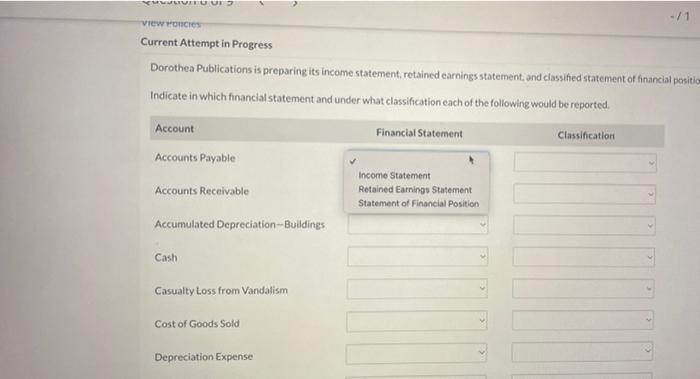

Question: - / 1 view ones Current Attempt in Progress Dorothea Publications is preparing its income statement, retained earnings statement, and classified statement of financial position

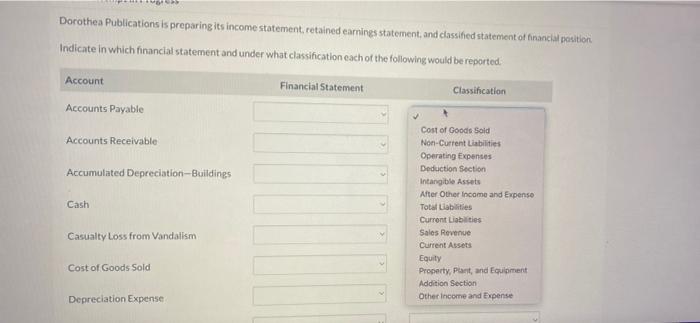

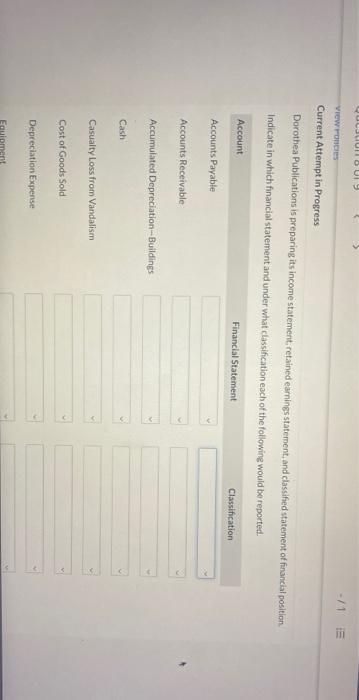

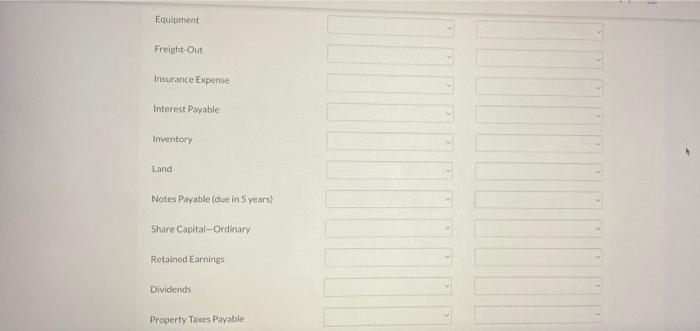

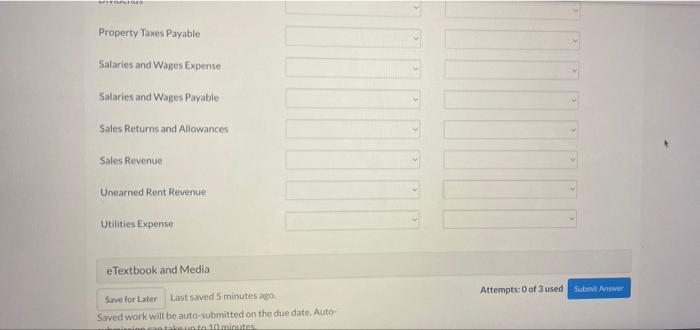

- / 1 view ones Current Attempt in Progress Dorothea Publications is preparing its income statement, retained earnings statement, and classified statement of financial position Indicate in which financial statement and under what classification each of the following would be reported Account Financial Statement Classification Accounts Payable Accounts Receivable Income Statement Retained Earnings Statement Statement of Financial Position Accumulated Depreciation -- Buildings Cash Casualty Loss from Vandalism Cost of Goods Sold Depreciation Expense Dorothea Publications is preparing its income statement retained earnings statement, and classified statement of financial position Indicate in which financial statement and under what classification each of the following would be reported. Account Financial Statement Classification Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Cash Cost of Goods Sold Non-Current Liabilities Operating Expenses Deduction Section Intangible Assets After Other Income and Expense Total abilities Current Liabilities Sales Revenue Current Assets Equity Property, Pan and Equipment Addition Section Other income and Expense Casualty Loss from Vandalism Cost of Goods Sold Depreciation Expense WUJUULI BULY -/1 III View Fonces Current Attempt in Progress Dorothea Publications is preparing its income statement, retained earnings statement, and classified statement of financial position Indicate in which financial statement and under what classication each of the following would be reported. Financial Statement Account Classification Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Cash Casualty Loss from Vandalism Cost of Goods Sold Depreciation Expense Equipment - Equipment Freight Out Insurance Expense Interest Payable Inventory Land Notes Payable (dut in 5 years) Share Capital-Ordinary Retained Earnings Dividends Property Taxes Payable Property Taxes Payable Salaries and Wages Expense Salaries and Wages Payable Sales Returns and Allowances Sales Revenue Unearned Rent Revenue Utilities Expense e Textbook and Media Attempts: 0 of 3 used Som AS Save for Later Last saved 5 minutes ago Saved work will be auto-submitted on the due date. Auto: takunta 10 minutes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts