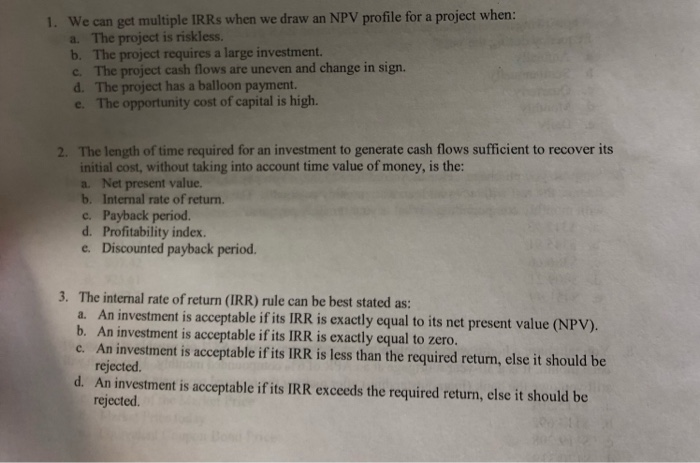

Question: 1. We can get multiple IRRS when we draw an NPV profile for a project when: a. The project is riskless. b. The project requires

1. We can get multiple IRRS when we draw an NPV profile for a project when: a. The project is riskless. b. The project requires a large investment. c. The project cash flows are uneven and change in sign. d. The project has a balloon payment. e. The opportunity cost of capital is high. 2. The length of time required for an investment to generate cash flows sufficient to recover its initial cost, without taking into account time value of money, is the: a. Net present value. b. Internal rate of return. Payback period. d. Profitability index. Discounted payback period. c. e. 3. The internal rate of return (IRR) rule can be best stated as: a. An investment is acceptable if its IRR is exactly equal to its net present value (NPV). b. An investment is acceptable if its IRR is exactly equal to zero. c. An investment is acceptable if its IRR is less than the required return, else it should be rejected. d. An investment is acceptable if its IRR exceeds the required return, else it should be rejected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts