respectively. What is the forward price for this coupon bond that Lucy would agree today to pay in years?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock