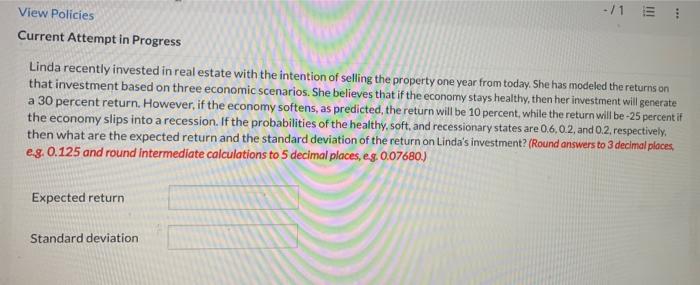

Question: -/1 *** View Policies Current Attempt in Progress Linda recently invested in real estate with the intention of selling the property one year from today.

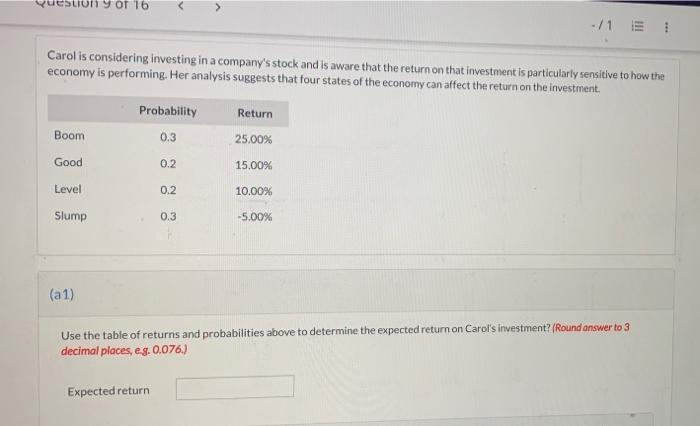

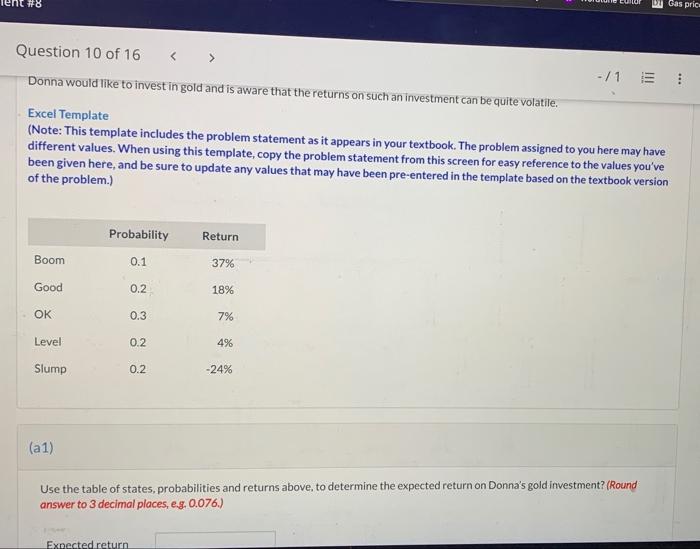

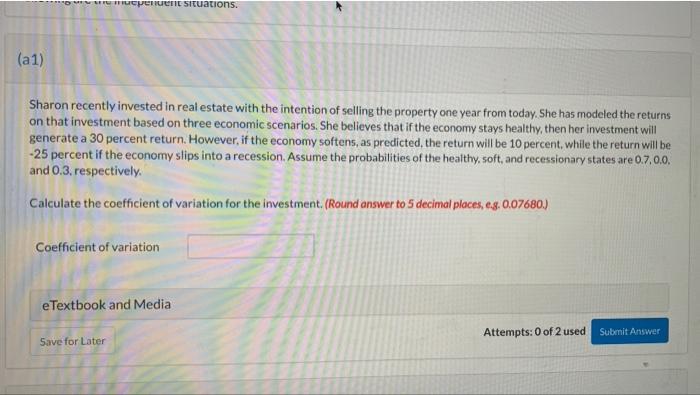

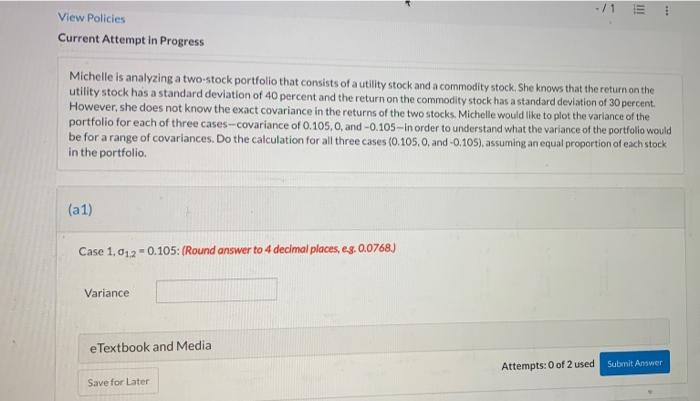

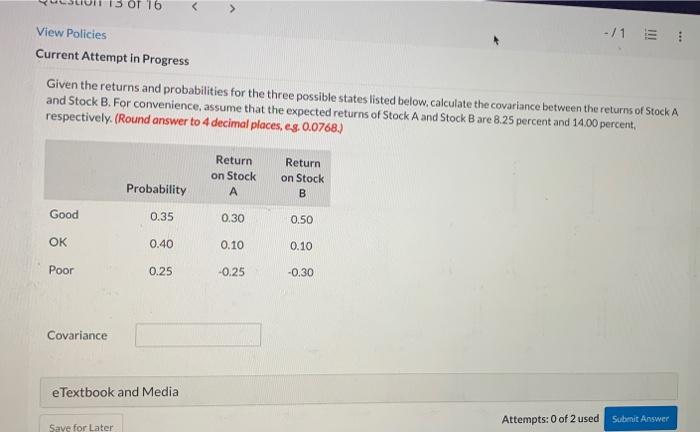

-/1 *** View Policies Current Attempt in Progress Linda recently invested in real estate with the intention of selling the property one year from today. She has modeled the returns on that investment based on three economic scenarios. She believes that if the economy stays healthy, then her investment will generate a 30 percent return. However, if the economy softens, as predicted, the return will be 10 percent, while the return will be-25 percent if the economy slips into a recession. If the probabilities of the healthy, soft, and recessionary states are 0.6,02 and 0.2, respectively, then what are the expected return and the standard deviation of the return on Linda's investment? (Round answers to 3 decimal places eg. 0.125 and round Intermediate calculations to 5 decimal places, eg. 0.07680.) Expected return Standard deviation Question Y OT 16 - /1 Carol is considering investing in a company's stock and is aware that the return on that investment is particularly sensitive to how the economy is performing. Her analysis suggests that four states of the economy can affect the return on the investment, Probability Return Boom 0.3 25.00% Good 0.2 15.00% Level 0.2 10.00% Slump 0.3 -5.00% (a 1) Use the table of returns and probabilities above to determine the expected return on Carol's investment? (Round answer to 3 decimal places, eg. 0.076.) Expected return #8 Gas prie Question 10 of 16 -/ 13 Donna would like to invest in gold and is aware that the returns on such an investment can be quite volatile. Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) Probability Return Boom 0.1 37% Good 0.2 18% OK 0.3 7% Level 0.2 4% Slump 0.2 -24% (a1) Use the table of states, probabilities and returns above to determine the expected return on Donna's gold investment? (Round answer to 3 decimal places, e.g. 0.076.) Expected return epent situations. (a1) Sharon recently invested in real estate with the intention of selling the property one year from today. She has modeled the returns on that investment based on three economic scenarios. She believes that if the economy stays healthy, then her investment will generate a 30 percent return. However, if the economy softens, as predicted, the return will be 10 percent, while the return will be -25 percent if the economy slips into a recession. Assume the probabilities of the healthy, soft, and recessionary states are 0.7.0.0, and 0.3, respectively. Calculate the coefficient of variation for the investment. (Round answer to 5 decimal places, e.g. 0.07680.) Coefficient of variation e Textbook and Media Attempts: 0 of 2 used Submit Answer Save for Later View Policies Current Attempt in Progress Michelle is analyzing a two-stock portfolio that consists of a utility stock and a commodity stock. She knows that the return on the utility stock has a standard deviation of 40 percent and the return on the commodity stock has a standard deviation of 30 percent However, she does not know the exact covariance in the returns of the two stocks. Michelle would like to plot the variance of the portfolio for each of three cases-covariance of 0.105,0, and -0.105-In order to understand what the variance of the portfolio would be for a range of covariances. Do the calculation for all three cases (0.105.0, and -0,105), assuming an equal proportion of each stock in the portfolio (a 1) Case 1.01.2 - 0.105: (Round answer to 4 decimal places, es. 0.0768.) Variance e Textbook and Media Submit Answer Attempts: 0 of 2 used Save for Later Of 16 -/1 View Policies Current Attempt in Progress Given the returns and probabilities for the three possible states listed below.calculate the covariance between the returns of Stock A and Stock B.For convenience, assume that the expected returns of Stock A and Stock B are 8.25 percent and 14.00 percent, respectively. (Round answer to 4 decimal places, es. 0.0768.) Return on Stock Return on Stock B Probability Good 0.35 0.30 0.50 OK 0.40 0.10 0.10 Poor 0.25 -0.25 -0,30 Covariance e Textbook and Media Attempts: 0 of 2 used Submit Answer Save for Later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts